Developing A Rotation Strategy Using Highly Diversified ETFs Part III

Post on: 5 Май, 2015 No Comment

Summary

- A diverse basket of ETFs can be used in a rotation strategy if the strategy compensates for the variance in their volatilities.

- This article provides a 14-year backtest of a rotation among the nine SPDR Sector ETFs and two bond positions.

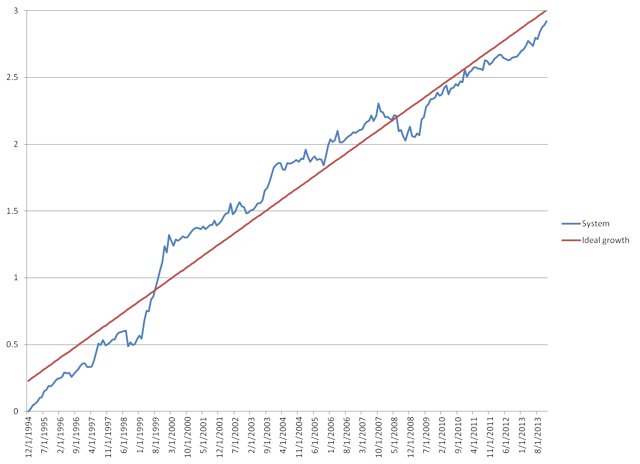

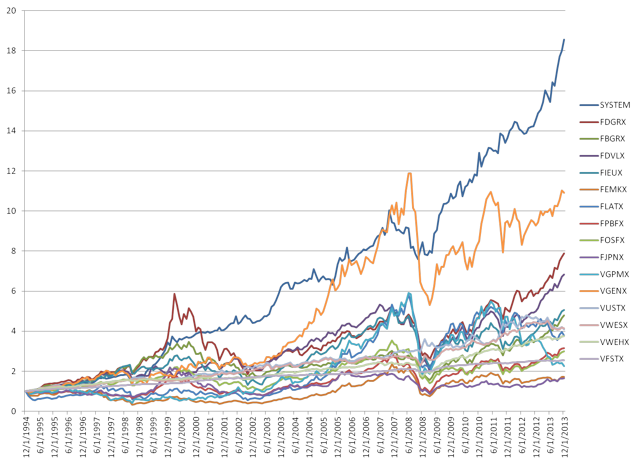

- Featured a CAGR of over 16%, maximum drawdown of 17% and a Sharpe ratio of 1.15 during the backtest.

In this series, I have described a price-based approach for rotating among a diverse group of ETFs representing multiple asset classes. In Part I of the series. I proposed a volatility compensation technique that normalized the volatilities of the underlying asset classes, providing a suitable basis for generating rotation signals. The strategy presented in Part I provided high returns with low risk over the backtest period. However, the period of testing data for the ETFs was limited to late-2006 and resulted in a relatively short backtest time of only seven years. Part II of the series provided a longer backtest of 19 years on a diverse group of mutual funds intended to mimic the asset classes of the ETFs studied in Part I. The results of Part II were also high returns with low risk relative to buying and holding the S&P 500.

This article proposes an application of the volatility compensation and momentum model to a rotation among the nine SPDR ETFs and two bond funds.

The ETFs selected for the backtest

The ETFs on which I relied are below:

- Industrial Select Sector SPDR fund (NYSEARCA:XLI )

- Technology Select Sector SPDR fund (NYSEARCA:XLK )

- Financials Select Sector SPDR fund (NYSEARCA:XLF )

- Health Care Select Sector SPDR fund (NYSEARCA:XLV )

- Consumer Discretionary Select Sector SPDR fund (NYSEARCA:XLY )

- Materials Select Sector SPDR fund (NYSEARCA:XLB )

- Consumer Staples Select Sector SPDR fund (NYSEARCA:XLP )

- Energy Select Sector SPDR fund (NYSEARCA:XLE )

- Utilities Select Sector SPDR fund (NYSEARCA:XLU )

The historical price data for these can be found at this link on Yahoo! Finance. Entering each symbol in the Get Historical Prices query will provide the pricing data on which I relied for this article.

In a related article. I have shown that returns and risk can be improved by rotating equities with bonds. Thus, for the strategy of this article, I have included two bond securities in the rotation with the nine SPDR sector ETFs. The first is VUSTX. which is the Vanguard long bond mutual fund. I chose this fund because I could obtain data back before 2000, enabling a long backtest. As a mutual fund, VUSTX can only be traded at the close of each trading day, unlike and ETF. However, the system of this article does not require intraday trading and, therefore, the use of a mutual fund such as VUSTX will work with this system. I could not find any restrictions on the purchase or sale of VUSTX on the Vanguard website other than a minimum investment requirement. I also did not see any purchase or sale fees on the Vanguard website for this fund. Its expense ratio is much like an index ETF at 0.20%.

I also chose SHY as a proxy for cash.

With the data I obtained at the links above, I was able to conduct a 14-year backtest from December 31, 1999 through December 31, 2013.

The basis of the system

The notion of rotating among market sectors based on momentum has been well known for quite some time. This article describes a system similar to the one presented here, in which top sector ETFs are rotated periodically based on recent price performance.

The ETF rotation systems that I have investigated and discussed on SA are based on buying an ETF having the best price performance among a group of ETFs over a certain period of time. One of my articles discusses an 85-day lookback period. One of my blog posts discusses a three-month lookback period. In Parts I and II of this series, the systems relied on the 1-month, 3-month, and 6-month price performance, as well as a 6-month volatility, and weighted each of these to generate a total rank for each asset class. In this article, I have also relied on the 12-month performance of the underlying ETFs in the ranking process.

In calculating the performance values, I relied on the natural logarithm of price performance. For instance, the 1-month price performance was the natural log of the ratio of this month’s price to last month’s price. The 3-month performance was the sum of the 1-month log performances for the prior three months. Similarly, the 6- and 12-month performance was the sum of the 1-month log performances over the prior 6 and 12 months. Lastly, the 6-month volatility was the standard deviation of the prior 6 months of 1-month log performance.

The system also included a stop based on whether the S&P 500 was above or below a 6-month simple moving average. If above, then the system rotated among the nine sector SPDR ETFs. If below, then the system invested in either VUSTX or SHY depending on their respective ranking, discussed below.

Volatility compensation

As shown in the table below, the volatilities of the underlying securities in this test (measured as annual standard deviation of daily price changes) varied significantly: