Diversification You re Doing It Wrong

Post on: 29 Апрель, 2015 No Comment

Diversification: Youre Doing It Wrong

Last revised on August 2, 2010

Blueleafs position: Diversification across asset classes is significantly more important than diversification of holdings in mutual funds and individual stocks. A single S&P 500 index fund provides all the stock diversification you really need.

Diversification is a key tenet of active investing as it reduces your risk exposure to bad events and collapses in the value of any one asset. If your entire portfolio consists of five stocks, a single company doing bankrupt will cause you to lose 20% of your investment dollars. If, instead, your portfolio consists of 20 stocks, that one company going bankrupt will only cause you to lose 5% of your portfolio’s value. The idea of diversification is to reduce risk, and this can be done by choosing a number of stocks varying by industry, sector, and company size. Maintaining a diversified portfolio of high-quality stocks is ideal.

But how much diversification is too much? At what point is your adviser selling you on diversification just to get an additional sales commission? After a certain point there is nothing you can do about correlation among your investments than rack up fees. Theres a fair amount of research that has calculated the level of diminishing benefit to diversification: beyond 30 stocks in a portfolio, the average standard deviation of annual portfolio return essentially levels off. [1]

One actively managed mutual fund and one bond fund, or one index fund and one bond fund, have more than enough diversification for anyone. Double up to two mutual or index funds and two bond funds and you’re more than golden. But going beyond that makes very little sense. Why? Because mutual funds cannot hold more than 5% of the stock in any one company, they tend to favor companies with larger market capitalization in their portfolios. Think about it: if you have hundreds of millions, or even billions of dollars to invest, that 5% rule makes it very difficult to have meaningful positions in small and midcap companies. Thus, as they increase in size, mutual funds begin to resemble the market, follow the market, and act just like the market. This is the reason that many mutual funds do not beat the market: it is not that the mutual fund managers are not capable; the rules set forth for mutual funds cause them to resemble market index funds as they grow in size. Many of the mutual fund managers running top funds these days were in fact beating the market earlier in their career when they had more flexibility and fewer assets under management.

And if all large mutual funds are plenty diversified and predominantly comprised of large cap stocks, there is no reason to own shares in ten distinct mutual funds. The companies that these mutual funds hold will undoubtedly overlap and you will have no more diversification than you would have been with just two or three. All you will really be doing is paying a significant portion of your assets in mutual fund fees. It is at the benefit of mutual fund managers and commissioned brokers to oversell the potency of diversification so that you purchase and sell mutual funds over time, creating additional fees and commissions for them at your expense.

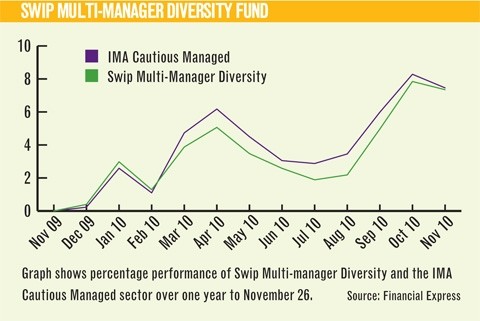

When you diversify, dont be fooled into thinking that equity-like instruments will provide you sufficient diversification in a crisis. When the tech bubble collapsed between 2000 and 2002, REITs and commodities provided a sufficient hedge. But when the housing bubble collapsed in 2008 and 2009, threatening the entire financial system as a whole, even these asset classes did not provide a safe harbor. [2] Only fixed income bonds provided a truly diversified hedge for investors.

When tailoring a portfolio to meet your needs and goals (specific goals, like retiring at 65, sending two children to the colleges of their choice, or buying a boat at 40), the way you structure your portfolio among asset classes is much more important in determining your performance and risk exposure than the specific securities you hold in your equity and bond portfolio.

[1] E. J. Elton and M. J. Gruber, Risk Reduction and Portfolio Size: An Analytic Solution, Journal of Business 50 (October 1977), pp. 415-37