Dividend Stocks Lists and Screens with a Value Bias

Post on: 19 Июль, 2015 No Comment

Dividend stocks often lose favor as investor chase capital gains and other high growth strategies. For a value investor, dividends are an integral part of investing arsenal. Dividend investors may be looking at the income, but there is much more to dividend investing than just the quarterly check.

Why Dividend Investing is Important

Please note that this includes ALL stocks in the S&P 500 index, including the ones that do not pay dividends. If the study was done only with dividend paying stocks, the results might have been even more in favor of dividend stocks. Similar research by Strategas Research Partners (as published in this Fayez Sarofim & Co/Dreyfus/BNY Mellon report. pdf) came to a similar conclusion with data going back to 1930s. If the history is any guide, investing in dividend stocks and reinvesting the dividends should form the core of your investment strategy.

Doesn’t a Dividend Mean the Company has Limited Growth Opportunities?

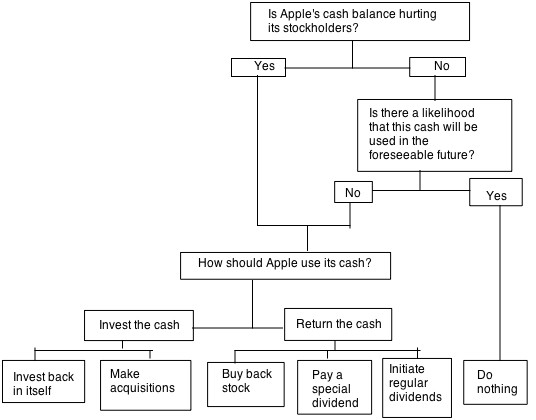

We are still fresh from the technology growth spurt when most tech companies chose to reinvest their profits into growing the business rather than paying a part of it to the shareholders as dividends. The argument that these companies have tremendous opportunities in front of them so paying a dividend is counter productive had gained widespread currency. While perhaps true in many cases, it is also of relevance that companies that choose to pay dividends are typically financially strong and pursue their growth and expansion with greater discipline. Many of these dividend paying companies in reality generate significant cash flow in excess of what they may need for their growth projects. Hoarding this cash is not the best use of capital.

It is also inevitable that every company goes through a lean phase at one time or another. Perhaps the competition is fierce and they lost market share, or maybe a weak economy has rendered their products a luxury. There may be management hiccups or a product launch or market entry gone wrong. Or the industry might be experiencing a cyclical down turn. Regardless, no management likes to cut dividends and if they are cut as a last resort, they are also likely to be restored as quickly as possible. A history of dividend payments instills discipline and a mindset that favors profitability over everything else. Growth for growth’s sake without regard to profits is not good business.

Dividend income is no longer as tax inefficient as it used to be when it was taxed at the ordinary income tax rate. With this last hurdle removed, even some tech companies that used the tax argument to avoid paying dividends have now started to pay dividends to their shareholders.

Why Dividends Make Sense to an Investor?

Buying a stock for dividend income involves taking on more risk than other instruments such as bonds to generate income. However, for this risk, the shareholders are rewarded handsomely. The aforementioned Fayez Sarofim & Co report compares incomes from $100,000 invested in S&P 500 and another $100,000 invested in Barclays US Aggregate Bond Index between 1980 and 2013. While the annual dividend income increased from $5,234 to $32,416 in the S&P 500 investment, the annual bond income declined from approximately $11,000 to $3,000. The main reason being dividend growth. Most financially strong companies choose to increase their dividends over the years as the profits rise. For bond investors, the coupon is locked in and the yield changes are not as significant. There is also an added leverage of compounding faster when the stock price is depressed (when dividends are reinvested). While we can set up similar reinvestment program for bonds, the swings in bond prices are not as significant due to the fact that bonds offer greater investment security.

In a low interest rate environment, bond and other fixed income yields decline. Dividend yields are often superior to fixed income alternatives in such periods. Lower borrowing costs also helps increase profits and more can be paid out as dividends.

Dividends are a great inflation hedge. With rising prices, dividends often rise at equal or greater pace.

Finally, for value investors like us, dividends offer a tangible way of identifying a company’s financial strength. Earnings forecasts, growth rates, market share, etc can all be a fiction but dividends are facts that we can see and touch.

Do we Recommend Reinvesting Dividends?

If you have no immediate need for withdrawing the dividend income, you should always reinvest dividends. For most investors, setting up a dividend reinvestment plan at their broker is sufficient. For more enterprising investor, we recommend letting dividends accumulate and selectively reinvesting them in the stocks in their portfolio that offer greater values. Always looking for the best values to reinvest their dividends in will make the portfolio compound at a faster rate via both dividend growth and capital gains.

In line with our value based philosophy, we frequently run dividend stock screens and generate lists of dividend stocks that we believe are the best undervalued dividend stocks available today. You will find these dividend stock ideas below. There are different screens we run to uncover different sources of value for these stocks and we take care to ensure that even when the stock price is depressed, the company has the ability to continue paying and growing dividends. Some of these are list of dividend stocks by industry, while others cover a variety of industries to help you in your asset diversification. Review the lists below for ideas and if you wish to receive new screens as they are posted in the future, you can sign up for the email newsletter here .