Developed market bonds

Post on: 16 Март, 2015 No Comment

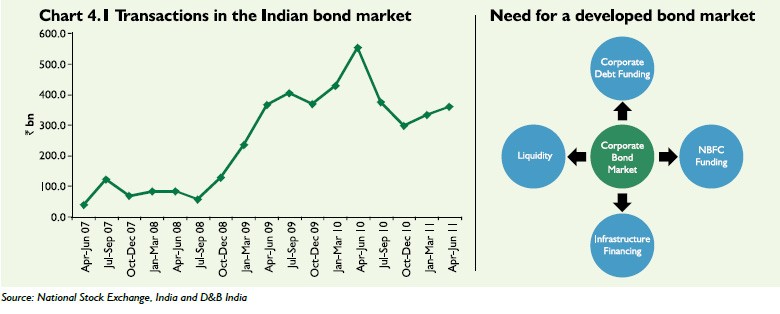

From the perspective of a U.S. domiciled investor, the international bond market makes up somewhat more than 35% of the market value of world investment markets (2011). [1] The global market is commonly divided into developed market bonds and emerging market bonds (see Fig. 1, Global Bond Market, for the country distribution by market value of developed market bonds in the Barclay’s Capital Global Aggregate Bond Index). In many instances, countries issue both nominal and inflation indexed debt securities. Sovereign debt (issued by governments) is the prevalent asset comprising the international debt markets. Approximately 20% of market index composition is corporate debt as foreign companies primarily use banks, not capital markets, for debt funding. [2]. A key investment decision regarding international bonds is whether or not to hedge currency risk.

Contents

Risk and return

Like bonds issued in the U.S. international bonds pay interest according to set schedules and return principal at maturity. In addition to risks common to all bonds (Bond basics — Risks ), international bonds bear currency risk unless this risk is hedged and political risk (for example, wars, revolution, sovereign debt defaults). [3]

December 1993

Correlation

Monthly 2006-2010

Pros and cons of international bond investing

In this section, we draw heavily on a 2011 paper entitled Global fixed income: Considerations for U.S. investors. in which Vanguard authors Christopher B. Philips et al. make a measured case for currency-hedged international bond funds. In this paper, they state: To make the strategic decision to include international bonds in a diversified portfolio, an investor should weigh the trade-offs among several factors which they list as

- the potential to reduce portfolio volatility,

- exposure to the largest global asset class,

- the costs of implementation,

- the investor’s own views on the future path of the U.S. dollar.

It is crucial to distinguish between hedged and unhedged foreign bond mutual funds, and to know which kind you are buying. Unfortunately, actively managed funds tend to leave the managers free to perform whatever tactical hedging maneuvers they think best, so these funds often do not clearly characterize themselves as one or the other. In these funds, the managers attempt to exploit currency risk by making advantageous use of currency movements.

A hedged fund reduces currency risk by buying forward currency futures contracts. Such a fund promises to give investors the benefit of reduced portfolio volatility by global diversification across different bond markets, and exposure to the largest global asset class. However, hedging increases implementation cost. And it reduces risk both ways; an investor who predicts future weakening of the dollar might hope to benefit from currency risk.

Arguments for holding only domestic bonds

David Swensen, the investment manager of the Yale Endowment Fund, in his book, Unconventional Success: A Fundamental Approach to Personal Investment, advises U.S. domiciled investors to avoid foreign bonds funds in their portfolios and stick with treasury bonds and treasury inflation indexed securities (TIPs). Swenson argues that, for U.S. investors, treasury bonds offer protection against financial crisis and deflation, and treasury inflation protected securities provide protection against inflation. In the case of foreign bonds, foreign currencies provide no expected return and unhedged bonds do not offer investors the same protection against financial crisis and deflation as do treasury bonds. In addition, foreign bonds held by a majority foreign clientele introduce political risk to the security (the foreign government’s interests might not be aligned with a non-citizen investor’s interests in crisis situations). In summary, Swensen states his position:

Foreign-currency-denominated bonds share domestic bond’s burden of low expected returns without the benefit of domestic fixed income’s special diversifying power. Fully hedged foreign bonds mimic U.S. bonds (with the disadvantage of added complexity and costs stemming from the hedging process). Unhedged foreign bonds supply investors with U.S. dollar bond exposure, plus (perhaps unwanted) foreign exchange exposure. Foreign-currency-denominated bonds play no role in well constructed investment portfolios. [9]

Author Rick Ferri posits three tests for including an asset class in a portfolio:

- Does an asset class provide exposure to a unique investment risk?

