Dollar Cost Averaging_1

Post on: 22 Апрель, 2015 No Comment

Contents

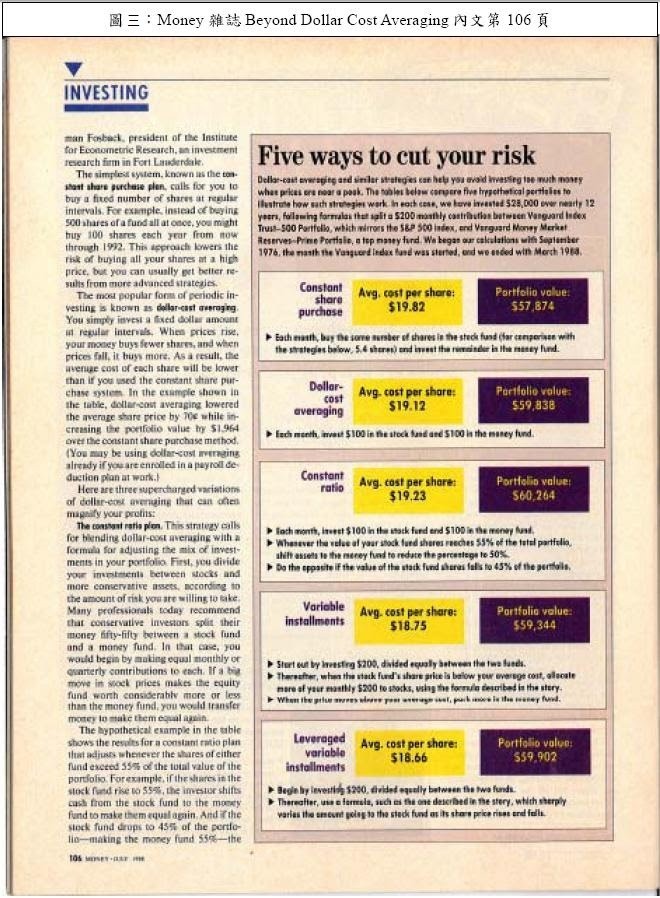

Dollar Cost Averaging (DCA) is the practice of investing a fixed dollar amount at regular intervals in a particular investment or portfolio. Most investors contribute periodically to retirement accounts and believe timing does not matter, if you are in the long run. Table 1 shows the returns of investing a fixed monthly amount over last 20 years for five types of portfolio.

70% investment in S&P500 and 30% in bonds; Investment in stocks driven by stock yield comparison to bond yields. Portfolio is re-balanced annually;

Note: Returns simulated by investing fixed amount per month starting in Feb 1989 in the S&P500 index and 10 year bond based on portfolio mix and strategy

As seen from the rate of returns table a 100% bond portfolio (Portfolio B) would have been better than stocks (Portfolio A) or a diversified portfolio (Portfolio C). Although 100% bond portfolio would have fared better in 2009 there are periods in between (2004) when stock portfolio (Portfolio A) would have outperformed.

To benefit from high stock returns and stable bond performance, investors need to have a diversified portfolio but more importantly need to devise stock market timing strategies. Simple strategies which require the portfolio to be rebalanced (Portfolio D) to the target diversified mix and avoiding stocks when the bond yields are higher (Portfolio E) can enable timing the market and improve the returns. Although these strategies do not provide the complete benefits of accurately timing the market they are better than a blind faith approach in DCA and an over reliance on a long term horizon.

Dollar Cost Averaging

DCA allows investors a self control mechanism to save towards their retirement. It allows investors to buy stocks at low average prices during any one year where stock market is expected to be end higher (typical bull market). On the other hand if the stock price at the end of year is expected to be lower (typical bear market) investors do not benefit by DCA and are buying stocks at higher price. Stocks generally outperform bonds over a long term but this is true for a one time investment and not for periodic investment in stocks as seen from the returns in Table 1. The performance of periodic investments versus one time investment is influenced by multiple factors: 1. The stock market may reach extreme heights and have a course correction at the end of the period. Contributions during the extreme heights (e.g. 1995-2000) will result in buying stocks at much high prices and the losses on those purchase outweigh the gains 2. A bull market increases the likelihood of increasing wages and salaries. Most investors have a fixed percentage contributed to savings, resulting in increasing the dollar investment when markets are rising. The opposite occurs in bear markets where people are likely to loose jobs and reduce or stop investing 3. Investors are likely to increase the % of the savings towards stocks during bull markets and decrease it during bear markets which is the exact opposite behavior

The above factors result in a Buy High and Sell Low strategy reducing portfolio returns as seen in Table 1. These returns do not include the negative effects of factors 2 and 3 so actual results for investors could be worse than shown in the table. Benefiting from stock market requires investors to devise market timing strategies versus relying on the false sense of security from DCA and long term horizon.

Simple Market Timing Strategies Investors can benefit from two simple strategies to time the stock market which do not require substantial know-how or time investment:

1. Portfolio re-balancing (Portfolio D) 2. Stock versus bond yield comparison (Portfolio E)

1. Portfolio Re-balancing: This strategy requires investors to periodically (e.g. annually) rebalance their portfolio to the original diversified mix. It is critical to be disciplined about this since the portfolio mix may not change by large percentage points every year. Portfolio balancing results in naturally timing the market since a percentage of asset classes that have increased in value are sold and gains are locked in. Investors need to follow the same discipline as DCA by balancing between different stock asset classes (e.g. domestic, international) and between stocks and bonds. This approach does not require significant time or stock market knowledge and increases the return without added risk.

2. Stock versus Bond yields: This strategy compares stocks yields (Dividend Yield + 1/PE Ratio) to bond yields and reduces or avoid investment in stocks if the yield is lower than bond yields (e.g. 10 year) and vice versa. Investing in stocks if the yields are lower than bonds creates a portfolio with high risk without the associated return. Investors can benefit by not investing in stocks when they are overvalued in comparison to bonds.

As seen in Table 1 the performance of portfolios D & E using these strategies is more predictable in different periods (e.g. 2004 versus 2009) and allows increasing the portfolio returns without subjecting to high risks. The two strategies require few data points, namely preferred asset mix based on retirement age, bond yields, stock PE ratios and dividend yields. These attributes are readily available and can be used to establish portfolio direction. There are other market timing approaches although they require significant time and know–how to produce predictable results and are best left to experts.

Conclusions

Investors can benefit significantly by periodic investments into diversified portfolios but more importantly by following market timing strategies such as portfolio re-balancing and/or yield comparison. A completely passive approach to investing and over reliance on a long time horizon can result in unpleasant surprises in portfolio performance. Investor needs to devise market timing strategy based on their individual goals and objectives