D Saidi Lower Oil Prices Should Give Way To Reforms Gulf Business

Post on: 1 Май, 2015 No Comment

The drop in oil price provides the ‘Perfect Storm’ opportunity for policy reforms, writes the founder and president of Nasser Saidi & Associates.

By Dr. Nasser Saidi March 8, 2015

Plunging oil prices have been giving sleepless nights to many a trader, finance minister and central bank governor.

Oil exporters are under pressure from the sharp nose dive in oil prices: lower oil revenues means growing fiscal burdens and external accounts pressure.

In June 2014, the price of a barrel of oil, then almost $115, began to slide; it sank to a six-year low of around $45 (as of January 13) but has since partially recovered to $60. Normally, falling oil prices would boost global growth.

A $10-a-barrel fall in the oil price transfers around 0.5 per cent of world GDP from oil exporters to oil importers who have a higher marginal propensity to spend.

However, this time round, weak global demand was one of the culprits, alongside increasing oil production.

Prior to the sharp decline in oil prices, the market was overflowing from non-OPEC members with the US energy technology breakthrough raising shale-oil output and leading it to prospective energy self-sufficiency.

US Shale, RUSSia, VenezUela, nigeRia aRe bleeding

The OPEC meeting on November 27, 2014 in Vienna was a turning point with the collective supply quota maintained at 30 million barrels a day, while oil demand was faltering due to slower growth in China and lackluster global growth prospects.

The decision not to cut production levels amid lower demand from Asia and Europe is a tsunami shock for oil producers like Russia, Nigeria, Iran and Venezuela.

The pressure is severe, as the oil price shock has also led to rapidly depreciating exchange rates and inflation as well as sharp falls in asset prices and stock markets.

The Ruble tumbled, forcing the Russian authorities to spend some $83 billion defending the currency in market interventions during 2014. Fitch downgraded Russia’s foreign currency bonds to BBB-, one notch above junk bond grade, while CDS rates for Russian and Venezuelan debt skyrocketed.

Nigeria has been forced to raise interest rates and devalue the Naira. The government also had to recalculate its budget twice in recent months, first down to $78 a barrel and later to $65 a barrel.

Venezuela, which was running deficits of close to 15 to 20 per cent of GDP during peak oil boom years, is facing inflation levels jumping to 100 per cent this year and looks ever closer to defaulting on its debt, sending its president on a fruitless overseas financing/aid raising trip.

But market prices do not discriminate. US shale producers are also bleeding. US shale producers had drilled some 20,000 new wells since 2010, more than 10 times Saudi Arabia’s tally, boosting America’s oil production by a third, to nearly nine million barrels a day. Many will not survive.

Already, the total US rig count is down 30 per cent since October 2014. More US shale capacity will be cut.

Big oil companies are being hit hard: BP is halving its exploration activity and slashing capital expenditure by 20 per cent.

Shell said it would reduce costs by $15 billion over the next three years, continue with a major divestment programme and freeze its dividend; and various others have announced significant layoffs.

S&P has downgraded 19 high-yield oil and gas companies since October — the largest set of ratings downgrades for a single sector since 2009, near the peak of the financial crisis.

To add salt to its wounds, many an oil company had borrowed heavily during the period of peak oil prices and low interest rates, only to find that given the strengthening of the dollar since then, not only do they have to repay larger amounts, but they also need to continue pumping oil to meet debt service.

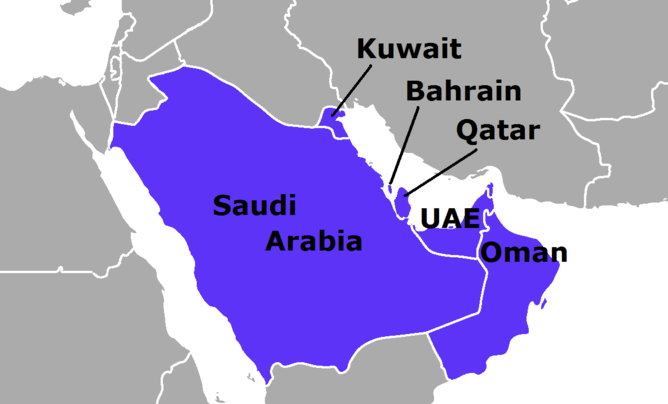

loweR oil PRiceS and an aPPReciating dollar: a doUble- whammy foR the gcc

GCC countries have announced 2015 budgets that already reflect lower oil prices with some countries announcing budget deficits. The oil price shock is equivalent to 15 per cent in GDP, a major shock.

