Denmark Ready to Intervene in House Market in EuroPeg Fight Bloomberg Business

Post on: 13 Апрель, 2015 No Comment

Photographer: Freya Ingrid Morales/Bloomberg

(Bloomberg) — Denmark is monitoring its property market and is ready to act should the country’s efforts to defend its euro peg result in unsustainable house-price distortions.

Morten Oestergaard, the country’s economy minister, says such a scenario “may come in the second or third wave” of the economic cycle as the central bank drives its main interest rate well below zero to keep the krone pegged to the euro. “If you can make money on borrowing, it’s probably not healthy in the long run. We’ve been through a housing bubble and we’re pretty much back where we started,” he said in an interview on Monday.

The central bank has spent the past two months fighting speculation it will follow Switzerland and abandon its ties to the euro. Oestergaard says any comparison between the two countries is flawed because Denmark’s euro peg is a non-negotiable part of its economic policy foundation, not a temporary response to a crisis.

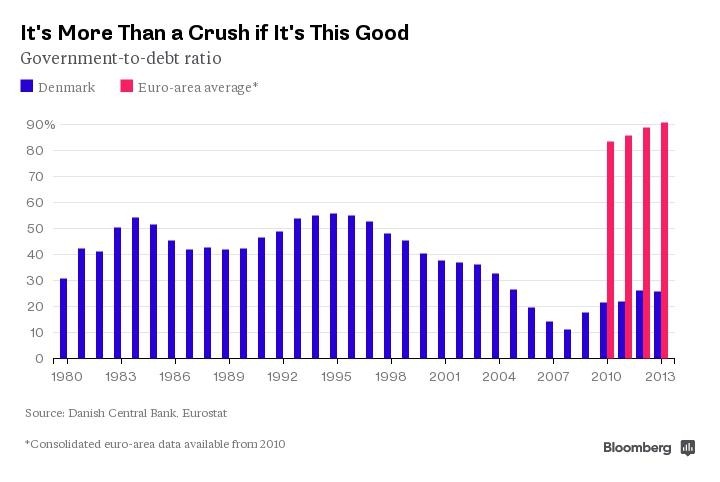

To defend the Danish currency peg, Governor Lars Rohde has cut the benchmark deposit rate to minus 0.75 percent and built up record foreign reserves, equivalent to about 40 percent of gross domestic product. Government bond sales have been suspended to cut the supply of krone assets investors can hold, and the debt office for a third consecutive time since mid-February rejected all bids for Treasury bills at an auction on Wednesday.

The latest capital-flow data suggest those measures are making an impression, prompting hedge funds and other investors to abandon their bets against Denmark’s peg. London-based LNG Capital said in February it was no longer hedged against a collapse of the Danish currency regime, while Danish pension fund PFA A/S said the same month krone assets were losing their appeal.

The krone lost as much as 0.15 percent against the euro on Wednesday, its biggest decline since Feb. 20, based on closing prices.

2008 Bubble

“The political mandate is so strong that nobody’s really questioning the top priority being that Denmark maintain its peg,” the 38-year-old Oestergaard said. He became economy minister in September, after his predecessor, Margrethe Vestager, left the Danish government to become the European Union’s competition commissioner.

The extreme measures taken to defend the currency regime have driven down interest rates across Danish debt markets, with the shortest-term mortgage bonds trading at negative yields. That means that, but for an administrative fee charged by banks, borrowers would be paid to take on more debt.

The development has already driven up house prices, with some parts of Copenhagen witnessing levels that exceed their 2007 peak. By 2008, Denmark’s housing bubble had burst, sending the nation into a recession that undermined consumer demand for half a decade.

Peg Defense

In a report published on Wednesday, Nordea Bank AB warned that Denmark’s defense of its currency regime risks fueling another housing bubble. Given the pressure on interest rates coming from the European Central Bank’s bond purchases, it’s difficult to assess when monetary conditions might normalize in Denmark, Nordea said.

Even before Denmark’s currency defense drove rates below zero, policy makers and regulators were discussing how to protect the housing market from future imbalances. Banks are under pressure to scale back issuance of one-year bonds used to refinance home loans as long as 30 years and the central bank has consistently criticized households’ addiction to interest-only mortgages.

Slow Recovery

Though the government isn’t discussing a housing market intervention for the time being, “we’re monitoring” the situation “to see where it may lead us, if it continues,” Oestergaard said. “All discussions are then on how we intervene in the housing market,” leaving the peg’s defense to the central bank, he said.

To be sure, Denmark’s negative interest rates represent a much-needed stimulus package and are helping an economy that’s still about 3 percent smaller than it was in 2007. After falling in January, consumer prices rose just 0.2 percent on an annual basis in February, to about one-tenth the level the ECB targets.

“For an economy in a slow recovery, low interest rates and low oil prices are good,” Oestergaard said. “The question is then whether we’ll arrive at a situation that requires us to develop political measures that counter” the risk of overheating. “I think you can develop a scenario where cheap money overheats the economy, but that’s still a few years away.”

To contact the reporter on this story: Peter Levring in Copenhagen at plevring1@bloomberg.net

To contact the editors responsible for this story: Jonas Bergman at jbergman@bloomberg.net Tasneem Hanfi Brogger, Christian Wienberg