Cutting Your Tax Bill As Stocks Soar

Post on: 27 Апрель, 2015 No Comment

Many Investors Who Face Hefty Levies on Capital Gains Are ‘Harvesting’ Their Losses to Minimize the Pain

Tom Herman and

Jane J. Kim

Updated Oct. 3, 2007 12:01 a.m. ET

With stock prices surging, many investors are realizing big gains when they sell off some of their holdings. But they should focus on their losers and not just their triumphs.

Investment advisers say that many already are offloading the losers in their portfolios as they try to minimize their 2007 capital-gains tax bill — and that many plan to do even more tax-related selling in coming weeks. Some investors say they’re lightening their holdings not only for tax reasons, but also because of fears that the stock market’s rally may be short-lived amid such concerns as mortgage defaults, a sinking dollar and a possible recession. Whatever the case, financial advisers say more people should consider the virtues of what’s called tax-loss harvesting.

Among investors who recently have been selling is Linda Schafer, who lives in the Triad area of North Carolina. In my long-term portfolio, I do look for stocks that have losses and take the losses and offset them against the gains I’ve got in others, she says. In recent months, she has sold some stocks she was looking to get out of anyway, including U.S. Steel Corp. and Wyeth.

Playing the Game

With stock prices up sharply this year, investors can save on capital-gains taxes by selling losing holdings.

- Use capital losses to offset capital gains on stocks and funds — with no dollar limit.

- Offset as much as $3,000 of net losses each year against your ordinary income.

- Don’t run afoul of wash sale rules, which are triggered by buying back the same investment — or a substantially identical one — within 30 days of a sale.

Further Reading

- More details on the U.S. Treasury Department’s monthly statement of receipts and outlays for the U.S. Government for fiscal year 2007 through Aug. 31, 2007 and other periods (PDF ). For the estate and gift tax data, see page five.

Tax advisers agree that it’s important never to make any investment move solely for tax reasons. But if you are thinking of selling some of your losers anyway, this could be a good time to pull the trigger.

Ms. Schafer has been putting more of her money into cash as a defensive move. With stock prices up strongly, she is starting to get concerned. Some of these stocks are so extended, she says.

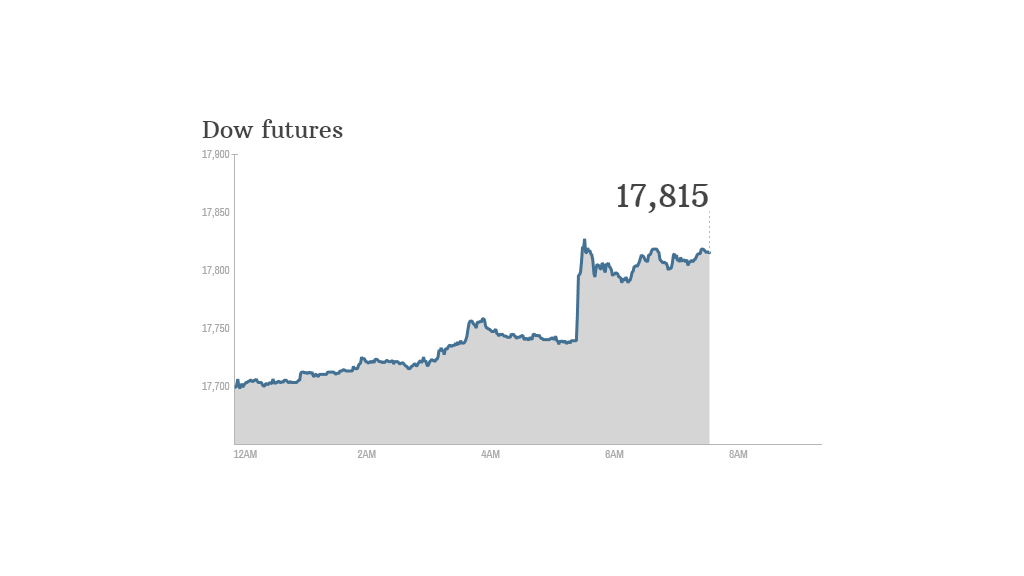

Yesterday, the Dow Jones Industrial Average fell 40.24 points to 14047.31. So far this year, the Dow Industrials are up 12.7%, after a 16.3% gain last year, giving millions of investors large amounts of capital gains.

The basic concept of tax-loss selling sounds fairly simple, but the rules can get complex in a hurry. For starters, you can use realized capital losses to offset capital gains in your stocks, bonds and mutual funds — and there’s no dollar limit. Suppose you sold stock earlier this year for a $100,000 gain. Now you sell other stocks and take a $100,000 loss. That soaks up all your gains, thus enabling you to avoid paying capital-gains tax.

