Currency ETFs Won t Fight Bernanke

Post on: 2 Май, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

NEW YORK ( ETF Expert ) — In the last eight weeks, bond traders have seemingly been willing to “fight the Fed .” The 10-year yield has crept up 50 basis since the start of February to 2.27%. What’s more, you don’t have to look very far to find an analyst willing to declare an end to the love affair that investors have had with U.S. government bonds.

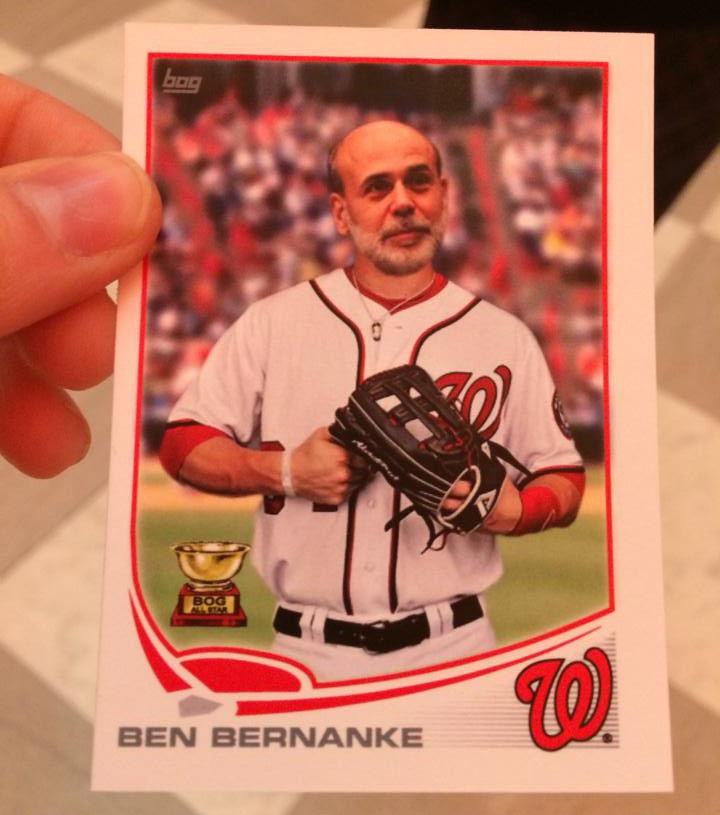

So why, on March 26, did Fed Chairman Ben Bernanke express doubt on the viability of a continuation in employment gains? And why would such negativity encourage the stock market to surge, striking multi-year highs?

Consider Bernanke’s speech to the National Association for Business Economics. He said, “While the labor market may lead to a self-sustaining recovery, we have not seen that in a persuasive way yet. In essence, the chairman wants to provide ongoing stimulation (e.g. ultra-accommodative rates, Treasury bond purchasing with electronic money printing, etc.) because he believes it is the answer for helping an economy that is not capable of sustaining itself.

Naturally, if the head of the most powerful central bank in the world says that it will continue buying bonds with electronically created money that didn’t exist prior to quantitative easing, that fiat currency may not be worth as much as it was before. Not surprisingly, gold moved markedly higher. And most currencies that trade internationally strengthened against the greenback.

It’s important to note, Bernanke probably needed to reassert his intentions. If you look at the one-month losses in Treasuries and the one-month losses in foreign currencies, it was as if people were beginning to bank on a self-sustaining U.S. economy. At least for a day, though, the chairman made sure that the U.S. dollar didn’t get ahead of itself.

Indeed, it may make sense to avoid investing in a manner inconsistent with the Federal Reserve’s goal. On the other hand, Europe’s economic contraction and ongoing austerity will make it hard for currency ETFs to make appreciable progress against the U.S. dollar.

That said, if you believe that the Australian dollar can hold its ground over the course of 12 months, Currency Shares Australian Dollar (FXA ) may reward you with a 3.5% to 4.0% annualized payout. That’s still better than the U.S. 10-year Treasury.

1-Day and 1-Month Returns For Popular Currency ETFs