Determining Risk and the Risk Pyramid_2

Post on: 29 Апрель, 2015 No Comment

Determining Risk and the Risk Pyramid 5.00 / 5 (100.00%) 1 vote

There are many risks in life; especially when it comes to investing in stocks, bonds or other investments. However, when it comes to investing, determining risk and the risk pyramid can help manage the risk more efficiently and effectively.

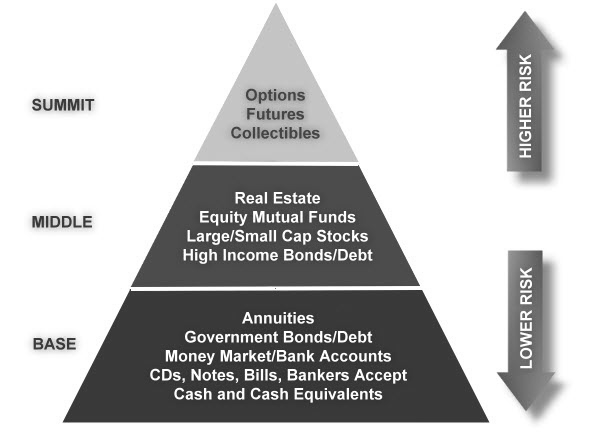

The risk pyramid consists of the bottom of the pyramid, which consists of low-risk investments, the mid part composed of growth investments and the top part composed of speculative investments.

Determining Risk and the Risk Pyramid

It is important to understand the risk-reward method. When a person invests money into anything, there is a risk that you may not get your money back. However, you expect a return, which gives you a kind of compensation for bearing the risk. In other words, the higher the risk, the more you should receive for holding the investment; while the lower the risk, the less you should receive.

Because there are so many different kinds of investments to choose from, an investor must determine how much of a risk he or she can afford to handle. Even though everyone is different, there are two important aspects to consider before deciding on a risk preference such as time horizon and bankroll.

Time horizon means that you need to determine how much time you have to keep your money invested. For example, if you invest a certain amount of money today, such as $40,000 but will need that money a year or two later for a down payment on an SUV or home, investing in high risk stocks would not work for you. A better choice would be to select a lower risk stock.

Bankroll is when you need to determine how much money you can stand to lose. This is a more realistic way of investing. By investing this way you wont be under pressure to sell of any investments. Keep in mind, the more money you have, the more risk you are able to take.

Once you have decided what level of risk you want, you can use the risk pyramid for balancing your assets. The pyramid is basically an allocation tool that can be used to diversify your portfolio investments. The pyramid has three tiers: the base of the pyramid, the middle portion and the summit. The base of the pyramid is stronger than the other portions. The middle portion is made up of medium-risk investments that give a stable return and the summit is reserved for high risk investment. The risk pyramid is quite helpful in balancing assets.

To conclude, what makes the risk pyramid so helpful is that individuals who want more risk can look at the pyramid and adjust it to their specific needs. Financial experts agree that the pyramid that represents your portfolio should be specified according to your risk preference. Find out how determining risk and the risk pyramid can help your financial portfolio today! Talk with a financial expert and find out how this method can help you.