Define Your Investment Universe

Post on: 28 Апрель, 2015 No Comment

Defining your investment universe is the single most important step in constructing your portfolio, as asset allocation accounts for over 90% of your success as an investor. Selecting good mutual funds is important but not nearly as important as selecting the asset classes that define your investment universe and allocating the optimal amount to each of those asset classes. Here we’ll address the selection of asset classes that will define your universe. Allocation across your universe will be discussed in a subsequent subsection.

In defining your investment universe, which is that set of assets that you will allocate your money to, you should consider all of the major asset classes in the following list and all of the investing styles within those classes:

- Domestic Stock: large-, mid-, small- and micro-cap

- International Stock: large-, mid-, small- and micro-cap

- Emerging Markets Stock

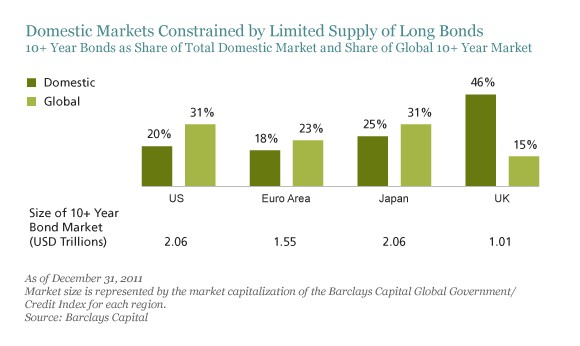

- Domestic Bonds, both corporate and government

- International Bonds

- Emerging Markets Bonds

- Domestic Real Estate

- International Real Estate

- Commodities, worldwide

- Money Market mutual funds for the cash component of your portfolio

You may also want to consider:

- Natural Resources: domestic, international or worldwide

- Precious Metals

- Various sector funds

- TIPS (Treasury Inflation Protected Securities)

Refer to the list of mutual fund types. which has links to descriptions of the various types of mutual funds, for additional information on the asset classes listed above. Also, you’ll find in-depth discussions of classification, categorization, styles and types of funds in the section entitled The Various Types of Mutual Funds .

Whatever you do, don’t limit your investment universe because of a lack of familiarity with some of the asset classes. If you need to learn more about investing internationally, for instance, spend some time on the Internet learning more about it rather than passing it up because you feel it may be too risky. Remember, the more diverse your holdings are, the less your residual risk will be.

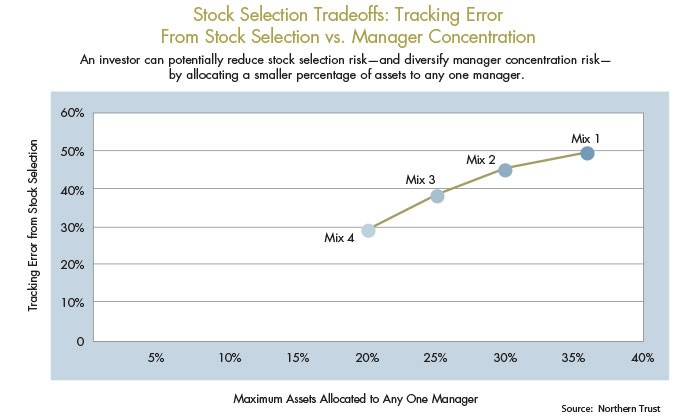

In practical terms there is a limit to diversification. Many advisors believe that a good rule of thumb is to have no less than 5% of your portfolio invested in any particular asset, as any less will have an immaterial effect on your portfolio. If you follow this rule and invest on a market-capitalization-weighted basis, you’ll automatically be limited in the number of mutual funds you can hold in your portfolio. Some advisors are comfortable with holdings as small as 2% and in theory there’s nothing wrong with that. If you establish an account where you pay no load and no transaction fees, having a lot of small holdings won’t hurt you. In that case, if your model suggests that you have some rather small holdings, go for it.

If you have or are going to have more than one account, say, taxable, IRA and 401k, treat them as a single portfolio when establishing your asset allocation. Just make sure you keep the assets that generate a lot of income or have high turnover rates in the tax-deferred accounts.

If you have limited investable funds, your initial investment universe will probably have to be narrower than desired. However, you can still achieve a fairly high degree of diversification with a few index funds and optimize your allocation to achieve efficiency within that universe. For example, you could allocate your investable funds to a Wilshire 5000 index fund, an international stock index fund, a world bond index fund and keep the cash you need for unexpected expenses and circumstances in a money market mutual fund, all of which have relatively low minimum initial investments. As your wealth grows, you can expand your universe by adding mutual funds in other asset classes, thus increasing your level of diversification and your expected rate of return for a given level of total risk.