Difference Between YTM and Coupon rates

Post on: 29 Май, 2015 No Comment

Difference Between YTM and Coupon rates

YTM vs coupon rates

When buying a new bond and planning to keep it until maturity, the shifting of prices, interest rates, and yields, will generally not affect you, except if the bond is called. However, if an existing bond is bought or sold, the price that the investors are willing to pay for it may fluctuate, as well as the yield or the expected return on the bond.

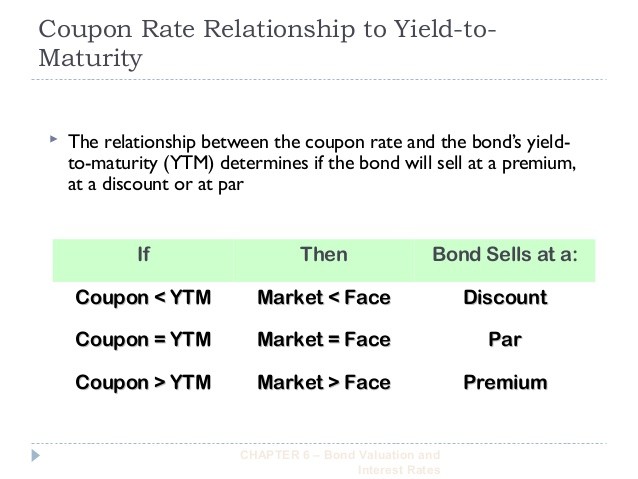

Yield-to-Maturity, or YTM, is the single discount rate applied to all future interest and principal payments. It will produce a present value equivalent to the price of the security. It may also be called a redemption yield, and it is the internal rate of return (IRR) that an investor would get on an investment, such as a bond or other fixed-interest security, like gilts. This is assuming that the bond will be held until maturity, and all payments will be made on time.

Actually, YTM is a calculation that only approximates the true return. Nevertheless, it is still useful, since it provides a quick way of making rough comparisons of the returns on bonds of various coupons and maturities. It provides investors the means to compare the values of different financial instruments. YTM is often the yield that investors enquire about when considering a bond.

The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation.

The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. It is expressed as a percentage of the face value. Basically, it is the rate of interest that a bond issuer, or debtor, will pay to the holder of the bond. Thus, the coupon rate determines the income that will be earned from the bond.

For instance, if you hold a $100,000 bond, with a coupon rate of 5%, you will receive $5,000 in interest every year.

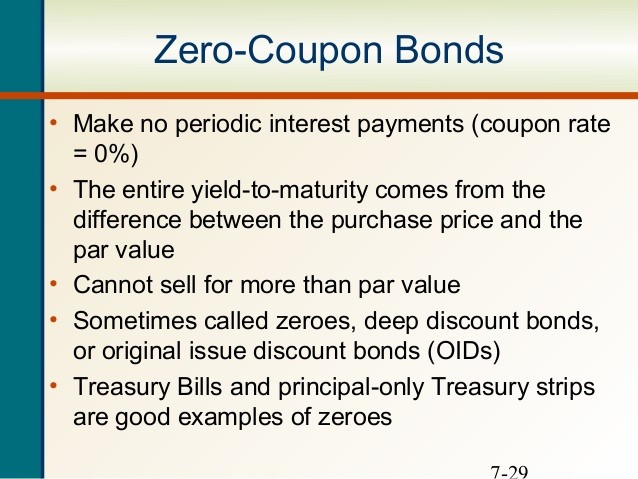

However, not all bonds have coupons. There are bonds which do not pay interest, but are still sold to investors at a price less than the face value. Such bonds are called Zero coupon bonds, and when they are held until maturity, the bond is redeemed for the face value. The coupon rate is the same with a bonds nominal interest rate.

Bonds, a longtime ago, literally, had coupons which were detached from the bond and mailed to the issuer in order to get the interest payment. Eventually, these tangibled coupons disappeared, since bonds, nowadays, are easily tracked electronically. Nevertheless, the term coupon is still used, even though the physical object is no longer implemented.

Summary:

1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond.

2. YTM includes the coupon rate in its calculation.