DoItYourself investment Portfolios

Post on: 18 Апрель, 2015 No Comment

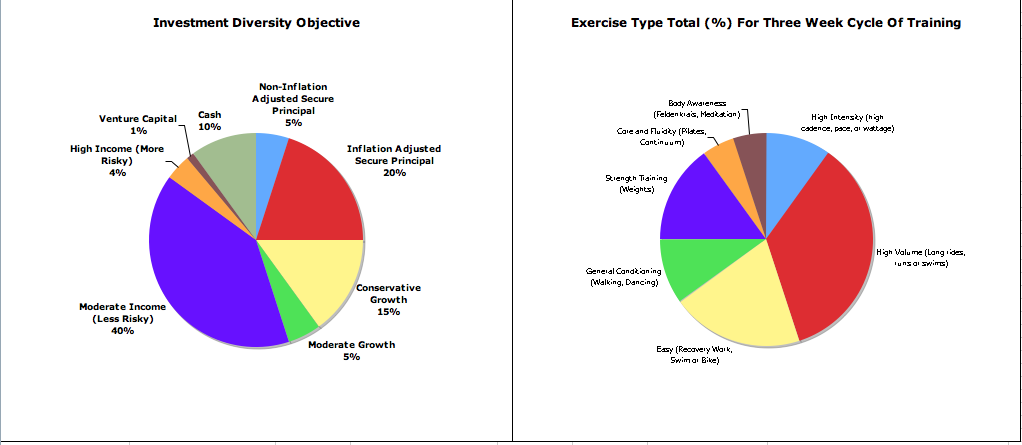

In this section of our website we want to show you what an investment portfolio looks like and how you would manage it using our balanced IFM Approach. Keep in mind that there are a number of different types of investment portfolios (such as conservative, balanced, growth, aggressive growth, etc.) and there are a number of different approaches you could use to manage your investment portfolio (such as passive, active, trading, growth, dividend, value-oriented, hedging, etc.). For more information about the different types of investment portfolios and approaches, see our section Portfolio Design .

Note: Our Sample DIY Portfolios are intended as educational tools and should not be misinterpreted as investment recommendations or advice. Visitors should ensure that the investments they purchase meet their own personal investment constraints and risk tolerances. The Portfolios are intended for those investors that view their savings as their own personally managed pension fund (i.e. a conservative, safe reliable investment portfolio). The sample portfolios are not intended as an example of a trading portfolio (a more risky, volatile, complex investment vehicle).

While there are many different investment processes to choose from, the IFM Approach is simple, consistent, and reliable. To further enhance your understanding of designing your own investment portfolio, we have put together the following three sample investment portfolios:

Sample Income Portfolio. Our Income Portfolio is a conservative investment portfolio with its primary investment objective being to preserve your precious hard-earned savings i.e. safety first. This portfolio invests in individual bonds. Guaranteed Investment Certificates (GICs). and preferred shares. The income portfolio has two objectives:

- to safeguard your savings, and

- to generate a steady investment income stream

Sample Balanced Portfolio. Our Balanced Portfolio is a portfolio that uses an investment approach that is similar to that of an old-time pension fund. The portfolios foundation has been built with individual bonds, GICs, and preferred shares, and upon this foundation individual common shares and Exchange Traded Funds (ETFs) have been placed. The balanced portfolio has three objectives:

- to safeguard your savings,

- to generate a steady investment income stream and

- to provide an opportunity for future growth from capital gains

Sample Exchange Traded Fund Portfolio. Our ETF Portfolio has been designed for tax-free (TFSA ) or a tax-deferred (RESP. RRSP. RRIF. etc .) investment accounts. In fact, when designing and managing the sample ETF portfolio we assume it will be held within a Tax-Free Savings Account (TFSA). The portfolio uses a couple of individual bonds, bond ETFs. and stock market ETF s. Just like the balanced portfolio, the sample ETF portfolio has three objectives:

- to safeguard your savings,

- to generate a steady investment income stream and

- to provide an opportunity for future growth from capital gains

Building our DIY sample portfolios with individual investments

Our portfolios are designed and constructed with a focus on owning individual investments. Our preference for individual investments (including bonds, GICs, preferred shares, common shares, and ETFs) is motivated by our desire to

- maximize investment control

- minimize investment costs, and

- maximize investment performance

Maintaining a focus on these three areas provides a number of benefits:

- With greater investment control comes a better understanding and comfort with your investments. Because each individual investment has a specific job within the portfolio, you are better able to gage how each investment is influenced by changes in the economic, business and market cycles. Greater control enables you to better measure, monitor, and modify your investments thereby increasing your success in reaching your financial goals.

- Investment costs are usually easier to determine for individual investments than they are for more complicated investments like Principal Protected Notes (PPNs), Index-linked Guaranteed Investment Certificates, mutual funds and segregated funds. By identifying and understanding the individual investment costs you are in a better position to ensure that you are not over paying for investments that under-perform.

- Finally, by investing in individual investments you gain the ability to quickly identify and monitor weak, under-performing investments. This will enable you to make timely changes thereby enhancing your investment portfolio’s overall performance.

