Dividends keep climbing even as profits disappoint

Post on: 28 Март, 2015 No Comment

Max Mason

20Lead%20-%20wide6688148513uesuimage.related.articleLeadwide.729×410.13ti31.png1425419875847.jpg-620×349.jpg /%

Keeping shareholders happy: Companies have stepped up their investor payout while having to slash costs in their businesses to bolster profits.

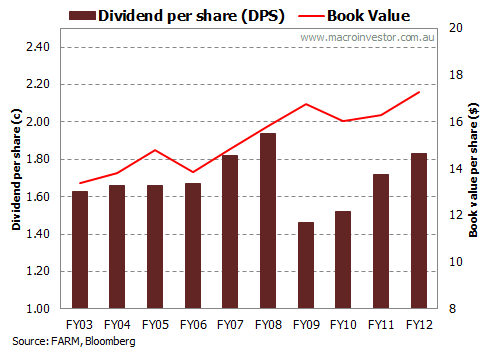

Dividend have grown more than twice as much as earnings in the February reporting season as Australian companies continued slashing costs to satisfy investors’ seemingly insatiable appetite for income.

The payout ratio across the benchmark S&P/ASX200 rose by around 5 per cent to 65 per cent, according to JP Morgan, while UBS said dividend growth was 5 per cent and 6 per cent if resources are excluded.

Underlying earnings growth in the six months to December was relatively flat at around 2 per cent, according to Deutsche Bank.

In the first half of fiscal 2015, we’re effectively going to get a flat earnings-growth landscape. That’s not good, but at the same time it could have been worse, Contango chief investment officer George Boubouras said.

Advertisement

The resources sector was the biggest drag on profit growth this reporting season. If mining companies are excluded, profits grew around 9 per cent, according to UBS.

But ironically much of the increase in the payout ratio was from resources, led by heavyweights Rio Tinto and BHP Billiton, which continued to return cash to shareholders despite falling revenue.

After the past few years of investor interest in yield and the outperformance of traditional high-yield sectors, and the subsequent lifting of payout rates by traditional low-yield sectors, dividend yields have now as a result converged across the market, Citi strategist Tony Brennan said.

Jump in payout ratios

Payout ratios among resources companies are expected to jump from around 50 per cent to just below 70 per cent by next year.

Evidence of an upward trend in earnings seems to have been enough to entice investors, Deutsche Bank strategist Tim Baker said. During February, the ASX200 jumped 6.1 per cent the best month since October 2011. The Australian sharemarket is now trading at a forward price-to-earnings ratio of 17.1 times, well above the median 14.5 times.

Much of the surge began when the Reserve Bank cut rates in the first week of February, with the expectation of more to come, ending the period of interest rate stability. With little money to be earned sitting in bank accounts, the search for income and dividends continued to dominate reporting season.

Earnings that are generally heading higher give confidence that dividend forecasts will be largely met, making equity yields quite compelling compared to yields on bonds and term deposits, Mr Baker said.

But the surging sharemarket stands in stark contrast to the outlook for company profits.

The percentage of companies that have had their earnings forecasts upgraded has been low compared to previous years, at 42 per cent. In addition, only 50 per cent of companies beat Deutsche Bank’s expectations, Mr Baker said

Investment banks have downgraded their earnings per share (EPS) growth forecasts for the full-year, with most believing the sharemarket will tread water until an expected improvement next year.

Citi downgraded its EPS growth forecast for the 2015 financial year from a rise of 1.3 per cent to a fall of 2.1 per cent. Consensus EPS forecasts, gather by JPMorgan, have fallen from a rise in earnings of 4.8 per cent to a rise of 2.3 per cent.

Most analysts and fund managers are forecasting improvement in earnings in the 2016 financial year.

Improvements next year?

Contango’s Mr Boubouras is expecting 8.5 per cent EPS growth across the ASX200, but this is contingent on the RBA cutting interest rates below 2 per cent, the Australian dollar staying below US80 and the long bond rate staying at current levels or lower.

Citi forecasts 7.6 per cent EPS growth for the 2016 financial year, while UBS expects 6.9 per cent.

Conditions in the domestic economy are not optimal at the moment, they’re mixed, and that is why cash rates are heading lower and corporate Australia is trying to engineer a recovery phase which is probably one or two years later, Mr Boubouras said.

Companies have been able to generally improve headline profit numbers thanks in large part to cost-cutting and falling energy prices, rather than revenue growth, which has been weak.

It can have a finite life as a strategy because you can find that you may have to load costs back in, Fidelity Australian equities portfolio manager Kate Howitt said.

The profit number, while important, is becoming less and less interesting because companies, with continuous disclosure requirements, generally guide pretty close to the number they end up reporting, Ms Howitt said.

Cash is king

The more interesting question is always about cash flow and how far they’ve had to stretch to achieve the profit number, Ms Howitt said.

Levered free cash flow the amount of free cash a company has after meeting all its debt obligations has increased sharply in the last two years. For the 2014 calendar year, average free cash flow across the ASX200 was at $94.58 per share, up from $31.35 in 2013, and up from negative $15.24 in 2012, according to S&P Capital IQ.

Not surprisingly, interest in expansion was also still limited and the emphasis on distributing earnings remained, with more companies lifting dividends to the extent that yields now look quite similar across much of the market, Mr Brennan said.