Diaspora Bonds The Israeli experience Columns

Post on: 23 Май, 2015 No Comment

ID: INTERACTIVE DIALOGUE

LAST week I wrote that I was very happy that a Jamaican administration is finally making a serious move to offer a bond to Jamaicans residing outside of the country. Most of the feedback I have got since that column was very positive, but naturally some questions were raised, especially about how it could actually be done.

When I was first told about this idea Israel was the main example being touted, therefore I would like to share what information I have been able to find about Israel’s experience with diaspora bonds so that more Jamaicans can have a clearer understanding of how this could work and how it could help. There is no need to reinvent the wheel, and we can instead adapt what Israel has been successfully doing since 1951.

Israel started raising funds from the Jewish diaspora in 1951 and established a specific entity to undertake this — the Development Corporation for Israel (DCI). To date, the DCI has raised over US$25 billion. Some people have asked why Jamaicans abroad would purchase diaspora bonds. In the case of Israel, a sense of patriotism played a role partly because Israel specifically was trying to maintain a relationship with Jews abroad, but it also paid an attractive interest rate on the bonds so that it would make financial sense to purchase such bonds.

Another question relates to what kind of bonds would be issued. Israel has issued bonds ranging from as low as US$100 to as high as US$100,000 that can only be redeemed at maturity, which is usually between 10 and 15 years. In addition, most of the Israeli bonds have been fixed-rate bonds, not floating-rate bonds.

Who can purchase? It has never been suggested or recommended that a purchaser of the diaspora bonds would have to be of Jamaican descent. In fact, Jamaica is better off allowing everyone to buy, because we have many non-Jamaicans who have fallen in love with the country and its culture who would gladly welcome the chance to contribute directly to further development.

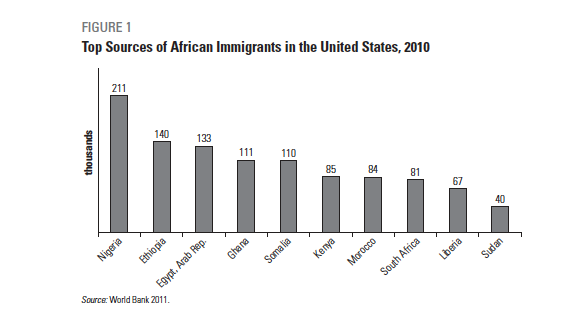

Brand Jamaica is strong and we should leverage that. The Israelis did not limit their diaspora bonds to only Jews but have primarily targeted them. They have gone as far as to have DCI staff in the USA, the main target market, organise regular investor events.

One of the most important questions that will guide the level of interest and ultimate participation is what the funds would be used for. Israel has used diaspora bond proceeds mainly for public sector projects such as housing construction, communications infrastructure and desalination. In Jamaica’s case, it has been suggested that the construction and upgrading of schools and hospitals would be the projects that Jamaicans abroad would find most worth of consideration.

There have also been a few suggestions with regards to upgrading law enforcement capabilities since that could help bring down crime, which would see immediate economic benefits. I have suggested that some of the higher-interest debt be refinanced and the interest saved diverted to health, education and security.

The World Bank has indicated that some countries leveraging diaspora bonds have used money transfer institutions to reach people instead of brokers, investment banks or commercial banks. Israel has also avoided the broker and investment/commercial bank route, opting instead to have DCI sell the bonds directly, with New York acting as the fiscal agent.

Jamaica most likely would leverage the extensive money transfer network that exists, combined with a broker or fiscal agent. There are undoubtedly large numbers of Jamaicans abroad who are intimately familiar with their money transfer location and agents, familiarity which would help with better understanding the bonds.

The JDX has not factored into any discussions I have seen to date. Yes, the Government of Jamaica did strategically default on some debt, but there seems to be little fear of a repeat of that (no one wants their diaspora bond to be exchanged for longer-dated maturities with lower interest rates).

Israel has been the most successful country at leveraging diaspora bonds and in the same way that their diaspora organisational structure has informed the structure that Jamaica has been building, so can their approach to bonds be a guide.

This column was partially informed by Development Finance via Diaspora Bonds by Suhas Ketkar and Dilip Ratha.

David Mullings was the first Future Leaders representative for the USA on the Jamaica Diaspora Advisory Board. He can be found on Twitter at twitter.com/davidmullings and Facebook at facebook.com/InteractiveDialogue