Determining the Price of a Small Business Business Value

Post on: 14 Июль, 2015 No Comment

Buying a business is the quickest and fastest route to entrepreneurship. Instead of spending time pre-planning and starting a business, you will have in your hands a business that may have already proven viable. An existing business may come with a solid customer base, supplier relationships, and even a well-developed brand. This is the best option for you if you want less hassles, less groping for strategies, and less mistakes compared to starting a business from the ground up.

As the buyer, the process of setting the price is often the most challenging aspect of buying a business. This is often fraught with emotions and conflicts, as both the seller and buyer have different ideas of what the business is worth. The party most prepared with an assessment of the business value will have the upper hand during the negotiations.

While there are no hard-and-fast rules in setting the price of a business, certain factors figure prominently in its computation. One is the prevailing economic condition: the price of a business usually goes up during a growth period, but decreases during times of recession or slow growth.

Another factor is the reason why the seller wants out and how bad he or she wants to sell the business. A seller who wants to sell the business as fast as possible is more likely to accept a discounted price. Word of warning, though: dont show how badly you want to buy the business as the seller can leverage this information against you during negotiations.

Determining the value of a business is more of an art than a science: it is not precise. Several methods commonly used in calculating the value of a business are:

1. Multiplier or market valuation

This method calculates the value of a business by using an industry average sales figure as a multiplier. You can use average monthly gross sales, monthly gross sales plus inventory, or after tax profits of comparable businesses in the industry. For example, the seller of a business with annual sales of $250,000 may peg the multiplier at 0.30 to generate a sales price of $75,000 (e.g. $250,000 X 0.30 = $75,000).

To determine the multiplier of the industry of the business youre buying, contact your trade association or consult the services of a business appraiser. You can also check out Richard Snowdens book The Complete Guide to Buying a Business, which lists the multipliers of some industry. Snowden shows sample multipliers of some industries below:

Travel agencies .05 to .1 X annual gross sales

Ad agencies .75 X annual gross sales

Retail businesses .75 to 1.5 X annual net profit + inventory + equipment

It is, however, difficult to substantiate multipliers. It can be a random number that may not truly reflect industry realities. Since it deals with average values, the formula does not take into account the differences of businesses within the industry. If a seller uses this approach, use the value only as an estimate but do not rely too much on it.

2. Asset Valuation

Some businesses are worth no more than the value of their tangible assets. If a company is asset-intensive, such as retail businesses and manufacturing companies, you can use the asset valuation method. This is a particularly good method to use if the business is losing money or paying the owner(s) less in total than fair market compensation.

The goal of the seller in using this approach is to get the best possible price for their equipment, inventory, and other assets of the business. This method is a summation of the following factors:

- Fair market value of fixed assets and equipment (FMV/FA), or the price you would pay to purchase the assets or equipment

- Leasehold improvements (LI), or modifications to space that would be considered part of the property if you were to sell it or not renew a lease.

- Owner benefit (OB), or the sellers discretionary cash for one year

- Inventory (I), including raw materials, work-in-progress, and finished goods or products.

3. Capitalized Earnings

This method of valuation is suitable for service companies and other non-asset intensive businesses. This method places no value on fixed assets such as equipment, and takes into account a greater number of intangibles. This valuation method is best used for non-asset intensive businesses like service companies.

The formula used to determine capitalized earnings is:

Projected Earnings/Capitalization Rate = Price

Where normal earnings are used to estimate projected earnings, and capitalization rate is an estimated risk level of investing in the business compared with other investment instruments such as stocks or bonds. The capitalization rate is an average of several factors, and may include length of time the company has been in business, length of time current owner has owned the business, reasons for selling, risk factors, profitability, location, barriers to entry and exit, level of competition, industry potential, technology, and others.

4. Intangible Value

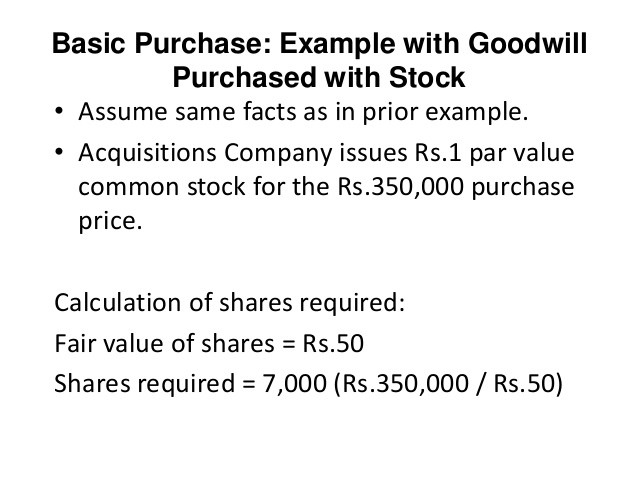

Some businesses, particularly those that are not asset-intensive, may be harder to quantify. Service companies and dot-coms are examples of businesses where this kind of valuation may work. In many cases, this involves measuring the goodwill or psychological value of a business, rather than its financial value.

For example, the valuation of an executive recruiting company may use the cost of recruiting an executive and use that calculation to determine the possible savings it will give to the buying company. The worth, therefore, of the executive recruiting firm is not in its overhead systems (e.g. offices, computers, phones) but in its intrinsic value.

In the dot-com world, most of the fallen companies based the value of their businesses on their customer base. Customers with a high likelihood of being retained are valuable in most industries. Other industries where companies are bought and sold based upon the value of the customer base include insurance agencies, advertising agencies, payroll services, and bookkeeping services.

5. Owner benefit valuation

This formula focuses on the sellers discretionary cash flow and is used most often for valuing businesses whose value comes from their ability to generate cash flow and profit. It uses a fairly simple formula you multiply the owner benefit times 2.2727 to get the market value. The multiplier takes into account standard figures such as a 10% return on investment, a living wage equal to 30% of owner benefit, and debt service of 25%.

6. Return on Investment

The most common form of determining the value of a business is through its return on investment, or the amount of money the buyer will realize compared to the performance of the business. Industry experts define a good buy if the business can provide you with a return on your cash investment of 15 percent or more.

- Business Valuation For Dummies

- Business Modeling: A Practical Guide to Realizing Business Value (The MK/OMG Press)

- How to Buy and/or Sell a Small Business for Maximum Profit A Step-by-Step Guide: With Companion CD-ROM

- The Small Business Valuation Book: Easy-to-Use Techniques That Will Help You Determine a fair price, Negotiate Terms, Minimize taxes

- Expensive Mistakes When Buying & Selling Companies