Currency intervention Wikipedia the free encyclopedia

Post on: 17 Июль, 2015 No Comment

Contents

Purposes [ edit ]

There are many reasons for the authority to intervene in the foreign exchange market .

Some general consensuses are related to adjusting the volatility or changing the level of the exchange rate. First, governments always prefer to stabilize the exchange rate because excessive short-term volatility erodes market confidence and affects both the financial market and the real goods market. When there is an inordinate instability, exchange rate uncertainty generates extra costs and reduces profits for firms. As a result, investors are unwilling to make investment in foreign financial assets. Firms are reluctant to engage in the international trade. Moreover, the exchange rate fluctuation would spill over into the financial markets. If the exchange rate volatility increases the risk of holding domestic assets, then prices of these assets would also become more volatile. The increased volatility of financial markets would threaten the stability of the financial system and make monetary policy goals more difficult to attain. Therefore, authorities conduct currency intervention. In addition, when economic conditions changes or when the market misinterprets economic signals, authorities use the foreign exchange intervention to correct exchange rates, in order to avoid overshooting of either direction.

Moreover, in recent years, another possible reason for intervention, profitability, has been brought forward. Some literature has presented significant profits from intervention. [ 1 ] Although few governments confess that profitability is a motivation for intervention, some monetary authorities admit that it is a useful gauge of their success in convincing the public for currency intervention.

Types [ edit ]

Currency intervention could be classified into different categories according to its characteristics.

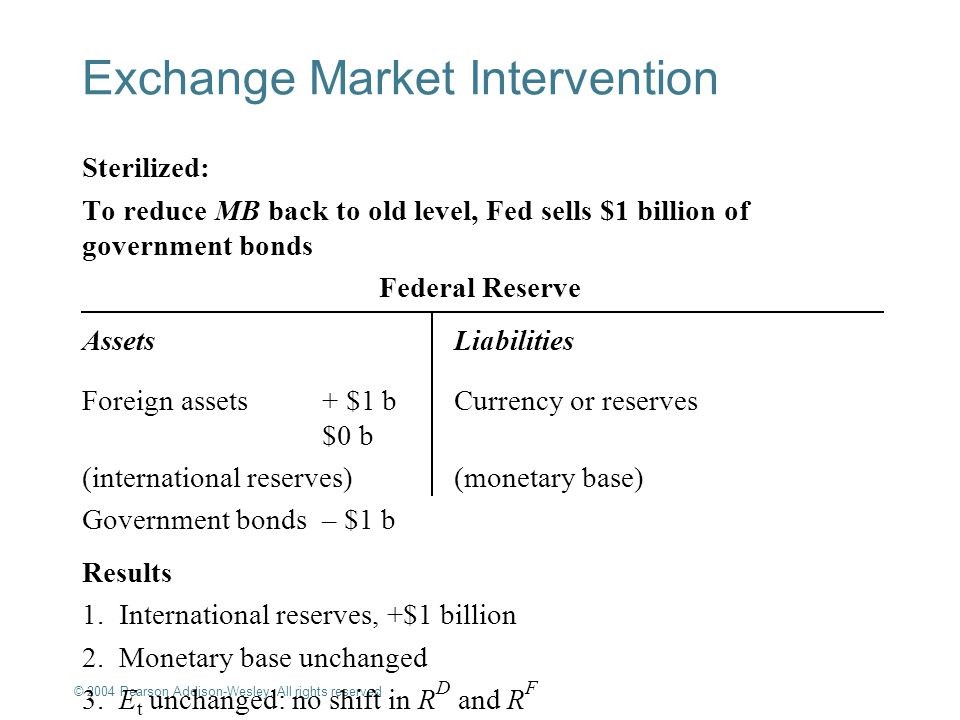

Sterilization [ edit ]

Depending on whether it changes the monetary base or not, currency intervention could be distinguished between sterilized intervention and nonsterilized intervention.

Nonsterilized intervention [ edit ]

Nonsterilized intervention is a policy that alters the monetary base. Specifically, authorities affect the exchange rate through purchasing or selling foreign money or bonds with domestic currency.

For example, aiming at decreasing the exchange rate/price of the domestic currency, authorities could purchase foreign currency bonds. During this transaction, extra supply of domestic currency will drag down domestic currency price, and extra demand of foreign currency will push up foreign currency price. As a result, the exchange rate drops.

Central bank purchase of foreign-currency bonds

Central bank balance sheet