Diversify Bond Funds with CDs

Post on: 26 Апрель, 2015 No Comment

by Harry Sit on February 4, 2013 2 Comments

The case for substituting CDs for bond funds should be obvious but Im surprised more people dont realize it.

CDs are FDIC insured. Bond funds are not. CDs lock in the rate for reinvesting interest. Bond funds do not. The downside to CDs is limited to the early withdrawal penalty. There is no such floor in bond funds. Finally, CDs have a higher yield than many bond funds.

Myth: You cant buy CDs in an IRA

Its true that some banks dont sell IRA CDs. CIT Bank does not. Barclays Bank does not. But other banks do. Ally Bank sell IRA CDs. So do Discover Bank, PenFed, and many other banks.

Myth: You cant buy CDs in an investment account

First you can buy brokered CDs in a brokerage account. If you dont care for brokered CDs because they dont have the best yields, nothing stops you from selling some from your bonds funds and moving that part to a bank or credit union to buy CDs. You can have multiple traditional IRAs or Roth IRAs with different custodians. Just do a partial transfer to the bank or credit union to buy CDs.

Myth: Its difficult to rebalance if your fixed income investments are in CDs

You dont have to be all-or-nothing: all CDs or all bond funds. Leave some money in bond funds for rebalancing and the rest of your fixed income investments can go into CDs. You dont need 100% of your fixed income money for rebalancing.

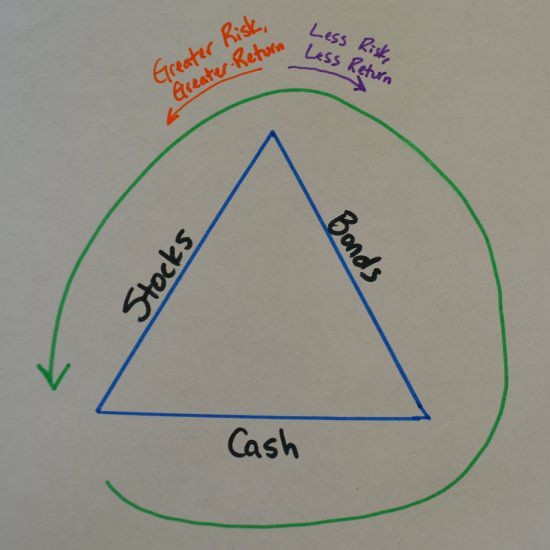

A previous post shows it takes a 20-25% drop in the stock market to shift the stocks/bonds allocation by 5 percentage points. If you leave 10% of the portfolio in bond funds, thats more than enough for rebalancing needs. If you normally invest 30% of your portfolio in fixed income, that means 2/3 of your fix income investments can go into CDs. If you normally invest 50% of your portfolio in fixed income, that means 80% of your fix income investments can go into CDs.

Your new money can still go into bond funds. The static pile stay in CDs.

Myth: You have to move from bank to bank for the best rates if you invest in CDs

If you buy CDs from a bank or credit union that offers good enough rates, you dont have to move if you are satisfied with good enough rates. CIT Bank. Ally Bank. Discover Bank. Barclays Bank. and PenFed all offer good enough rates. One bank may be better than another for a specific term at one point of time, but the rates are all competitive with bond funds. Even if you move, its once 5 or 7 years when you are investing for the long term. Whats the big deal?

Bottom line: invest in bond funds and CDs, not bond funds or CDs.

[Photo credit: Flickr user UW-River Falls Archives ]