Currency ETFs Go Long Dollar Gold Yen

Post on: 5 Июль, 2015 No Comment

There's always a bull market somewhere, and right now there are three

3 Good Places to Put Your Cash

Pessimism has been at a multi-year high. You can see from the recent spike in the CBOE Volatility Index (VIX ) and the exchange-traded note (ETN) I recommended several weeks ago, the iPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX ). That typically means we are at or near a bottom (at least in the short-term).

That doesnt mean you should get bullish here by any means. We always wait for a few confirmations of a bottom before doing that, and we havent seen any yet. Just early signs. Even if the market has an intermediate-term rally, it will probably just sell off again.

Below is a chart of the S&P 500 (SPX ) and a chart of the Nasdaq. They dont look too hot right now, do they?

Well, Ill show you some bull markets you may have forgotten about.

You should know by now that you can easily place bets against the major indices by way of inverse exchange-traded funds (ETFs). These are simply ETFs that do the opposite of what the tracked index does. Many people know about the ProShares Short S&P500 (NYSE: SH ) the ProShares Short Dow 30 (NYSE: DOG ) and the ProShares Short QQQ (NYSE: PSQ ). If the underlying index moves down 10%, the corresponding ETF, in theory, moves up 10%, and it trades just like a stock.

Im not saying that its time to start getting bearish on the market; Im just listing the most obvious bull markets of late. When the market rallies again, and when you think its in for another dip, that will be the time to buy the above ETFs.

Lets consider a few other bull markets that you may be able to profit from right now.

Bull Market #1: The U.S. Dollar

One of the most common questions I hear from people who want to sit in cash is, How do I avoid losing money?

First, if youre in the United States, where sitting in cash means sitting in the U.S. dollars, you should take comfort in knowing that you own an asset, and that assets value is appreciating relative to other currencies.

What is cash? Its a place to store value. And to be a savvy, investment-minded person, when it comes to ANY form of value storage (stocks, bonds, currency, art, diamonds), you should always think of your investments value as a relative comparison to other investments.

Currency just happens to be a common and digestible example of that concept. But few people understand that every investment works the same exact way.

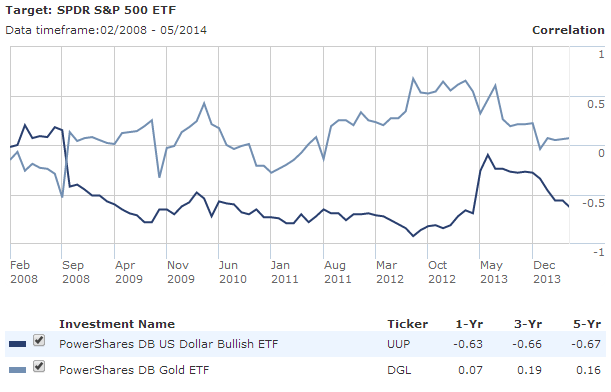

Lets look at the PowerShares DB US Dollar Index Bullish (NYSE: UUP ). This ETF mimics the Deutsch Bank Long US Dollar Futures Index. That means it tracks the value of the U.S. dollar. So, if you want to goose the returns of the U.S. dollars you already store value in, this is the place to do so.

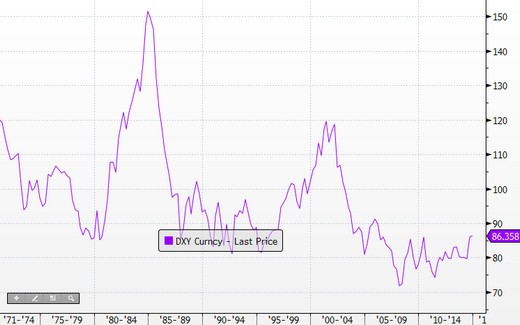

You can see below how the dollar has been advancing versus other currency.

The greenback has lost nearly half of its value over the last five years, but since the rest of the world started falling apart, the U.S. dollar is up and you can play that uptrend. UUP can be used to either speculate on the value of the U.S. dollar, or for those of you who want to sit in cash with a goosed return, this may be the right place to park your funds until you see the next golden opportunity.

Bull Market #2: Gold

Another recent bull market, which has just started to break out again, is gold. The popular ETF that tracks the price of gold is the SPDR Gold Trust (NYSE: GLD ).

Making Money on the Flip Side of the Coin

Lets jump back to currencies for a second here. There have been tremendous bear markets in currencies versus the U.S. dollar. So why do I even mention them? Because you can simply buy deep in-the-money put options on these currency ETFs and make a killing.

Since youre using leverage by trading options, it makes sense to use 10%-15% of the money you would normally commit to an unleveraged position so you dont take on more risk than youre used to.

Lets take a look at some foreign currency ETFs.

CurrencyShares Euro Trust (NYSE: FXE )

CurrencyShares Swiss Franc Trust (NYSE: FXF )

There are plenty of others, such as CurrencyShares Swedish Krona Trust (NYSE: FXS ) and CurrencyShares Australian Dollar Trust (NYSE: FXA ), but you get the point. You can buy put options on these currency ETFs and make money.

Bull Market #3: The Japanese Yen

If you want to diversify by positioning yourself in a strong currency besides the U.S. dollar, consider the Japanese yen.

CurrencyShares Japanese Yen Trust (NYSE: FXY )

Since ETFs trade like stocks, they give you the ability to trade currency without having to open a separate specialized account.

You can always make money in the market, or you can always sit in cash. But the worst thing to do is bury your head in the sand because, as we all know, a bad situation can get worse. Remember: Theres always a bull market somewhere!

3 Must-Own Recovery Stocks Set to Double

Get the names of the best cheap stocks to rebuild your wealth in 2010. Each stock sells for less than $10 a share and is set to double in the next 12 months. Download your FREE report here.