Dividend Discount Model (DDM)

Post on: 16 Март, 2015 No Comment

A security with a greater risk must potentially pay a greater rate of return to induce investors to buy the security. The required rate of return (aka capitalization rate ) is the rate of return required by investors to compensate them for the risk of owning the security.

This capitalization rate can be used to price a stock as the sum of its present values of its future cash flows in the same way that interest rates are used to price bonds in terms of its cash flows. The price of a bond is the sum of the present value of its future interest payments discounted by the market interest rate. Similarly, the dividend discount model (aka DDM. dividend valuation model. DVM ) prices a stock by the sum of its future cash flows discounted by the required rate of return that an investor demands for the risk of owning the stock. Future cash flows include dividends and the sale price of the stock when it is sold. This DDM price is the intrinsic value of the stock. If the stock pays no dividend, then the expected future cash flow is the sale price of the stock.

P (1+k) n

k = Capitalization Rate

n = Number of Years until Stock is Sold;

Present Value of Stock Sale Proceeds

In the above equation, it is assumed that 1 dividend is paid at the end of each year and that the stock is sold at the end of the n th year. This is done so that the capitalization rate (k) is an annual rate, since most rates of return are presented as annual rates, and simplifies the discussion. We are only interested in the equation’s pedagogical value rather than specific results. Note also that this equation is similar to the formula for calculating bond prices in terms of the yield to maturity. where the dividend payment is replaced with the coupon payment, the stock price is replaced by the par value of the bond, and the capitalization rate is replaced with the yield to maturity to yield the bond price.

Note that if the stock is never sold, then it is essentially a perpetuity, and its price is equal to the sum of the present value of its dividends. Since the DDM considers the current sale price of the stock to be equal to its future cash flows, then it must also be true that the future sale price of the stock is equal to the sum of the cash flows subsequent to the sale discounted by the capitalization rate.

In an efficient market, the market price of a stock is considered equal to the intrinsic value of the stock, where the capitalization rate is equal to the market capitalization rate. the average capitalization rate of all market participants.

There are 3 models used in the dividend discount model:

- zero-growth. which assumes that all dividends paid by a stock remain the same;

- the constant-growth model. which assumes that dividends grow by a specific percent annually;

- and the variable-growth model. which typically divides growth into 3 phases: a fast initial phase, then a slower transition phase that ultimately ends with a lower rate that is sustainable over a long period.

Zero-Growth Rate DDM

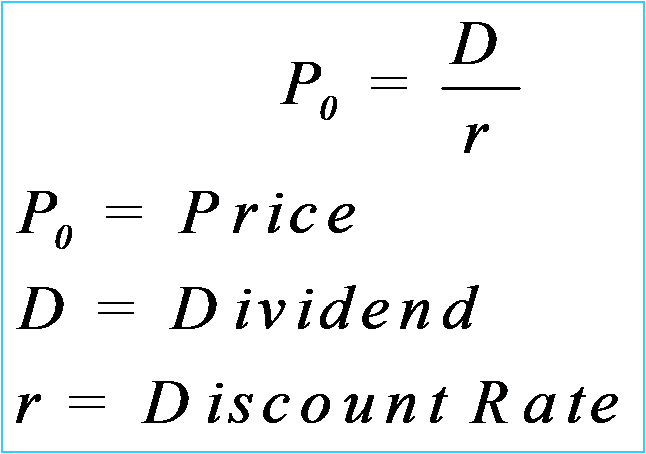

Since the zero-growth model assumes that the dividend always stays the same, the stock price would be equal to the annual dividends divided by the required rate of return.

Stock’s Intrinsic Value = Annual Dividends / Required Rate of Return

This is basically the same formula used to calculate the value of a perpetuity, which is a bond that never matures, and can be used to price preferred stock. which pays a dividend that is a specified percentage of its par value. A stock based on the zero-growth model can still change in price if the capitalization rate changes, as it will if perceived risk changes, for instance.

Example—Intrinsic Value of Preferred Stock

If a preferred share of stock pays dividends of $1.80 per year. and the required rate of return for the stock is 8%. then what is its intrinsic value?

Intrinsic Value of Preferred Stock = $1.80 / 0.08 = $22.50 .

Constant-Growth Rate DDM (aka Gordon Growth Model)

The constant-growth DDM (aka Gordon Growth model. because it was popularized by Myron J. Gordon) assumes that dividends grow by a specific percentage each year, and is usually denoted as g. and the capitalization rate is denoted by k .