Does your portfolio s return stack up

Post on: 15 Апрель, 2015 No Comment

This article appeared in the July 2014 ASX Investor Update email newsletter. To subscribe to this newsletter please register with the MyASX section or visit the About MyASX page for past editions and more details.

Understanding benchmark indices is critical to assessing investment returns.

By David M. Blitzer, S&P Dow Jones Indices

S&P Dow Jones Indices calculates and publishes thousands of indices each day, far too many for any single investor to follow or use. From this mass of market measurements, a few are widely recognised, consulted and cited.

Among these are the benchmarks or flagship indices, including the S&P/ASX 200 and the S&P/ASX 50 in Australia, the S&P 500 and the Dow Jones Industrial Average in the US, the S&P GSCI for commodities, and more recently the S&P Australia Fixed Income Series covering bonds in Australia.

What are benchmark indices and why are they critical tools?

A benchmark index covers an identifiable and recognisable segment of a market. The S&P/ASX 200 is the 200 largest stocks in the Australian market and represents that segment on which institutional investors focus. The S&P 500 in the US is similar — it covers large-cap US stocks.

The statistics — especially returns and risk — measured with the benchmark should be the returns and risks of the market. This is the case if the benchmark index is a float-adjusted market-cap weighted index. Float adjusted means that only those shares available to investors are counted. Shares under closely held control or Treasury stock are excluded.

Market-cap weighted means that each stock’s impact on the index is proportional to its market value. The overall market is market-cap weighted, therefore so must a benchmark index.

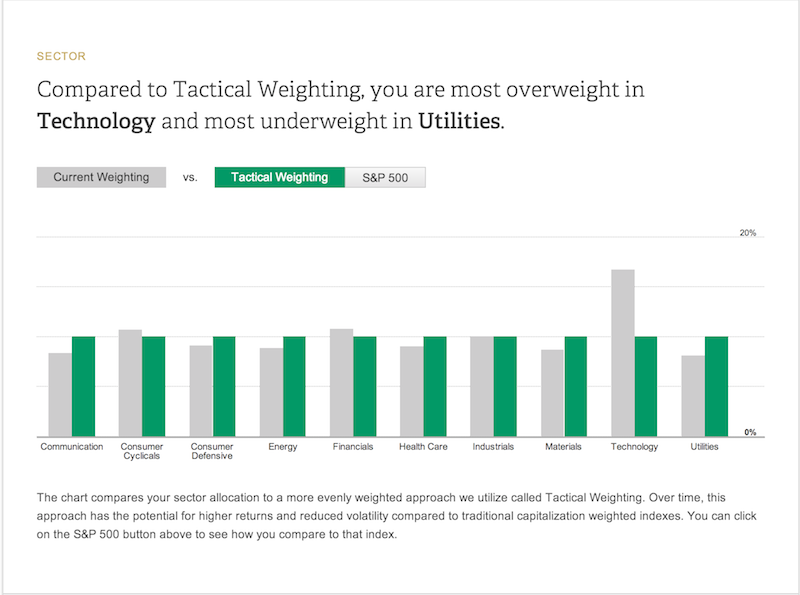

In recent years there has been growing interest in other approaches to index weighting. Examples are equal weighting or weighting by other attributes of a stock, such as its dividend yield, earnings, revenues or even its volatility. These are all viable and useful approaches and all will give different results to market-cap weighting, but none will give statistics that track the market statistics.

Besides the weighting approach and recognition, for most benchmark indices there is a wealth of data published by the index provider and a lot of commentary written by market analysts in investment houses or the media. This information can be valuable to investors.

The effect of asset classes

Benchmark indices do vary by asset class. Commodity indices track trading in futures contracts. Because futures contracts have expiration dates and are created or extinguished through trades, there is no easy way to assign a measure comparable to the market capitalisation of a stock.

The S&P GSCI, a leading commodity benchmark, is weighted by annual value of the global production of each commodity. This is the closest equivalent to market capitalisation. As with an equity benchmark, the index market statistics on return and risk will track the market statistics.

Bond indices often use the par value of the bonds as the weight measure; the par or face value reflects the indebtedness of the bond issuer and gives a good picture of the overall market condition.

In any asset class there is a lot of variety. Within equities, stocks can be divided by sector or industry, into dividend and non-dividend paying, or into growth and value stocks. In bonds, the divisions are based on maturity, credit rating or the size of the coupon or annual interest rate. Commodity contracts vary by the commodity group and expiration date.

Each of these breakouts defines a sub-index and each sub-index has valuable information about the overall market. Which sub-index was up, or down, can explain a large part of why a market or asset class moved.

One clear example in many markets recently is the importance of technology stocks, which have boosted a number of markets in 2014. The same kind of analysis can indicate whether higher oil prices push stocks up because oil company earnings are expected to rise, or instead send stocks down because higher petroleum prices reduce consumer disposable income and weaken retail stocks. Benchmark indices, because they are broad based and cover the market, are excellent tools for this kind of sector analysis.

Investing is about strategy selection and evaluation

In its simplest form, investing can be divided into two steps: selecting an investment strategy and evaluating the results. Selecting the strategy means deciding which and how much of different stocks, bonds, ETFs, funds or other securities to hold.

Research demonstrates that the most important parts of a strategy are which markets and which asset classes to focus on; the individual stocks or bonds chosen are less important than the overall strategy of choosing the proportions of each asset class or market.

Among the information needed for this broad strategy are the risks and returns of each market or asset class. This information is derived from benchmark indices. One of the hardest parts of investing is dispassionately analysing the results of an investment strategy — why weren’t the returns stronger? Or, if the plan turned out to be very successful, what can we learn for the next time? Doing this requires the same kind of market data provided by benchmark indices.

While both data and theory demonstrate the efficiency of investing with index-based products, there will always be some investors who choose individual stocks, bonds or other securities in the hope of obtaining better results than an index-based product. Beating the market means getting better returns than the market — better than the benchmark index.

Investors in Australia, who buy a selection of the stocks included in the S&P/ASX 200 and underperform the S&P/ASX 200, should ask themselves why they would not be better off simply finding an ASX-listed Exchange Traded Product that tracks the index at very modest cost.

S&P Dow Jones Indices publishes a report comparing indices and active fund management performance to demonstrate the percentage of funds that were outperformed by the comparison benchmark index over a three-year period. (Editor’s note: this table shows almost two thirds of Australian Equity General active managed funds underperformed the S&P/ASX 200 Accumulation Index over three years.)

Percentage of funds outperformed by the Index