Daily Pfennig Central Banks Unite To Battle Deflation – Is It The Right Fight Daily Pfennig

Post on: 16 Август, 2015 No Comment

Central banks across the globe have joined forces to combat a menacing force. The monster isn’t the one central bank leaders have typically feared. The opponent isn’t inflation, but its opposite: falling prices. Instead of trying to keep the value of the currency supported by holding inflation at bay, these central banks are instead focused on finding new and innovative ways to devalue their currencies. The opponent is deflation – but is this a battle they should be fighting?

I understand all of their concerns, as Central Bank leaders in Europe and the U.S. sat by and watched their Japanese counterparts do anything and everything they could to try and free themselves from the seemingly unbreakable grasp of deflation. Japan’s economy, the globe’s third largest by nominal Gross Domestic Product (GDP), has only seen one year of growth above 2% in the past 20 years. This lack of growth is what continues to drive the Bank of Japan (BoJ) toward ever-increasing rounds of stimulus – and is also what is pushing the central bankers of Europe in a similar direction.

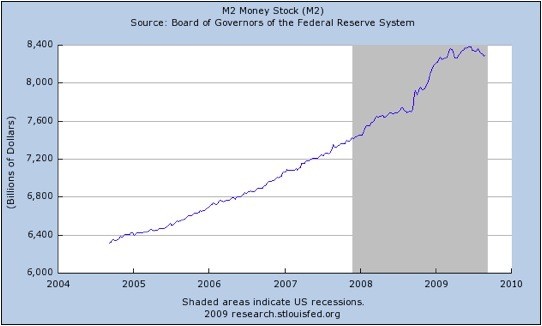

This easy-money path is one that has become well worn over the past decade as both the U.S. and UK have also traveled down this road. In 2008 and 2009, the global economy was on life support, and leaders of the globe’s largest central banks felt it was their duty to do as much as possible to keep it from failing. Quantitative Easing (QE) was initiated, stimulus packages were created, and money was printed. The United States, along with many of the other major central banks, did everything in the book to inflate the global economy.

The U.S. and UK economies have rebounded but, in spite of all of the liquidity that has been pumped into the system, inflation remains subdued. So, why are these central bankers still worried? After all, in some ways, the U.S. and UK economies look to be headed in a fairly sustainable direction – a low inflation/low growth scenario. But, these leaders are still very worried about deflation, which they feel remains as the largest current threat. Here are a few of the reasons the leaders of the globe’s largest central banks see deflation as a bigger threat than inflation.

Inflation Rate

It made sense to think that widespread inflation would result because the U.S. economy was artificially stimulated. But, six and a half years later, it hasn’t come in broad general terms.

(Click here to view a larger image.) Every year, inflation is supposed to go up little by little, and that has happened. With all the capital injection into the economy, pundits screamed hyperinflation. That did not happen (at least not yet).

In general, a little bit of inflation can be good for an economy and job creation. The Fed is targeting a 2% inflation rate. 1 Some economists believe that inflation under 6% is safe. 2 Currently, the inflation rate is about 1.3%. 3

Anything above 7% is considered an inflationary environment. The U.S. saw this for a few years in the mid-‘70s, and again from 1979 to 1981 during stagflation. The chart above shows that inflation has otherwise been very difficult to come by.

Currently, inflation can be seen in certain areas such as real estate and the stock market as a result of the stimuli, but it hasn’t been spread out across all asset classes like so many have predicted. In fact, Federal Reserve policymakers are still concerned about the country’s lack of more inflation.

The Consumer Price Index (CPI) is at its lowest point since the end of 2009 – the last year the U.S. faced dramatic deflation. And, this trend could continue since the fundamentals of the economy and financial system aren’t as dependent on stimuli as they were in 2009.

Prices Of Gold And Oil

The price of gold is a litmus test for inflation. Gold is considered a traditional disaster insurance in case of a dollar collapse or hyperinflation. The shiny metal has been declining since reaching all-time highs past $1,900 in 2011.

