Druckenmiller Stock Rally to Continue but Could End ‘Very Badly’

Post on: 21 Апрель, 2015 No Comment

Although the stock market rally can continue for a while longer, it could end very badly, Stanley Druckenmiller, founder of Duquesne Capital, told CNBC.

The Dow Jones Industrial Average on Tuesday soared to a new record high. The stock market rally, probably is its seventh or eighth inning, could end in an investment bust or inflation.

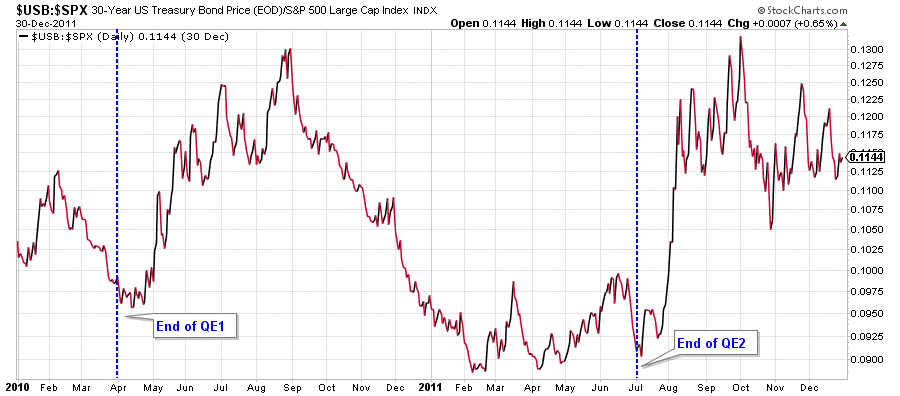

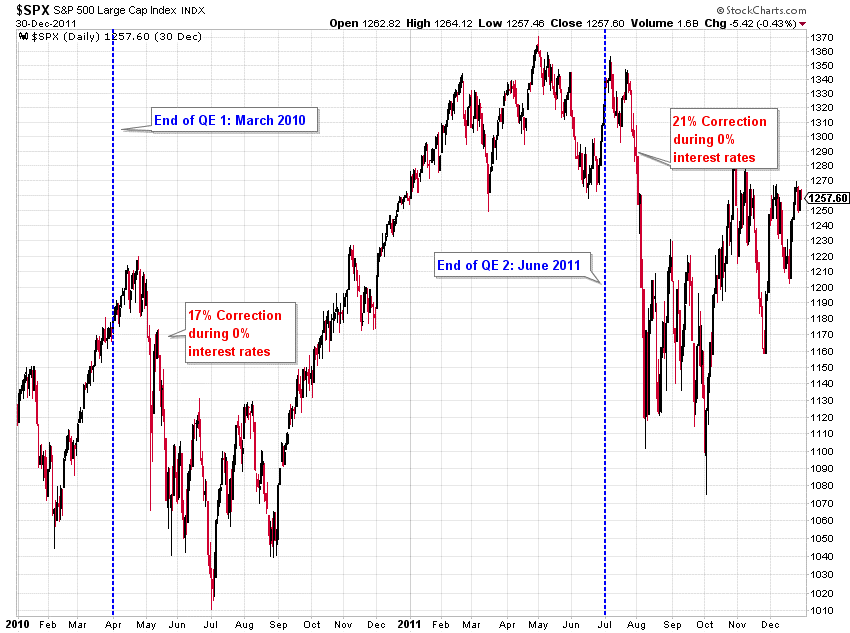

The Federal Reserve’s loose monetary policy is supporting the stock market gains. In the past, stocks have jumped when the Fed started rounds of quantitative easing, or bond purchases to lower interest rates. Stocks faltered when the Fed concluded QE rounds.

Now with QE forever, I don’t know when this things ends, Druckenmiller told CNBC, noting that $85 billion a month is flowing into stocks. We’ve got a great supply and demand situation for stocks right now.

But at point, it will end. All the lobsters are getting in the pot. At some point they’re going to get burnt.

The Fed is playing a dangerous game with QE, he told CNBC.

It’s one thing to control short-term interest rates, he said. It’s another thing when you’re taking 75 to 80 percent of the bond supply and holding that price down, he said. This is a big, big gamble to be manipulating the most important price in free markets.

The Fed’s huge purchases of bonds are canceling bond market signals that can be taken as warnings, he added. When you cancel those signals you get into problems.

Some experts say the threat of bond values collapsing when rates rise is driving investors into stocks. But Druckenmiller told CNBC there’s no reason that bonds should go down when the Fed is buying so many bonds.

The Dow Jones Industrial Average soared Tuesday to its highest level ever, erasing losses from the financial crisis after a four-year rally fueled by the fastest profit growth since the 1990s and monetary stimulus from the Federal Reserve, Bloomberg News reported.

Whats amazing about this bull market is that people still dont think its real, Richard Bernstein of Richard Bernstein Advisors, a money management firm, told The New York Times. We think this could be the biggest bull market of our careers.

Corporate earnings of S&P 500 companies 500 have not reported a decline in earnings since the third quarter of 2009, said Princeton University economics professor Alan S. Blinder, according to the Times.

2015 Newsmax Finance. All rights reserved.