You may even be able to use losses to offset some of your ordinary income. Suppose your losses are even larger than your gains, or you don’t have any gains. In that case, you can use as much as $3,000 of those net losses each year (or as much as $1,500 if you’re married but filing separate returns) to offset wages, interest and other ordinary income. Excess amounts can be carried over into future years.

This net loss rule is especially significant since wages and other ordinary income typically are subject to much higher federal income tax rates than capital gains. The top federal income tax rate on salary, interest and other regular income is 35%. By contrast, the top rate on long-term capital gains on stocks, bonds and most other securities typically is only 15%. (Long term typically refers to investments that you’ve owned for more than a year. Short term refers to a year or less.)

Investors who do decide to sell losers should be careful not to violate what are known as the wash sale rules, which can be devilishly complex. In general, a wash sale occurs when you sell a security at a loss and, within 30 days, you buy exactly the same thing or something substantially identical. That means 30 days before or after the sale. If you violate the rules, you can’t deduct your loss. Instead, you’re supposed to add the loss that wasn’t allowed to the cost of the new securities. The result is your cost basis in the new securities — the figure which you use to calculate future gains or losses.

ENLARGE

What does substantially identical mean? Unfortunately, it isn’t clear. For example, it’s clear you can’t sell General Electric Co. stock at a loss, buy back the same stock the following day and deduct your loss. But what would happen if you sell GE at a loss today and buy it back 30 minutes later for your IRA? Does that violate the wash-sale rule? Tax lawyers say it’s unclear. Many, however, advise against it, just to be safe and because it probably doesn’t pass the smell test. (For more on wash-sale rules, see related Tax Report .)

Investors who sell a security at a loss can avoid running afoul of the wash-sale rules simply by buying back a different security. Jim Pflugrath of The Woodlands, Texas, sold shares in WisdomTree International SmallCap Dividend exchange-traded fund, which holds small-cap international stocks, to capture a 10% short-term loss. On the same day, he bought a different ETF with a similar investing focus.

My asset allocation remains the same, yet I’m able to benefit from this tax-loss harvesting, says Mr. Pflugrath, who hopes to use the short-term loss to offset some of his ordinary income. The government is paying part of my loss.

Capital losses may be especially valuable when used to offset gains from art, antiques and other collectibles, which are subject to higher tax rates. For example, one New York couple made a handsome profit this year by selling a wine collection they had accumulated over many years, says Nadine Gordon Lee, president of Prosper Advisors LLC in Armonk, N.Y.

To help cut their tax bill, they sold some securities at a loss during July and August and expect to do even more selling soon, Ms. Lee says. The couple is especially eager to harvest losses this year because long-term capital gains on wine collections and other so-called collectibles typically are taxed at a top federal rate of 28%.

Before you rush to harvest your losses, however, be sure to check with an accountant or lawyer who understands the intricacies. This issue can get complex when investors have combinations of short-term gains and losses and long-term gains and losses. For details, see IRS Publication 550 .

Clif Purkiser of Honolulu says he will probably sell some of his regional bank stocks, such as First Horizon National Corp. at a short-term loss later this year to offset capital gains and some of his ordinary income. He plans to replace First Horizon with other bank stocks such as Bank of America Corp. The 48-year-old retiree says he’s ruthless about cleaning out any short-term losers by the end of each year, and typically waits until after Thanksgiving to do any harvesting since he has a clearer picture of his taxes.

Be aware, though, that waiting until late in the year to harvest losses can be a costly mistake, says Bob Gordon, president of Twenty-First Securities Corp. in New York. We think there’s much more opportunity available if you loss-harvest all year, he says.

Consider taking your losses early and often, says Duncan W. Richardson, executive vice president and chief equity investment officer of Eaton Vance Corp. Early tax-loss harvesting helps investors lower the tax bite, preserve capital and control their emotions, three essentials to successful long-term investment.

Don’t put off taking action until November or December each year because the markets may be buffeted around that time by emotional selling as many other procrastinators rush for the same exit, Mr. Richardson says. It’s human nature to delay admitting a mistake as long as possible.

PROCRASTINATORS FACE an important deadline soon.

Earlier this year, millions of people received six-month filing extensions from the IRS. That gives them until Monday, Oct. 15, to file their federal income-tax returns for 2006.

For those who haven’t yet filed, don’t forget about the telephone excise-tax refund, which is designed to give back previously collected long-distance telephone taxes. For more details, including eligibility requirements, see the IRS Web site. (www.irs.gov ).

Individuals, businesses and tax-exempt groups are eligible, the IRS says.