DailyTech Samsung to Invest ~$42B USD in 2012 Mostly on Chipmaking OLED TVs

Post on: 31 Май, 2015 No Comment

Samsung surges as competitors shrink, cut back

Apple, Inc. (AAPL ) and Samsung Electronics Comp. Ltd. (KS:005930 ) have been fighting an intense war over sales of smartphones, the handheld computers that many people feel embody the future of personal computing and electronics. The war has been waged in the court [1 ][2 ][3 ][4 ] [5 ][6 ][7 ][8 ] [9 ][10 ][11 ][12 ] [13 ]. It has been waged in the media. It has been waged on the market.

I. Samsung Outspends Rivals on R&D, In-House Process Technology

But at the end of the day, two things are clears. First, Apple has absolutely won in profitability. Second, Samsung does not care because it is beating Apple in sales .

The two companies wildly different approaches are perhaps best embodied by their different philosophies in terms of spending on research and development. Apple is notorious for being one of the stingiest spenders in terms of research paying in 2010 a reported mere $2.4B USD — 2 percent of its annual income — to research and development (R&D).

Samsung by contrast spent $6B USD in 2009 on R&D, according to Booz & Comp.

And this year it plans to broaden the gap in research and capital spending devoting 47.8T Won ($41.8B USD) to its efforts. According to Reuters about 31T Won ($27.1B USD) will go to facilities, 13.6T Won ($11.9B USD) to R&D, and 3.2T Won ($2.8B USD) to capital investments.

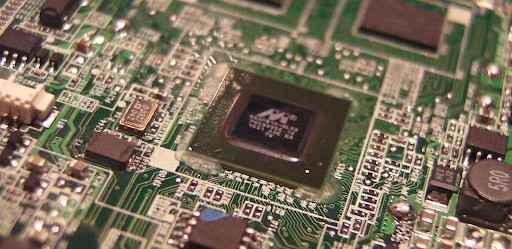

Samsung is outspendings its rivals in capital and research.

[Image Source: SeongJoon Cho/Bloomberg]

By contrast, Intel Corp. (INTC ) — another key rival — is expected to have spent on $9.8B USD on capital expenditures (mostly facilities) [source ] and another $6B-$7B on R&D in 2011 [source ].

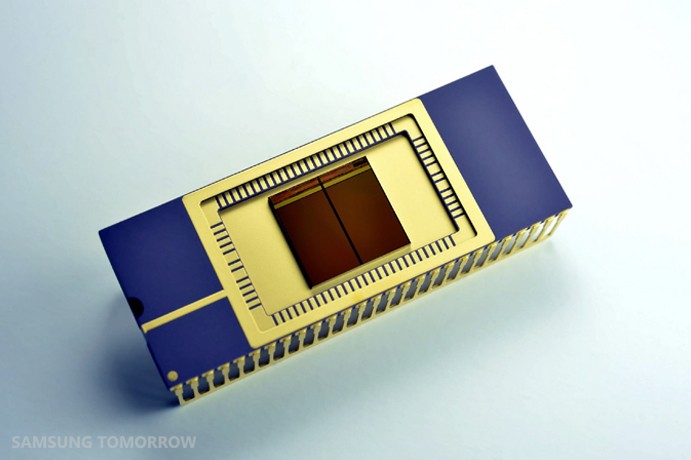

The numbers are a bit misleading, though, as Samsung is fighting a war on many fronts. The company makes chips galore — from systems-on-a-chip (SOCs), which use licensed ARM Holdings plc (LON:ARM ) IP-cores, to NAND flash chips. Samsung holds the distinction of reportedly being the only DRAM manufacturer to remain profitable during the recent plunge in component prices.

Of the 31T Won for facilities, in 2012 Samsung is expected to spend 7.5T Won ($6.56B USD) on SOCs (e.g. its Exynos SOCs found in its smartphones) and sensors. This is the first time that part of Samsungs component spending has surpassed DRAM and NAND investments, which are expected to total 6.5T Won ($5.69B USD).

An R&D breakdown was not mentioned, but assuming that its similar to the capital expenditures on facilities, Samsung could be ponying up as much as 3.3T Won ($2.9B USD)

What this means is that Samsung is spending approximately half to two thirds third of what Intel is spending on CPU-making. This puts Samsung in an elite league beyond other chip-heavy firms like Advanced Micro Devices, Inc. (AMD ).

II. The Race to Tiny — Samsung Remains Neck and Neck With Intels Older Lines

The investment is starting to show signs of paying off. Samsung was the only major ARM chipmaker to get 32 nm chips out in 2011, though it failed to yield devices (you can think of this as akin to Intels production of Ivy Bridge in 2011. in that its accumulating stock to storm the market next year). It shipped its first production-line 32 nm stock last year. By contrast, rivals like Qualcomm Inc. (QCOM ) are just hitting the similar 28 nm node in 2012, courtesy of Taiwan Semiconductor Manufacturing Comp.. ltd. (TPE:2330 ) (TSMC).

