Dividend yields on REIT stocks attractive to income investors

Post on: 1 Апрель, 2015 No Comment

Tags

Recent Kimco dividend hike puts current yield at more than 4 percent

Yield-starved investors seeking higher returns in this low interest rate environment have often flocked to the Real Estate Investment Trust (REIT) sector, which allows them to invest in real estate in much the same way as mutual fund investors are able to invest in other types of securities.

What makes REIT stocks so attractive to the income investor is the sectors track record of paying significant cash dividends and generating above-average yields. By law, U.S. REITs are required to pay out at least 90 percent of their taxable income as dividends. Most, like Kimco, elect to pay out 100 percent or more.

In essence, REIT stocks allow investors to enjoy the stable and consistent income stream from commercial property investing without the high cost or illiquidity of owning the property directly.

Dividends the cake for REIT investors

I like how Brad Thomas described REIT dividends in a recent post on Forbes.com. Thomas quoted another financial writer, Chuck Carnevale of Seeking Alpha, who said common-stock dividends, in general, are a kicker or bonus return. In other words, capital appreciation is the cake, and dividends (if any) are the icing.

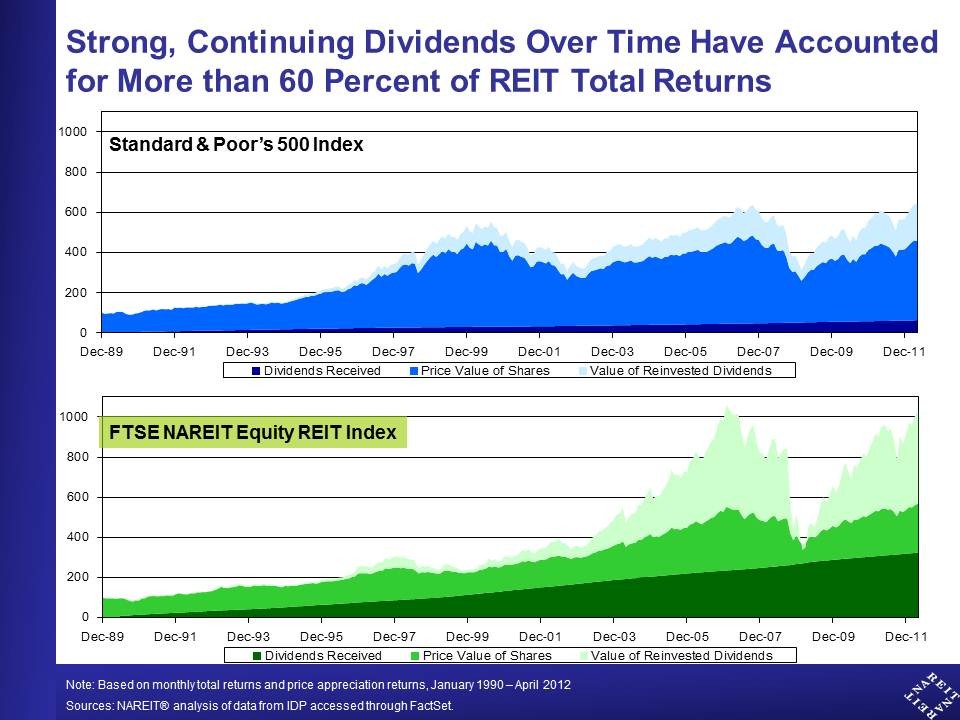

Thomas took this cake-and-icing analogy a step further. He pointed out that since dividends typically represent more than 50 percent of a REITs total return, they are the cake of REIT stocks, while capital appreciation is the icing the exact opposite of the typical equity investment.

Because REITs pay consistent dividends, they are more than just icing on the cake, Thomas wrote. Instead, they provide a value proposition like no other stock and perhaps that is why the cake and eat it too strategy is appetizing to many intelligent REIT investors.

The consistent income-generating properties of REITs are one of the main factors that make them such an attractive investment, according to Cohen & Steers, a global investment manager specializing in real estate securities.

Stable and growing cash flows

In a recent white paper. Cohen & Steers said such investments have consistently produced strong returns relative to other equities and fixed-income securities, benefiting from a business model focused on generating stable and growing cash flows.

During the modern REIT era, real estate securities in the U.S. have outperformed both stocks and bonds in terms of total returns, the report said. From 1994 through the second quarter of this year, REITs have generated annualized total returns of 11.2 percent, compared with 8.4 percent for stocks and 6.8 percent for bonds.

Furthermore, many real estate securities offer above-average dividend yields, the report said, and have a history of consistently raising their dividends, resulting from cash flow growth that can come organically from rising rents and occupancies, or externally from development and acquisitions.

REIT dividends grew an average of 5.9 percent annually between 1993 and 2007, before dipping sharply as investment gains for many companies evaporated during the Great Recession. But REIT dividends are now back on their historic upward trajectory, having grown an average of 11.6 percent last year. They are projected to grow 6.6 percent a year between now and 2016, according to Cohen & Steers.

Rising dividends, the report noted, are a big factor in why REITs have outperformed the broader equity market. Since 1994, reinvested dividends have accounted for 57 percent of the total returns for U.S. REIT stocks, compared with only 24 percent for the broader equity market.

In the last decade, the average dividend yield of U.S. REITs has been 3.46 percent, compared with 2.09 percent for U.S. stocks, 1.98 percent for U.S. bonds, and 1.67 percent for 10-year Treasuries. The historical spread between U.S. REIT yields and 10-year Treasury yields has been about 110 basis points, on average, since 1994. Today, REITs offer a yield premium of approximately 180 basis points relative to Treasuries.

Kimco increases dividend 10.5 percent

Kimco, Im proud to say, is one of the better performing companies in the REIT sector in both the long and short term.

Recently, as part of our third-quarter earnings release. we announced a 10.5 percent annualized increase in our quarterly dividend, to $0.21 per common share, reflecting the strength of our 2012 performance and confidence in our future growth prospects. That translates into a current yield of more than 4 percent, compared with an average yield of 3.6 percent for our peer group.

Our latest dividend increase continues a long tradition of consistently paying cash dividends for Kimco. The fact is we have paid a cash dividend every quarter since our IPO, unlike some REITs that issued stock dividends during the recession to conserve cash. Kimcos dividend payout has grown an average of 7.2 percent a year since our initial public offering at the end of 1991.

I should point out here that dividends for REITs are treated as ordinary income, or a pass through, because REITs dont pay corporate income tax themselves. For tax purposes, dividends are allocated to ordinary income, capital gains, and return of capital.

Traditionally, Kimco has paid out more than the 90 percent of taxable income that is legally required of REITs. We typically pay out 100 percent or more of our earnings. Last year, we paid out 129 percent. with the extra 29 percent treated as a return of capital.

Return of capital is not taxed as ordinary income, but is applied to reduce the shareholders cost basis in the stock. When the shares are eventually sold, the difference between the share price and reduced tax basis is taxed as a capital gain.

The following chart illustrates the total return an investor in Kimco stock would have realized since our IPO both in terms of pure capital appreciation (7.5 percent) and by reinvesting dividends (13.4 percent). For the convenience of our investors, Kimco, like many REITs, offers a Dividend Reinvestment Plan that makes automatic reinvesting of dividends a simple matter.

Source: Bloomberg

How does that total return performance stack up against the REIT sector and the broader equity markets? The following charts show that Kimco has outperformed those other investments both since our IPO, and within the last year.