- Does the asset class provide a real return (higher than the inflation rate)?

- Is the asset class available in a broadly diversified, liquid, low-cost fund?

Ferri judges international bond funds as passing the first two requirements, but prior to 2013 as failing on the cost issue with expenses not being 0.20% or lower. In May of 2013, Vanguard released their Total International Bond Index fund. That fund’s Admiral and ETF share-classes both have expense ratios of 0.20%, passing Ferri’s third requirement and now apparently would merit consideration for strategic asset allocation in portfolios. [10]

Arguments for holding hedged international bond funds

In Global fixed income: Considerations for U.S. investors. Philips et. al. state in their summary that For the average investor seeking to minimize volatility in a diversified portfolio, we find that allocating from 20% to 40% of the fixed income portion to international bonds can provide a reasonable balance between diversification and cost, assuming that the currency risk inherent to this asset class is hedged.

In The Only Guide You’ll Ever Need for the Right Financial Plan, p. 51, Larry Swedroe et. al. state that Unhedged foreign-currency exposure for fixed-income investments is not generally recommended.

Currency risk has no expected return. There is no evidence of persistent ability to generate profits from currency speculation. Investors should not use these instruments to make speculative bets on the direction of particular currencies against the dollar. Investors seeking the diversification benefits of foreign-currency exposure by investing in international equities that are unhedged for exchange-rate risk. On the fixed-income side, investors generally seek stability of the value of these assets, allowing them to take equity risks.

Arguments for holding unhedged international bond funds

Some Bogleheads forum posters hold foreign bond funds as a way of intentionally obtaining an exposure to currency risk, because they expect it to be favorable. In this case, the investor’s own view of the future path of the U. S. dollar weigh in the balance. They might consider investing directly in foreign currency itself, but see bond funds as superior because of the intrinsic return of the bonds themselves.

Reasons for not seeing currency risk as a negative factor include these: a) for the foreseeable future, they expect it to be favorable, i.e. it is a safe bet that the dollar will not strengthen soon; b) in the long run, currency risk is zero-sum and should neither increase or decrease expected return; c) currency risk is uncorrelated with other asset price movements and may improve portfolio returns as a whole.

Swedroe et. all note, also, that Some investors—such as those living part-time in a foreign country or planning to retire in a foreign country—may be sensitive to the prospect of a falling dollar. Such investors may benefit from hedging their dollar exposure as part of their fixed-income portfolio toward achieving this hedge.

Market index

The most recognized international developed market bond index is a subset of the Barclays Global Aggregate Index (also available in a float-adjusted version) which measures investment grade fixed-rate debt markets. The international developed market subset of the Global Aggregate Index consists of the following sub indexes:

- Two major components

- Pan-European Aggregate (EUR 300mn)

- Asian-Pacific Aggregate Index (JPY 35bn).

The remainder of the index consists of Global Treasury(ex US treasuries), Eurodollar (USD 300mn), Euro-Yen (JPY 25bn), Canadian (USD 300mn equivalent) index-eligible securities not already in the two regional aggregate indices. [11]

Barclays Capital also provides a benchmark for global inflation indexed bonds, the Barclays Capital World Government Inflation-Linked Bond Index. The international subset of this index includes bonds from UK, Australia, Canada, Sweden, France, Italy, Japan, and Germany. [11]

Morgan Stanley, Citigroup, BofA Merrill Lynch, and Deutsche Bank also provide international developed market indexes.

Index funds

Indexed portfolios of international developed market bonds for U.S. domiciled investors are currently available from ETF providers iShares and State Street Global Advisors. The portfolios are unhedged. Vanguard offers U.S investors hedged international developed market index funds in the form of both an ETF and a mutual fund. The firm uses the fund in the four fund portfolios designed for its balanced Vanguard LifeStrategy funds and its balanced Vanguard target retirement funds. Dimensional Fund Advisors offer hedged short and intermediate term global bond funds, available to do-it-yourself investors in some employer provided plans (as well as a 529 plan made available by the state of West Virginia .)

Table 5. International Developed Market ETFs