While some GCC ministers have been vocal in the media that their countries’ development spending is on track despite falling oil prices, stock markets have declined on the prospect that lower oil prices means lower government spending and hence lower economic growth and company earnings.

GCC countries also face pressure from their peg to the US dollar that has appreciated more than 10 per cent against all major countries (EU, Japan and others). This implies a loss of competitiveness for GCC countries which hurts their non-oil sectors including manufacturing, tourism and other services.

Dubai is suffering because of Russian sanctions and the falling Ruble, which have negatively impacted Russian tourist flows, while European tourists feel the pinch of a depreciated Euro and anemic growth.

GCC countries thus face both the pressure of lower oil and export revenues as well as a loss of competitiveness due to the appreciating US dollar.

HOW SHOULD THE GCC ADJUST TO THE NEW PARADIGM?

Avoid Pro-Cyclical Fiscal Policies: GCC countries have limited economic policy choices given their pegged exchange rates to the US dollar, resulting in a lack of monetary policy independence. Their only policy tool is fiscal policy.

The setting of fiscal policy is crucial. GCC nations need to avoid abrupt spending cuts that result in pro-cyclical fiscal policy as happened in past episodes of declining oil prices in the 1980s.

Past policy choices exacerbated the negative shock from oil price falls: Lower government spending led to a shrinking of the non-oil sector, compounding the contraction in the oil sector and leading to a fall in overall growth.

GCC fiscal settings and outcomes will also reverberate across the region. In particular, GCC growth has spillover effects on Middle Eastern countries that are labour exporters to the GCC.

A repeat of past pro-cyclical policies would negatively impact labour exporting nations (Egypt, Jordan, Lebanon, Yemen and others) resulting in falling remittances, tourism and capital investment from the GCC at a time of turmoil and geopolitical instability.

It is also likely that foreign aid from the GCC will shrink, adding to the economic problems of the transition countries.

Instead of a pro-cyclical policy option, GCC countries need to adjust spending programmes gradually and reduce the size of government to the extent that the decline in oil prices is more likely to be permanent.

Remove fuel subsidies and shift spending to productive investments: GCC countries need to shift spending towards job-creating, growth-lifting expenditure, build human capital and development spending that crowds-in the private sector and launch public-private partnership (PPP) programmes and privatisation.

In particular, there is an unprecedented opportunity to remove subsidies and wasteful social support schemes. Fossil fuel subsidies account for about 10 per cent of the GCC’s combined GDP, a major drain on government budgets.

The sharp fall in oil prices provides a ‘perfect storm’ opportunity to remove fossil fuel subsidies.

A good example is Indonesia: On January 1, President Joko Widodo abolished the fuel subsidy which was costing $19.6 billion or 15 per cent of the state budget, more than three times the allocation for infrastructure (such as roads, water, electricity and irrigation networks) and three times the spending on health.

This courageous reform was undertaken in a country where around half of its 250 million people live with an income at or below $2 per day. By comparison, GCC countries are enormously wealthy with per capita incomes some 20 to 30 times that of Indonesia.

The GCC should follow Indonesia’s lead and abolish oil subsidies, let domestic oil prices reflect international prices and free up budgetary resources for economic and social development.

The GCC needs to diversify the sources of government revenue: They must reduce their over-reliance on oil revenue, which represents some 85 per cent of overall revenues.

This requires fiscal reform and can be achieved by (a) adjusting the prices of public utilities (electricity, water, transport) in line with underlying costs, (b) introducing a broad-based VAT, say at five per cent that could raise up to three per cent of GDP in revenue, and (c) imposing new excise taxes on gasoline, diesel, tobacco, alcohol and similar products.

The GCC can run budget deficits: Last, but not the least, there is no problem with running budget deficits as long as this does not threaten long-term fiscal sustainability. GCC countries have low levels of debt.

The fall in oil revenues is the perfect opportunity to finance budget deficits by issuing Treasury Bills and government bonds and Sukuk in local currency.

Issuing medium and long-term bonds and Sukuk instead of the practice of using current revenue should finance infrastructure and development projects. This policy change would give a big push to developing local currency financial markets.

A HISTORIC OPPORTUNITY

The collapse of oil prices should be used by GCC countries to undertake economic and fiscal reforms that could simultaneously lead to diversification of government revenue, reduce dependence on oil revenue, help develop local financial markets and remove distortions to production and consumption resulting from oil subsidies.

The starting point should be to abolish oil and gas subsidies.