Don’t Chase Yield in Muni Bonds Total Return

Post on: 16 Март, 2015 No Comment

Municipal bonds

High-risk debt from Puerto Rico has rallied strongly this year. Here, a February view of the Hato Rey financial district in San Juan. Reuters

Investors have been finding rich returns this year in the municipal debt sold by U.S. cities and states, but that doesn’t meant they should go chasing yield in the asset class, analysts and investors say.

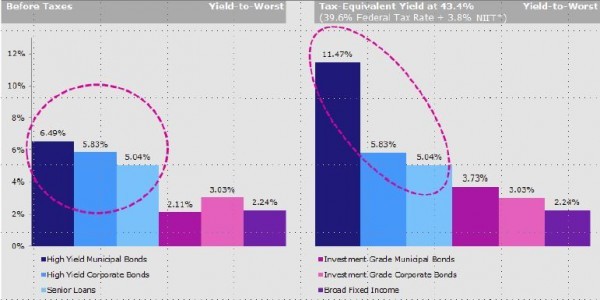

Tax-exempt municipal bonds have returned more than U.S. blue-chip stocks and corporate debt in 2014. They have posted their longest string of monthly gains in more than two decades, spurred by a broad bond-market rally, low supply and high demand.

Considered nearly as safe as Treasurys because they’re backed by taxes, munis have returned 8.32% in 2014 through Friday, including price gains and interest payments, according to Barclays. That compares with 6.86% for the Dow Jones Industrial Average, 6.68% for highly rated corporate debt and 4.07% for U.S. Treasury debt.

The gains stand out because munis, long a staple in the portfolios of retirees and other investors seeking capital preservation and stable income, suffered a 2.55% decline last year, driven by Detroit’s record bankruptcy and Puerto Rico’s financial woes. Puerto Rico bonds lost almost 20% last year, according to Barclays.

In fact, some of the riskiest municipal debt has been the best-returning this year. Puerto Rico bonds have seen total returns of 11.96%, according to Barclays, even after the commonwealth passed June legislation allowing some public agencies to restructure billions.

High-yield municipal-bond mutual funds have posted big gains, led by Nuveen and Eaton Vance funds that have returned more than 16% this year. On average, high-yield muni returns returned 12.49% this year through Friday, more than double the 6.07% on muni funds that buy lower-risk intermediate-term bonds from around the country, according to researcher Morningstar.

That doesn’t mean it’s a great idea for individuals to grab up low-rated municipal bonds.

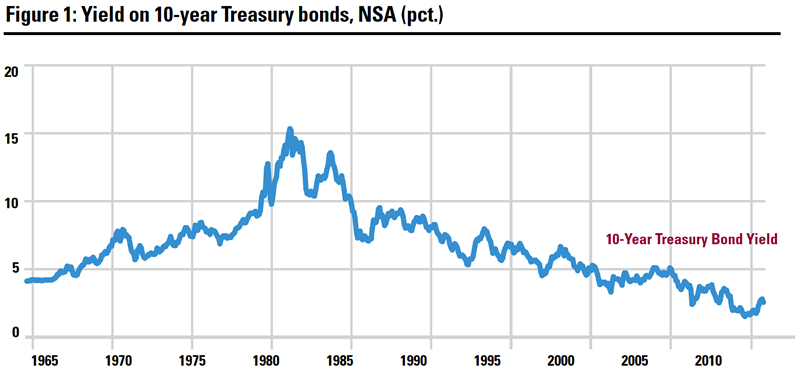

With interest rates low, riskier debt offers less payoff than it might under other circumstances, says James Iselin, head of municipal fixed income at Neuberger Berman, which manages about $10 billion in tax-exempt debt.

“You have to stick to your knitting,” Mr. Iselin says. “When there’s a lot of money splashing around in marketplaces and a limited supply, they can seem like they’ll move in one direction forever.”

Instead, he says, “Now’s a good time for investors to be cautious and not overpay for the risk they’re taking.”