Samsung is a leader among ARM CPU makers in fab processes. [Image Source: IntoMobile]

Intels mobile offering Atom will only hit 32 nm by H2 2012. So it is behind Samsung on the mobile front as well.

Now this may seem a bit confusing as Intels first 22 nm chips — Ivy Bridge — are expected to begin to retail in Q2 2012. But the thing holding Intel back is that while it has smaller process fabs than either TSMC or Samsung, it only has a limited number, forcing it to devote them to its core PC business. The reality of the situation is that unless Intel seriously ups its capital investment, mobile chips will likely keep getting the hand me down fabs. while the cream of the crop will be reserved for the PC.

This is good news for TSMC, but especially for Samsung — the current leader in ARM process technology. Now Samsung does still have to worry about some of the tricks Intel has up its sleeve — including 3D FinFET transistors. which will hit its mobile lineup in 22 nm chips in 2013.

Predicting Samsungs arrival at 22 nm is a bit interesting given its rapidly increasing R&D/capital expenditures contrasting its historical struggles. Samsung began 32-34 nm (30 nm [range] in Samsung-speak) DRAM mass production in 2011, around the same time it start to pump out its first 32 nm SOCs (albeit in lower quantities). Samsungs 30 nm range node was first sampled in 2009, but problems with NAND controllers delayed commercialization to the present. Samsung sampled 20 nm range (like 22 nm) NAND in Apr. 2010. So if the 20 nm node follows the trend of the 30 nm node, you can expect to see Samsung with 22 nm SOCs in 2013, alongside Intel.

Intels roadmaps at IDF slung mud at this idea, but given Samsungs massive investments on the chip making front, it might be premature to think that Samsung cant deliver 22 nm in 2013.

III. Mo Money, Mo Selling Features

Samsung is clearly serious about its chip making investments. It is issuing

$1B USD in new bonds, its first new debt in over a decade. The money will go towards chip making capacity expansion, presumably in part towards expanding Samsungs only overseas fab. located just minutes away from a major Apple customer service call center in Austin, Texas.

Its hard to say how much of a difference these investments will make to Samsungs core smartphone sales. But pushing smaller process and higher yields via deeper investment certainly cant hurt Samsungs profit margins and industry-leading smartphone market share .

Led by the Galaxy S II, Samsungs smartphone lineup proved much more popular in terms of sales than its rival Apples lone product. [Source: Samsung]

Furthermore, they offer a nice trickle-down effect to Samsungs feature phones, which are currently second only to Nokia Oyj. (HEL:NOK1V ) in sales. Samsung has announced its hopes to pass Nokia in total combined smartphone and feature phone sales in 2012 .

Samsung plans to funnel 10T Won ($8.75B USD) into its LCDs, rechargeable batteries and LED businesses, investments which should also give a nice boost to its smartphone and feature phone lineup.

IV. Samsung Beefs up Investment in Other Divisions, Too

Outside the core chip making and smartphone businesses Samsung is prospering as well. The company plans to pour 7T Won ($6.13B USD) into commercializing OLED. Samsung recently took Sony Corp.s (TYO:6758 ) struggling LCD business (mostly TV manufacturing) off its hands.

While LCD TVs are the core of Samsungs current TV sales, OLEDs represent the future of the market. South Korean rival LG Display (sister company to LG Electronics Inc. (KS:066570 ) — also a smartphone rival of Samsung) revealed a large OLED TV at CES 2012.

Market research firm DisplaySearch says that OLEDs currently only amount to 4 percent of the display market, but will rise to a substantial 16 percent by 2018.

Samsung OLED sets, circa-2010 [Image Source: OLED-TV.com]

But while LG is serious about OLED, the LG Group (the parent of LG Electronics and LG Display) is cutting investment by $3B USD in 2012. The OLED division will be relatively untouched, getting 4T Won ($3.5T USD), but thats only about half of what Samsung is investing.

And overall LG is going in the reverse direction to Samsung who increased its investments from 2011 42.8T Won ($37.45B USD), a net swing of +11.7%. LG is not alone in its cutbacks. Sony, Toshiba Corp. (TYO:6502 ), Hitachi Ltd. (TYO:6501 ), and Sharp Corp. (TYO:6753 ) — the top vendors in Japan — all made similar cuts. Combined these firms are only spending 1.3T ($16.9B USD) on investments — roughly on two fifths of what Samsung is spending.

These rivals are also cutting employees, while Samsung is adding an estimated 26,000 employees in 2012 to its global workforce of 350,000.

Samsung, a massive South Korean conglomerate composed of 80 sub-units which span everything from dishwashers to automobiles is currently Asias most valuable tech company. The gap between Samsung and its Asian rivals is only expected to grow as the investment gap grows.

Despite its heavy investment Samsung is still turning profits. It is expected to haul in 5.2T Won in calendar Q4 2011 ($4.73B USD). That isnt Apple-esque profits, by any stretch, but its not bad considering Samsungs industry leading investments in its technology future.