Background information: Do-It-Yourself Sample portfolios

Both the income and balanced investment portfolios share a number of common characteristics including the following:

- Each portfolio was designed and the investments were purchased in June of 2010.

- Each portfolio began with $100,000 of savings and assumes no further deposits or withdrawals will occur.

- Each portfolio assumes all income (interest, dividends and capital gains/losses) are retained within the portfolio.

- Each portfolio records the interest and dividend income received quarterly as an addition to the portfolio’s cash balance.

- Each portfolio’s accumulated cash balance will be reinvested during the July to September quarter.

- Each portfolio’s performance is measured as of June 30th and is measured in terms of a simple, average annual rate of return with no adjustment for timing of investments or receipt of income.

- Each portfolio’s performance is assessed a success or failure when compared with its specific benchmark that has been established with the help of the Projected Annual Portfolio Value Comparison calculator found in the InvestingForMe Tools section.

Reports and summaries also included

We also support our DIY Portfolios with a number of useful reports and summaries. These provide a greater understanding of each portfolios management and the purpose of each specific investment held within the portfolio. The reports and summaries are used in the ongoing monitoring, management and measurement of each portfolio. Note: Once an investment portfolio has been designed and the investments purchased it becomes important for a process to be established for the monitoring, measuring and management of the investments toward the portfolios goals. Just as there are many different approaches to designing a portfolio, there are numerous different approaches to monitor, measure and managing an investment portfolio. The IFM Approach has developed a series of nine summaries and reports to help monitor, measure and manage the Portfolios. Every investment portfolio should be supported by a similar series of summaries and reports for measuring its success. Here is a list and a brief description of the reports and summaries that we use in our Sample Portfolios and update at the end of each quarter:

Investment Policy Statement (IPS) Every investor should design their own personal IPS before they begin designing, implementing, and managing their investment portfolio. The IPS simply states the investment portfolios purpose and goals. It’s simply a portfolios mission statement describing the reasons for the portfolio, the financial parameters placed on the design and management of the portfolio, and its financial goals. A well-written IPS can keep investors focused on their personal goals and helps to guide the investment selection process.

- Sample Portfolio Snapshot — In this quarterly summary, the portfolio’s individual investments are summarized as at the quarter’s end. Details of each investment’s quantity, brief description, book value, market value and yield are provided. The summary provides a complete picture of the investment portfolio as a whole.

- Quarterly Summary The Quarterly Summary is an important part of the InvestingForMe investment process. It provides a quarterly snap-shot of the portfolio and assesses the portfolios asset allocation in relation to the established allocation targets. The summary is used when assessing the portfolios success or failure in achieving the portfolio’s desired investment returns. The summary provides a breakdown of the portfolios Fixed Income maturity ladder and preferred share allocation, and helps you assess whether the portfolio remains within the guidelines as dictated by the IPS. We also use the Quarterly Summary to assess whether the portfolios asset allocation should be re-balanced. In addition, the summary is where you can state your current investment, economic and political concerns (concerns that may have a negative impact upon the investment portfolio and should be monitored). It is also an opportunity to make a note of any specific concerns that might impact a single investment within the portfolio.

- Transaction History The transaction history is important for reviewing and assessing past investment decisions by providing the answers to important questions such as the following: Have past investment decisions been consistent with the portfolios IPS? On balance, were the past investment changes successful? Did the transactions correctly reflect the stated quarterly investment concerns?

- Annual Income Payment Schedule This schedule provides a summary of the monthly income receipts for each individual investment held within the portfolio. For those investors that rely upon their investment income to help support their lifestyle, the schedule helps with the month-to-month budgeting process.

- Holding Descriptions — Each investment within the portfolio has a specific job to achieve. In this summary, we provide a brief summary of the investment along with a description of the investment’s specific features ad characteristics.

- Annual Performance Summary The Annual Performance Summary is used to measure the portfolios success or failure to achieve the annual milestone values, as set out by the Projection of Annual Portfolio Values. The Annual Performance Summary is simply a bottom-line picture of the portfolios past performance. It summarizes the interest/dividend income earned and the realized and unrealized capital gains/losses. At InvestingForMe. we do not measure a portfolios success against a market benchmark, but rather we compare the portfolio value against our personalized projection of future portfolio values.

- Projected Annual Portfolio Value Comparison — Success in investing dictates that you need to establish a financial goal, determine your financial starting point, design and manage your investment portfolio toward that financial goal, and periodically measure your success or failure. The Projection of Annual Portfolio Values provides the sample portfolios with their financial goals. It is the ruler by which to measure investment success or failure. The Annual Performance Summary is compared with the annual milestone values established by the Projection of Annual Portfolio Values. If the sample portfolio meets the annual financial milestone values, then we know we are on track to reaching our goals. If, on the other hand, the portfolio is not meeting the milestone values, then the portfolio’s asset allocation and IPS should be reviewed and possibly revised.

- Archives — Retaining past quarterly reports and summaries for your review is important if we are going to help you to understand the design and management of the Sample Portfolios. These pasts reports give you the ability to review prior quarters’ activity to better understand and assess the benefits and pitfalls inherent in portfolio design and management.

Note: To learn more about InvestingForMe s investment approach, see our section Class Room IFM Approach .