Diversifying Your Portfolio with Alternative Investments Accredited Investor News

Post on: 1 Апрель, 2015 No Comment

Alternative investments encompass a vast number of different kinds of investments. It’s a loose term that refers to almost anything that doesn’t include stocks and bonds. It’s time to break it down and talk about what exactly an alternative investment is – and how to make it work for your portfolio.

Alternatives: Defined

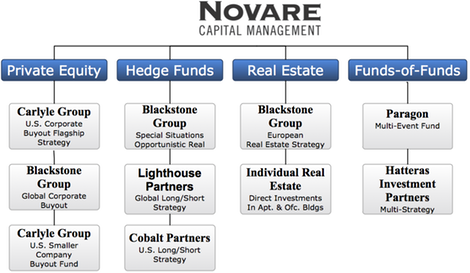

The actual definition of an alternative investment is actually more complex than you might think. The category of alternative investments spreads between a series of different types of investments, which can include private equity, mutual funds, exchange traded funds, liquid investments, illiquid investments – the list goes on, and that’s not even getting into specifics.

A Variety of Assets

When it comes to alternative investments, what it all boils down to is a variety of asset classes. This is almost inherent to the strategy. What actually defines an asset class is as fuzzy to delineate concretely as the definition of an alternative investment, however, since many investors simply do not agree on whether certain investments actually can be defined as such. For example, alternative investors often put their money into art and even stamps or timber, while a lot of traditional investors believe that these do not necessarily comprise asset classes.

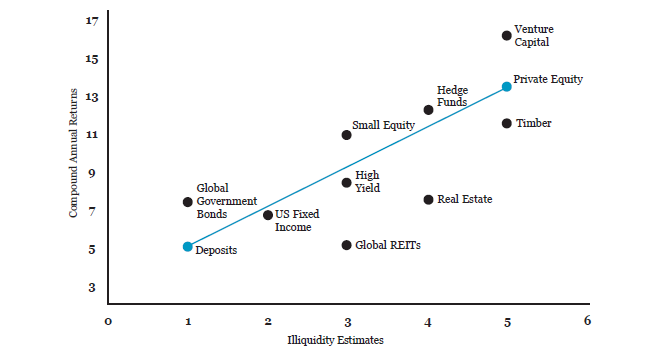

These assets, however, can definitely bring around a high return, which leads alternative investors to diversify with these kinds of investments. What are some other ways to diversify? By investing in property and real estate, currencies, as well as concrete assets such as gold and other precious metals, you can create a hugely diverse portfolio.

Alternatives: The Smart Route to Take

Alternative investment, according to this article from Investment News, is simply the smarter way to go about investing. The experts believe that asset strategies with alternatives are great for managing the risks of investment while simultaneously improving the expected return. A few seasoned investors have become complacent, believing that the easier market from twenty to thirty years ago is going to resurface, but the research shows otherwise. The return of the smooth ride is, ultimately, quite unlikely.

Not only is alternative investment a smarter route to take than staying solely in the realm of traditional investments, but the experts also believe that it is a more ethical approach. When veteran investors take on the role of guiding novice investors through the benefits of alternatives and means of accessing them, everyone can benefit from the strength of individually diverse portfolios.