Source: Spot prices, January 1, 2010 to January 2, 2015, from InfoMine.com 4

(Click here to view a larger image.) The collapse of gold can be correlated to the economy’s lack of inflation. In other words, investors’ general concerns of hyperinflation have been diminishing; therefore, the price of gold has been creeping lower and lower, month by month. Real assets such as gold are seen as a hedge against higher inflation, as their values actually increase when general price levels move higher, which occurs in an inflationary environment. This is why gold is more sought after in periods of higher inflation. So, a falling gold price can be an indication that investors are no longer worried about increasing inflation.

The price of a barrel of crude oil is also approaching its lowest price since 2009 – again, the peak of the last U.S. deflationary period. While the lower prices probably have more to do with a change in the supply/demand relationship than inflationary expectations, these discounted crude prices are definitely anti-inflationary.

Source: Crude Oil WTI (NY MEX), 2005-2015

(Click here to view a larger image.) Analysts estimate oil to continue to stay low for at least the next year, as OPEC has indicated they won’t be cutting production anytime soon and the slowing global economy will hold demand down.

Bond Market Is A Sign

Perhaps the best indication of what investors think about the possibility of inflation vs. deflation is illustrated by the recent activity in the bond market. The lack of yield on longer-term bonds would indicate that investors have little concern about higher inflation in the near future. Yields on longer term bonds are mainly based on the value of future cash flows – in an inflationary environment, investors will place less value on these future cash flows as inflation will decrease the value of this future cash. Investors will, therefore, push the price of fixed-income assets down and the yields on these bonds higher if/when they expect inflation. The current high prices/low yields seen in the fixed-income markets would indicate that a majority of investors are not concerned with inflation.

Why Central Banks Want (And Need) Inflation

So, most investors seem to share central bank leaders’ lack of concern regarding future inflation. And, as I mentioned earlier, central bank leaders have taken this one step further by actually trying to create inflation. So, why do these central banks feel the need to increase inflation? The answer can be found in the piles of debt that governments have accumulated. An inflationary environment will allow governments to pay off these fixed debts with devalued currencies. On the other hand, a deflationary environment forces these same governments to use more expensive currency to pay down their debts.

When deflation grabs hold, companies and consumers stop spending as they wait for prices to fall. On the face of it, an environment of falling prices would seem to be great for consumers. But, many of the consumers in the U.S. are “borrow and spend” consumers who have accumulated debt in order to continue to consume. Just as with over-indebted governments, deflation makes it much harder for these consumers to pay back their loans. For those with little or no debts, deflation is not a concern and is rather something that can be beneficial (lower prices). So, the current levels of overall debt in the global economy (both private and public) have made deflation a much scarier proposition than inflation.

Central banks have had more experience with inflation than deflation, and find it easier to deal with. When prices rise too quickly, policy makers can raise interest rates to combat inflation. And, there is no limit to the increases that can be made to interest rates (recall the double-digit interest rate increase initiated by Paul Volker back in the late ‘70s). There is less room on the downside of interest rates, giving central banks fewer options. Recently, the European central banks have started experimenting with negative interest rates, showing just how desperate they are in their attempts to hold off deflation. There is little doubt that central banks fear deflation much more than inflation – but that doesn’t mean inflation is no longer a risk.

What Can We Conclude?

There are many indicators that show investors are currently not at all concerned with inflation. And, that is one of the reasons I believe it holds the highest risk for investors. It is typically the unseen enemy that delivers the most dangerous blow. Central bank leaders seem to believe they can easily control inflation if and when it begins to take hold. The problem is that the central bankers don’t have a crystal ball, and past experiences would indicate their ability to see the future isn’t that good. So, there is a real chance they won’t be able to stay in front of inflation once it starts spreading. History has shown that inflation can accelerate quickly once it takes hold. Just as deflation is hard to reverse, inflation can be equally tough to turn around.

Investors have a habit of following the herd when it comes to expectations – and the last few years have benefitted those with this herd mentality. But, you should always maintain proper diversification to protect against the possibility of various investment environments. While deflation seems to be the greater concern of central banks today, we all know the investment environment can change quickly. Having a percentage of your overall portfolio invested in the traditional inflation hedge of hard assets is one potential way to handle an unexpected turn in the market, and precious metals are one of these asset classes.

In the coming year, cautious investing to all.

Until the next Daily Pfennig ® edition

Sincerely,

Chris Gaffney, CFA

President

EverBank World Markets, a division of EverBank