Debt Uber Alles Implications Of No PostCrisis Deleveraging For Global Equity Markets

Post on: 28 Апрель, 2015 No Comment

by Constantin Gurdgiev February 17, 2015

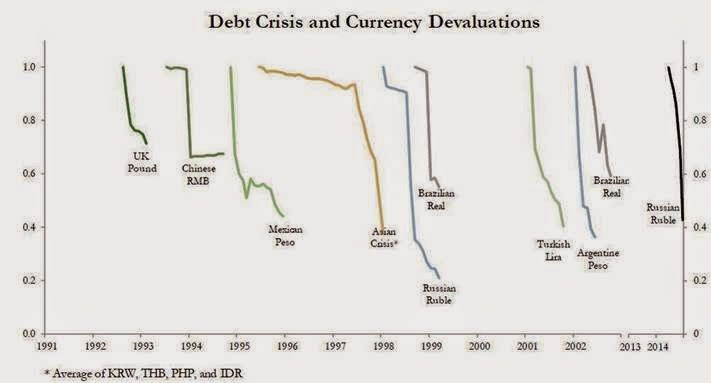

Back in 2009-2010, at the height of the Global Financial Crisis (GFC), various regulatory and supervisory bodies – from the IMF and the Bank for International Settlements, to the ECB and the national governments and monetary authorities have focused their attention on the need for the global economy to deleverage. Quarterly and monthly reports as well as position papers on debt deleveraging across the financial system tracked and reported hundreds of billions in debt reductions. The European Union went one step further, producing not just a post-crisis debt deleveraging push, but a whole roadmap aimed at restricting future debt accumulation by the member states. It was adopted by the European legislators under the 6+2 Packs legislation and the Fiscal Compact Treaty. 1

These efforts, as a recent research note from McKinsey highlights, turned out to be in vain. 2 Based on McKinsey estimates, at the end of 2000, global stock of debt (excluding unregulated private lending) stood at USD87 trillion. By the end of 2007 the same figure was USD142 trillion. Years later, after rounds and rounds of painful restructuring, massive waves of forced sales of assets, bankruptcies and insolvencies, and other debt reduction measures, by the end of H1 2014, the global stock of debt rose to USD199 trillion, more than doubling up on 2000 levels of overall indebtedness.

The McKinsey research shows that over 2000-2007 and subsequently during 2007-2014, all categories of debt posted increased in volume. In 2000-2007, the leading sources of new debt were Financial Institutions (with an annual rate of growth in debt issuance of 9.4 percent). In 2007-2014 the leading source of new debt was Government (with growth in debt assets running at 9.3 percent per annum). In other words, if the GFC was caused, at least in part, by the rampant growth in credit creation by the banks, the post-GFC response by the Governments was to deliver growth in public debt that almost matches the pre-crisis excesses of the banks.

Upping the ante on McKinsey, Bank for International Settlements latest data puts total value of all financial assets around the world in 2014 at USD296 trillion, up 40.5 percent on the 2005-2007 average. Of these, debt amounted to USD227 trillion (or almost 77 percent of the total), reflecting growth of 45.8 percent over the crisis period. 3

Now, give these numbers a thought. In the aftermath of the Global Financial Crisis, governments around the world prioritised deleveraging of banks, corporates and households. At the same time, regulators, central banks and policy analysts were promoting the virtues of equity over debt as the source of investment funding. The austerity-centric response to the series of financial and growth crises, especially within the euro area, has further reinforced public perception that debt was on a decline, while equity was on a rise.

Alas, exactly the opposite took place behind the media veil of ignorance. In 2014, equity share of the total quantum of financial assets was 2.7 percentage points lower than prior to the crisis. Debt share became 2.7 percentage points higher. Within debt class itself, Government debt share of the global financial markets went up by 6 percentage points between 2005-2007 and 2014. Today, after the spectacular blow up of the euro area debt crisis, Government debt accounts for 19.6 percent of all financial assets outstanding around the world.

Source: Data from the Bank for International Settlements

While stock of equity in the global economy rose by USD14 trillion in 2014 compared to 2005-2007 average, stock of Government debt was up USD 29.3 trillion, stock of financial institutions bonds rose USD13.7 trillion, stock of non-financial corporate bonds was up USD10.3 trillion, stock of securitised loans rose by USD2 trillion and stock of non-securitised (highest risk) loans went up USD16 trillion. In simple terms, assets that directly blew up in the Global Financial Crisis and subsequent Great Recession and the Euro area Debt Crisis, saw their total volume outstanding in the economy rise by USD61 trillion during these crises.

From the financial markets participants, analysts and intermediaries perspective, there are several key points being raised by this data.

The first point is the size of the debt markets. A recent FT conference covering debt markets highlighted the extent of the dangerous mis-pricing of risk in both sovereign and corporate debt markets, including, but not limited to, the risks underlying wide presence of the negative yields. 4 Currently, roughly USD2 trillion of European sovereign debt is trading at negative yields. And there is another USD15 trillion of assets at play in this category worldwide. Neither the financial institutions holding this debt, nor the markets intermediating in it are prepared to absorb potential losses, should yield reversions take place. A move in bond prices by ca 15-20% can result in balance sheet losses comparable to the immediate impact of the GFC.

The second point is the longer-term relative positioning of the debt markets compared to equity. Over 2004-2014 period, share of equity in total financial assets outstanding never exceeded 26.7 percent. Even at the peak of the pre-crisis markets, debt accounted for more than 73 percent of the total volume of financial assets traded. If equity were to take up a stronger role in underwriting corporate investment and banks’ funding in the future, we are looking at equity issuance to the tune of USD55 trillion in 2014 dollars. This would roughly double the volume of equity in the market. That is a material risk by any measure.

In simple terms, all of this means that the policymakers’ and regulators’ ambitions to increase corporate and financial sectors’ reliance on equity over debt risk very substantial disruption to the existent structure of the markets. Even a 10 percent rate of replacement for debt with equity for all, but secured private sector debts would require an equity injection of USD15.5 trillion or a rise in the quantum of equity listed in the markets of some 22.5 percent.

All analysts – exposed to traditional portfolios of debt and equity, and those keen on the alternative investment classes – should pause to think about the large themes defining today’s markets.

This is a syndicated repost courtesy of True Economics. To view original, click here .