Dividend Asset Allocation

Post on: 27 Апрель, 2015 No Comment

Dividend Asset Allocation

When it comes down to building any investment portfolios, choosing the right asset allocation is crucial. In fact, it has been proven many times that a good asset allocation is directly responsible of an investment portfolio returns. If you are not well diversified, you may run into big troubles. So how asset allocation can be applied in a dividend investing strategy? There are many ways to look at your asset allocation:

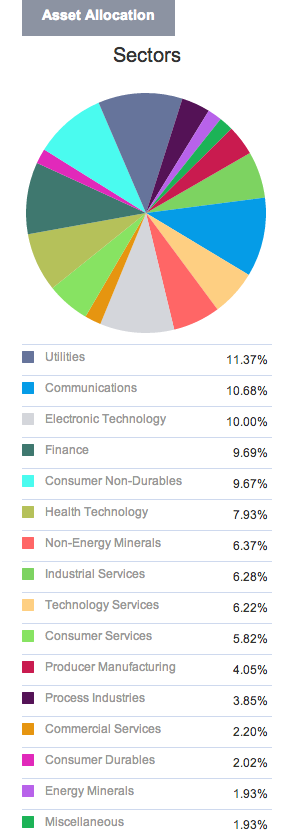

Dividend Asset Allocation By Sector

Consumer, Cyclical

Consumer, non-Cyclical

Energy

Financial

Industrial

Technology

Utilities

Each sector has their specific characteristics and ways of reacting to the economy. While utilities and consumer, non cyclical include more defensive stocks, technology and consumer, cyclical are more sensible to economic cycles. So the question you must answer before building your asset allocation is: which type of investor are you and what is your investing goal?

Ideally, a good dividend asset allocation would include dividend stocks from each sector. Therefore, you are not only picking solid dividend payers but you also invest in different sectors that will react differently to economic cycles. This will allow you to have a smoother investment return over the long run.

Dividend Asset Allocation By Country

After looking at the different sectors, you might want to consider a few countries as well. For North Americans, it is easy to trade US and Canadian stocks. If you have the choice, I would personally buy my energy and financial dividend stock on the Canadian side. They are known to have a strong banking system and their energy stocks pay higher dividend than most US stocks in this sector. You can look at the Best Canadian Dividend Stocks here.

Doing an asset allocation per country gives you the opportunity to pay on 2 different economic cycle based on 2 different types of economies (US Vs CAN). While the Canadian market is great for financials and resources, their stock market is not as diversified and as solid as the US stock market. In addition to this, you can find solid dividend payers on the US side which shows 50% of their sales offshore. Therefore, you are diversifying your geographical asset allocation through buying US stocks, making money in other countries. Trust me, it’s easier than buying stocks on international markets! We have listed the Best US Dividend Stocks here.

Is a Good Dividend Asset Allocation Enough?

It is very important to have a solid asset allocation; you should know this by now. However, are dividend stocks enough to fulfill your portfolio in terms of asset allocation? The answer lies in the answer of this question:

Which type of investor are you and what is your investing goal?

A 100% dividend stocks may be the answer for several dividend investors. I personally think that it doesn’t fit completely my own investor profile and goals. As I am also seeking high growth in my portfolio, I took a part of my asset allocation into non-paying dividend stocks with higher potential for growth over the upcoming years. Some others may think that a 100% equity portfolio (even though it’s dividend stocks) may be too risky. Therefore, they might add bonds or certificate of deposits to their asset allocation.

This entry was posted on Wednesday, April 6th, 2011 at 10:54 am and is filed under Dividend Strategy. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response. or trackback from your own site.