Debt to GDP Ratio Definition Calculation and Use

Post on: 5 Апрель, 2015 No Comment

Use the Debt-to-GDP Ratio to Predict Which Country Will Default Next

Definition: The debt to GDP ratio compares a country’s sovereign debt to its total economic output for the year. A nation’s annual economic output is measured by GDP. or Gross Domestic Product .

Why is this useful? It gives investors a rough gauge as to a country’s ability to pay off its debt. If the debt-to-GDP ratio exceeds 77% for an extended period of time, investors will start to worry. They will demand more interest rate return for the higher risk of default. This increases the country’s cost of debt. This can quickly become a debt crisis. (Source: World Bank. Finding the Tipping Point )

If a country were a household, GDP is like its income. Banks will give you a bigger loan if you make more money. In the same way, investors will be happy to take on a country’s debt if it produces more.

How to Calculate the Debt to GDP Ratio

To figure the debt to GDP ratio, you’ve got to know two things: the country’s debt level and the country’s economic output. This seems pretty straightforward, until you find out that debt is measured in two ways. Most analysts look at total debt. However, some (like the CIA World Factbook) only looks at public debt .

This is a little misleading. Even in the U.S. all debt is essentially owned by the public. Here’s why. The U.S. Treasury has two categories. Debt held by the public consists of U.S. Treasury notes or U.S. Savings Bonds owned by individual investors. companies, and foreign governments. Public debt is also owned by pension funds. mutual funds. and local governments.

The other category is Intragovernmental Holdings. This is the category not reported by the CIA World Factbook because it’s debt the Federal government owes to itself, not to outside lenders. The CIA figures if the government doesn’t repay itself, so what? It’s just a method of accounting between two agencies.

However, it really does matter a lot. The money the Federal government owes itself is really owed mostly to the Social Security Trust Fund and Federal department retirement funds. Thanks to the Baby Boomer generation, these agencies take in more revenue from payroll taxes than they have to pay out in benefits right now. That means they have excess cash, which they use to buy Treasuries. The government just spends this excess cash on all government programs. When the Boomers retire, Social Security will cash in its Treasury holdings to pay benefits.

Therefore, you should always look at the total debt, not just the debt owed to the public, because all Federal debt is owed to the public. That’s why Intragovernmental Holdings should be counted in the debt to GDP ratio.

How to Use the Debt to GDP Ratio

The debt to GDP ratio allows investors in government bonds to compare debt levels between countries. For example, Germany ‘s debt is $2.4 trillion, dwarfing that of Greece, which is $434 billion. But Germany’s GDP is $2.9 trillion, much more than Greece’s $318 billion — which is why Germany (and the EU) is bailing out Greece, and not the other way around. The debt to GDP ratio for Germany is a comfortable 83%, while that for Greece is 142%.

So, is the debt to GDP ratio a good predictor of which country will default. Not always. Japan ‘s debt to GDP ratio is 197%, and has been for decades. Japan is not in danger of default, because most of its debt is held by its own citizens. A lot of Greece’s debt was held by foreign governments and banks. As Greece’s bank notes became due, its debt was downgraded by ratings agencies like Standard & Poor’s. which made interest rates rise. Greece had to find a way to raise more revenue, and undertook spending cuts and tax increases to do so. This further slowed its economy, further reducing revenue and its ability to pay down its debt.

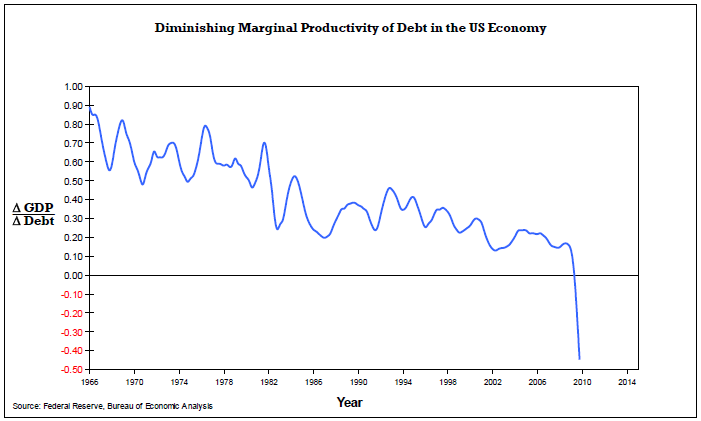

As a country’s debt to GDP ratio rises, it is often a sign that a recession is underway. That’s because a country’s GDP decreases in a recession. This causes taxes, and federal revenue. to decline at exactly the same time the government spends more to stimulate its economy. If the stimulus spending is successful, the recession will lift, taxes (and federal revenues) will rise, and the debt to GDP ratio should level off.

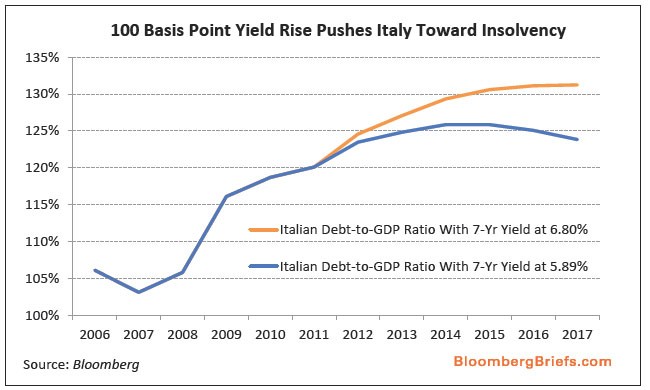

The best determinant of investors’ faith in a government’s solvency is the yield on its debt. When yields are low, that means there is a lot of demand for its debt, so it doesn’t have to yield as high a return. But if yields are high, look out. That means investors don’t want the debt, so the country must pay more to get them to buy it.

This can be a downward spiral. High interest rates make it more expensive for the country to borrow. This increases fiscal spending. which creates a larger budget deficit. which creates more debt.

The debt to GDP ratio is a less important indicator for a country which can issue debt in its own currency. The U.S. for example, can simply print more dollars to pay off the debt. For this reason, the risk of default is very low. On the other hand, the debt holders wind up with money that’s worth less. This will eventually make them avoid that country’s debt.

That’s why the debt to GDP ratio, for all its faults, is still widely used. It’s a good rule of thumb that indicates how strong a country’s economy is, and how likely it is to use good faith to pay off its debt. Article updated September 24, 2014