Did Fannie and Freddie Cause Mortgage Crisis

Post on: 8 Май, 2015 No Comment

Many have blamed the mortgage funding practices of Fannie Mae and Freddie Mac for creating the subprime mortgage crisis. Although they played a large role, they cannot be held 100% responsible. Instead, they are a prime example of the larger economic forces that really caused the banking credit crisis and bailout.

Between 2005-2007, most of the mortgages they bought or guaranteed were either subprime, interest-only or negative amortization. But that’s because those were the types of loans being made by banks and unregulated mortgage brokers. Government regulations precluded Fannie and Freddie from buying mortgages that didn’t meet down payment and credit requirements. This meant they bought, resold or guaranteed 50% of the mortgages made, but it was actually the most credible half. By 2007, only 17% of their portfolio was subprime or Alt-A loans. However, when housing prices declined, and homeowners began defaulting, this relatively small percentage of subprime loans contributed 50% of the losses.

This was made worse by their use of derivatives to hedge the interest-rate risk of their portfolios. However, as a private sector company with shareholders to please, they were doing this to remain competitive with other banks, who were doing the same thing.

As government sponsored enterprises, Fannie and Freddie took on more risk than they should have, since taxpayers ultimately had to absorb their losses. But they didn’t cause the housing downturn, the preponderance of exotic loans, and the use of derivatives instead of stock sales to cover potential risk. Instead, they were an example, not a cause, of the mortgage crisis.

Fannie Mae and Freddie Mac did not, by themselves, cause the subprime mortgage crisis. Legislative attempts to rapidly wind down Fannie and Freddie will not prevent another recession. Worse yet, it could further harm the housing market.

Fannie and Freddie were government sponsored entities (GSEs). This meant that they had to be competitive, like a private company, and maintain their stock price. On the other hand, the value of the mortgages they re-sold on the secondary market was implicitly guaranteed by the government. This caused them to hold less capital to support their mortgages in case of loss. As a result, Fannie and Freddie were pressured to take on risk to be profitable but knew they wouldn’t suffer the consequences if things turned south.

The government set them up this way to allow them to buy qualified mortgages, insure them and resell them to investors, thus freeing up funds for banks to make new mortgages. In this way, they were traditionally involved in at least half of all new mortgages made each year. By December 2007, when banks began to constrict their lending, Fannie and Freddie were really the only lender still operating, responsible for 90% of all mortgages .

Government regulations precluded Fannie and Freddie from buying mortgages that didn’t meet downpayment and credit requirements. However, as the mortgage market changed, so did their business. Between 2005-2007, few of the mortgages acquired were conventional,fixed-interest loans with 20% down. Fannie Mae’s loan acquisitions were:

- 62% negative amortization

- 84% interest only

- 58% subprime

- 62% required less than 10% downpayment.

Freddie Mac’s loans were even more risky, consisting of:

- 72% negative amortization

- 97% interest only

- 67% subprime

- 68% required less than 10% downpayment.

It was the preponderance of exotic loans in addition to subprime borrowers that made Fannie and Freddie’s loan acquisitions so toxic.

Fannie and Freddie Held Fewer Toxic Loans than Most Banks

It is critical to understand, however, that because of regulations, they took on less of these loans than most banks. According to several analysts, they increased their acquisition of these loans to maintain market share in what had become a very competitive market. (Source: (Source: SeekingAlpha, How Much Are Fannie and Freddie to Blame?. October 2, 2008; Washington Post Fannie and Freddie Become Hot Topic. October 10, 2008)

In 2005, the Senate sponsored a bill that sought to forbid them from holding mortgage-backed securities in their portfolio because it wanted to reduce the risk to the government. In total, the two GSEs owned or guaranteed a total of whopping $5.5 trillion of the $11.2 trillion mortgage market.

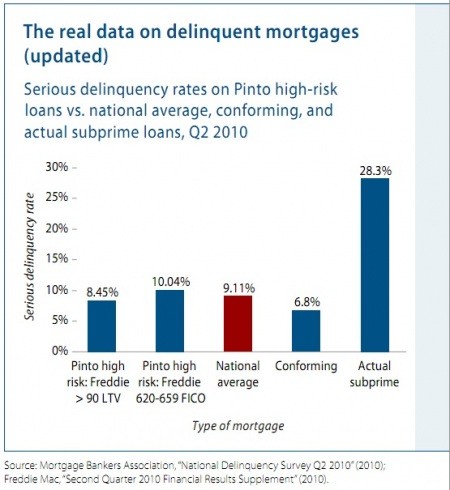

After the Senate bill failed, Fannie and Freddie actually increased their holdings of risky loans. That’s because they could make more money from the loans high interest rates than from the fees they got from selling the loans. Again, they were seeking to maintain high stock prices during a very competitive housing market. Even so, by 2007 only 17% of their total portfolio was either either subprime or Alt-A loans. Due to regulations, their percentage of these loans are actually better than many banks. (Source: Barron’s, Is Fannie Mae the Next Government Bailout?. March 10, 2008; IHT, Fannie and Freddie’s blame game, August 24, 2008)

Derivatives Helped Cause Fannie’s Downfall

As GSEs, Fannie and Freddie weren’t required to offset the size of their loan portfolio with enough capital from stock sales to cover it. This was a result of both their lobbying efforts and the fact that their loans were insured, so they felt they didn’t need to. Instead, they used derivatives to hedge the interest-rate risk of their portfolios. When the value of the derivatives fell, so did their ability to insure loans. (Source: NYT, Fannie, Freddie and You. July 14, 2008)

This exposure to derivatives proved their downfall, as it did for most banks. As housing prices fell, even qualified borrowers ended up owing more than the home was worth. If they needed to sell the house for any reason, there would lose less money by allowing the bank to foreclose. Borrowers in negative amortization and interest-only loans were in even worse shape. Even though subprime and Alt-A loans only made up 17% of Fannie and Freddie’s portfolio, they were responsible for over half of their losses in 2007.

Elimination of Fannie and Freddie Could Destroy Any Housing Recovery

Some legislators propose eliminating Fannie and Freddie. Others suggest that the U.S. copy Europe in using covered bonds to finance most home mortgages. With covered bonds, banks retain the credit risk on their home mortgages, but sell bonds backed by those mortgages to outside investors, thus off-loading interest-rate risk.

Elimination of Fannie and Freddie will dramatically reduce the availability of mortgages and increase the cost. Banks have not, and would not, step in to guarantee mortgages. Studies have shown that, without Fannie and Freddie, mortgage iterest rates could go as high as 9-10%. This would damage the housing market before it’s had any chance to recover. (Source: Barron’s, Life After the Old Fannie and Freddie. September 15, 2008)