Does Quantitative Easing Work

Post on: 2 Май, 2015 No Comment

During times of crisis, traditional monetary policies become less effective in stimulating economic activity. Several nations have adopted unconventional monetary policies including quantitative easing. credit easing and zero interest rate policies to combat financial turmoil and recessions. Central banks use these measures to keep interest rates near zero and facilitate bank lending. This can be done through the purchasing of government bonds or assets, which, in effect, expands a central bank’s balance sheet.

Many countries have embraced these policies to fight deflation in the wake of the 2008 financial crisis. In particular, the United States, United Kingdom, Japan and a number of European countries have used quantitative easing (QE) to lower interest rates and increase the money supply. The deployment of QE in the U.S. has been deemed relatively successful; however, Japan has had waning success with the policy.

How Quantitative Easing Works

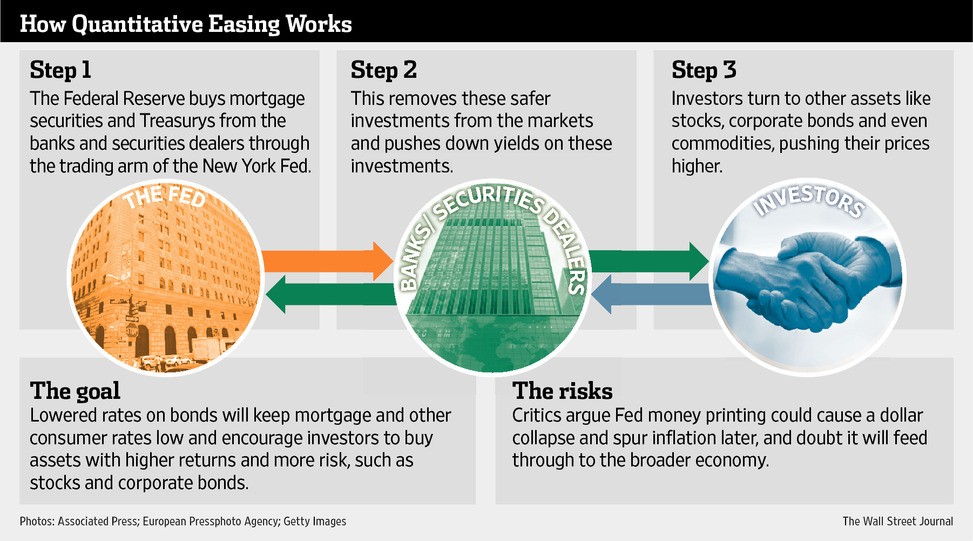

Traditional monetary policy consists of the buying and selling of government securities in the open market to expand or control the money supply. As a result of open market operations. the interest rate will either rise or fall. However, when interest rates are near zero, open market operations cannot be used, and an unconventional policy must be implemented. QE is the purchasing of securities which puts downward pressure on interest rates and increases lending. The Federal Reserve, for example, will buy treasury bonds, essentially creating money in the central bank’s accounts.

The massive purchasing of assets, in theory, pushes up prices, forcing interest rates down as a result. In economics, low interest rates lead to borrowing, job creation, and increased consumption, spending, and investing. Likewise, low interest rates decrease exchange rates and increase net exports.

QE in the U.S.

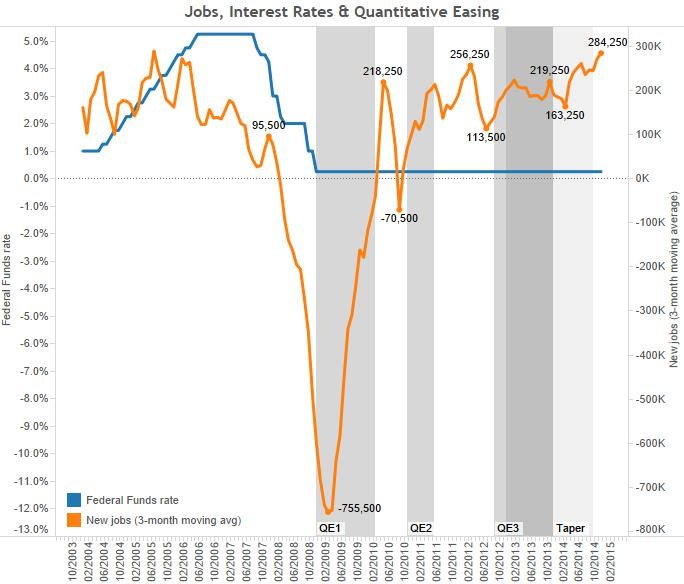

The United States used QE to aid its economic recovery following the 2008 financial crisis. Generally recognized as the most successful QE effort, the Federal Reserve’s balance sheet expanded from $700 billion in 2008 to $4.4 trillion in 2014. As a result of three successive waves, the U.S.’s QE is the largest economic stimulus program in world history. Spanning 2008 to 2010, QE1 aimed to help banks remove mortgage backed securities (MBS) from their balance sheets. By 2009. $200 billion government-sponsored enterprise debts and $1.25 trillion in mortgage back securities were purchased. QE2 was announced after QE1, stating the purchase of $600 billion in long term treasury notes. The round ended in 2011, and the Fed maintained its balance of $2 trillion in securities.

Loading the player.

Following the success of QE1 and 2, the Fed purchased $40 billion in mortgage backed securities per month in QE3 in an effort to further remove toxic assets from banks’ balance sheets. QE3 also continued the $85 billion monthly purchase of long-term treasury notes. QE in the U.S. achieved most of the Fed’s goals, including removing MBSs from bank’s balance sheets, restoring trust in the banks, stimulating the economy and decreasing interest rates.

QE in Japan

The first application of QE occurred in Japan in 2001, and the country has used the policy multiple times in the interim. In 2013, Japan launched a massive QE program worth $1.4 trillion. The nation’s ongoing economic overhaul, which consists of QE as well various policies implemented by Prime Minister Shinzo Abe, has been referred to as Abenomics. The Bank of Japan purchased $70 billion in government bonds per month, comparable to the U.S. efforts, even though the Japanese economy is one-third the size of the U.S economy. Japan’s efforts have been deemed aggressive given its low inflation and struggles with consumer spending.

It is insisted that economic activity in Japan has increased since the start of the QE program. However, expected inflation is designed to boost credit and borrowing, though Japanese households still have an aversion to debt. With negative real money growth, the impact of QE stimulus on economic activity is diminishing.

The Bottom Line

Traditional monetary policy simply isn’t able to stimulate the economy during a recession. In order to increase economic activity, central banks must fight deflation and decrease interest rates in order to spur borrowing, consumption and spending. When interest rates approach zero in a struggling economy, an unconventional approach such as quantitative easing can stimulate economic activity. Through three separate waves, QE has accelerated the U.S.’s economic recovery after the Great Recession. The European Central Bank recently ushered in the use of QE to stimulate economic growth to avoid deflation. However, in Japan, any short-term positive effects from QE are predicted to wane in the near future, highlighting why the benefits of QE remain a point of contention between economists and analysts.