Dollar Cost Averaging Strategy

Post on: 16 Март, 2015 No Comment

There is this cool thing that happens when you ignore all the stock picking stuff that people talk about, stop paying attention to the “experts” on TV and simply invest your money in a dispassionate and consistent manner. The aforementioned cool thing is that you end up with a lot more money. Now I know people have told you to “buy low and sell high” and maybe you’ve even read a few investing books, but the fact is that the vast majority of people are terrible at timing the market. The media plays a huge part in this because they offer so much noise (both literally and figuratively) and that can’t help but distort markets. Think about how media makes money they need to sell advertising, and to do that they need viewers. Is the best way to gain viewers to merely report market events and maybe do some journalistic digging? Unfortunately it is not. The best way to gain viewers is to be as sensationalistic as possible. This is why when you watch investing shows everyone is either predicting a massive downfall or a new bull market and everyone appears to know exactly what to do. The facts simply do not bear out that these experts know what they’re doing.

Everyone Seems to Beat The Market So Why Is It Still There Again?

Almost every investing study out there says that the average investor would be much better off if they kept their investment methods simple and consistent. One of the main reasons for this is the natural rewards of dollar cost averaging investment strategies. The idea is to automatically take a percentage of your earnings each period (I set mine up for quarterly, but as long as it is consistent almost any period will do), and invest in as a diversified manner as possible. The exact amount of risk you want to take, and your long-term balance you want to have between different asset classes is something you can decide on in under an hour with the help of a fee-only financial advisor, or by reading some basic investment blogs. If you take a consistent percentage of your earnings throughout the year, and invest it according to you pre-approved plan, your chances of success go much higher.

Now I can hear some of you hollering out there that it is crazy to buy when the market is high, why would you want to buy more then? The fact is that no one has any idea when the market is high or not. At various points in the last couple decades people thought that equities were done their bull run only to see them rise by 30% over the next couple of years. The same phenomenon of misinformation and hesitation occurs when the market is sinking as well. Who wants to invest when they impression is that their investment will likely be worth less the very next day? The investing gurus out there even have a catchphrase for it, they say, “Never try to catch a falling knife.” Absolutely ridiculous, but hey they are doing so well handling their own investments these days that their Golden Boy (Jamie Dimon) only lost a few billion dollars (and he isn’t even sure how) so I’m willing to read from their gospel. The bottom line is that by taking the emotions out of the game, and merely sticking to a basic plan, you will do far better than most.

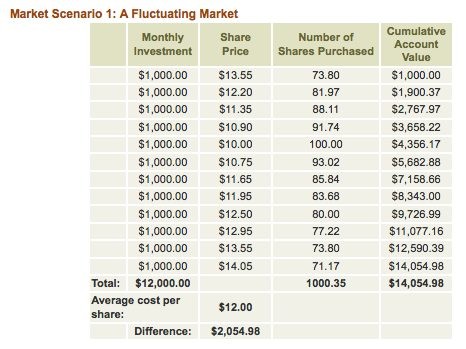

Here is the math behind what I mean. The downside of dollar cost averaging is that you will definitely buy into markets when they are at their high points. The nice part is that equities and other asset classes have basically only went up over extended periods of time, however it often takes decades for those larger economic cycles to truly reveal themselves. On the flip side of the equation, you will also always buy when the market is at its lowest as well. Now some of you might be saying, “Ok, so I’m going to get average returns then because they highs and lows will cancel out, why is this so great?” This is where the “genius” of dollar cost averaging strategies comes into play. Take a look at this example (the term units is just an arbitrary form of measurement):

Dollar Cost Averaging Case Study

Youre able to regularly save $200 per month.

- In January, the units cost $1 each, so youre able to buy 200 units.

- In February, the cost of the units falls to $0.95, so youre able to buy 210 units.

- In March, the cost of the units again falls, this time to 85c, so youre able to buy 235 units.

- In April, the cost of the units rises to $1.05, so youre able to buy 190 units.

- In May, the cost of units rises again to $1.15, so you’re able to buy 174 units.

Now, the average price of the units on a monthly basis was $1, and you bought 5 months’ worth, so you likely have around $1000 worth of units that cost $1 each right. Let’s see:

At the end of May, you own 1009 units. Your total cost over the 5 months was $1000. which means that the average price of the units you bought is actually $0.99. In other words, you made more money than if you merely had purchased 1000 shares at the average monthly price. This is due to the fact that you naturally bought more when the market was low.

As you can see, when prices rise you will naturally buy less of your specific asset class (at this point my life, it’s almost always equities for me). When prices are low, your consistent amount of money will purchase more shares for you. In this manner you are guaranteed to buy more when the market is low and slant the market toward yourself a little bit. It will only make a slight difference in terms of percentages, but over time, the compounding effect can make a huge difference.

I honestly believe that unless you have access to some of the top hedge fund managers out there (these guys do exist… if you have net worth of over $1 million), the most efficient and stable way to accrue investment returns is to use dollar cost averaging through a discount brokerage and basic ETFs. Using this method, you will eliminate a ton of fees over the long haul, you will diversify your hard-earned capital, and you will take a lot of the emotion out of your investing (which is exactly what kills most investors’ overall returns). Set a plan for asset allocation, open a discount brokerage account, hook it up to your bank, automate your finances, and worry about more important stuff in life!