Currency and commodity price movements to dictate interest rate changes Roger Advice Interest Rate

Post on: 23 Апрель, 2015 No Comment

Roger Kerr posted on August 14, 2011 19:40

The international events of the last two weeks with the US Government debt palaver, S & P downgrade, wild equity market movements, global growth forecasts slashed and the US Federal Reserve pledge to keep their interest rates super low until 2013 — have all combined to make the local interest rate outlook cloudier than ever. In fact, we appear to be looking straight into a rather bleak winter snowstorm.

Long-term, five to 10 year wholesale market swap rates have reduced sharply, however not as far as the US 10-year Treasury Bond yields which have plunged from 3.00% to 2.25% as global investors still see this biggest market in the world as the safest place to be with their money in times of market turmoil. Our 10-year swap rates have moved down from 5.25% to 4.90%, a 0.35% reduction compared to a 0.75% drop in the US Treasury Bonds. New Zealand 10-year Government bond yields have decreased over the same time period from above 5.00% to 4.50%.

The net, net result of these movements is that our 10-year swap spreads (swaps against 10-year NZ Govt Bonds yields) have moved out from 20 basis points to 40 basis points (4.50% c.f. 4.90%). The change in the swap spread demonstrates investor preference for sovereign credit risk over bank risk.

If global financial and investment markets are still volatile in a month’s time when the RBNZ release their 15 September Monetary Policy Statement, Alan Bollard will be “on hold” with any changes to OCR monetary policy settings. Not even taking back the March earthquake 0.50% OCR reduction. The RBNZ are concerned about the global GDP growth outlook in terms of its impact on the NZ economy. As this has deteriorated since the upbeat June RBNZ MPS economic prognosis, you have to expect the September statement to be dovish and downbeat. Such a statement will be negative for the NZ dollar at that time; however the moneymarkets have already priced-out the interest rates increases that were priced into the forward market previously.

In particular, if the NZD/USD exchange rate remains above 0.8000 over the next month or two, you have to anticipate that the RBNZ will be lowering their 2012 GDP growth and inflation forecasts. Interest rates lower for much longer is the outcome under that exchange rate scenario. If the NZ dollar depreciates further to the mid-0.7000’s over coming weeks the RBNZ might not be so drastic with cutting their GDP growth forecast. One reason why the NZD would be in the mid-0.7000’s is further falls in our export commodity prices, which does pull economic growth down from +4.5% projections. If however, the NZD depreciates to the mid-0.7000’s entirely due to EUR/USD reductions (not commodity prices falling), the growth outlook is improved and interest rates will then be heading upwards earlier.

Never underestimate the dominant impact of the NZ dollar exchange rate on our GDP growth performance. A NZ dollar remaining in the 0.8000’s suggests GDP growth dropping away as the big export industries dominate our economy and economic fortunes. If the exporters are not expanding and investing due to a high exchange rate, economic growth goes downhill rather quickly.

Bank refinancing landscape changing

Up until two weeks ago the environment for a NZ corporate borrower to refinance existing debt or raise new debt from local banks was increasingly competitive with reducing pricing levels (lower fees and margins).

Those borrowers who took advantage of that lower market pricing in recent months should be well pleased, as the latest global market ructions will be forcing bank borrowing costs higher in international debt markets. Already the credit spreads on traded Australasian bank debt have moved out 50 basis points as the chart below depicts.

The world is a riskier place and higher bank borrowing costs is one consequence that cannot be overlooked. Local banks have their funding houses in order and are less reliant on global debt markets than they were up until 2008. However, higher overseas credit spreads will encourage the banks to fund more onshore from the retail market, bidding deposit interest rates upwards.

NEW ZEALAND DOLLAR MARKET COMMENTARY

Lower global growth outlook not positive for the Kiwi dollar

To say that the New Zealand dollar has been buffeted around by the storm that erupted in global financial/investment markets ahead and after the US debt fiasco, would be a serious understatement. The volatility in the NZD/USD FX market has been extreme in recent weeks with two and three cent daily trading ranges becoming the norm as interbank NZD market liquidity reduced as some global investment bank players pulled back from participating in the market.

In very uncertain and wildly fluctuating market sentiment, movements up and down were exaggerated due to the lower liquidity and trading volumes. After reaching a low of 0.7985 on 10 August, the Kiwi dollar has swung violently between 0.8430 and 0.8100, largely driven by the wild swings up and down in global sharemarkets. The sentiment of international investors, hedge funds and currency traders has been to sell the Kiwi aggressively when the Dow Jones Index has plummeted on the US credit rating changes and economic releases. Equally, the same players have bought the NZD back just as aggressively when the US sharemarket has rallied upwards. The question that everyone is asking is — if and when will the crazy volatility come to an end, or is this the new normal for a very uncertain world in terms of future economic conditions and thus individual listed company earnings performance from that environment?

Standing back from the day-to-day events and volatility is always difficult in these circumstances when there is just so much hesitancy and uncertainty about the future. However, as far as the NZD/USD exchange rate value and direction is concerned, the changes in recent months could be summarised as follows:-

§   The rapid retraction from the post-float record highs of 0.8830 to the low 0.8000’s over the past two weeks has to be seen as a massive unwinding of money parked temporarily into NZ dollars by international investors ahead of the US debt ceiling “D-day” on 2 August. The Kiwi and Aussie dollars were seen as a safe haven away from both the USD and EUR over that period. There was no great surprise that the NZD depreciated quickly once the US politicians reached some sort of compromise. At that time the risk of credit rating downgrade appeared to have reduced and the money flooded back out of the Kiwi.

§   When Standard & Poor’s made their US Government sovereign credit rating downgrade to AA+ a few days later, equity markets plummeted as contemporaneously weaker economic figures suggested much lower US and global GDP growth. The NZD plummeted further to the sub-0.8000 level as risk was quickly taken off the table by investors as sharemarkets and commodity markets plunged.

§   The bounce back up from below 0.8000 to the current 0.8300 level has come about as the US Federal Reserve pledged to keep US interest rates at the super low levels until 2013. Sharemarkets for the meantime have recovered as the monetary stimulus in the US continues. The Federal Reserve has to date refrained from further quantitative easing by printing more USD’s to help the US economy recover.

The outlook for the NZD/USD direction over coming months depends heavily on external, international economic and financial market factors. Domestic NZ economic data, monetary policy and Government fiscal policy developments are unlikely to have as much influence as overseas events. Although a more “downbeat” Monetary Policy Statement from the RBNZ on 15 September will be NZ dollar negative. As always, the movements in the AUD/USD exchange rate, EUR/USD exchange rate, commodity prices and the Dow Jones Index will determine where the NZD ends up.

Economic policy makers in both Europe and the US have their work cut out to satisfy and placate jittery investment markets. There cannot be much confidence (judged from their track-record to date) that the European political and economic leaders can make the tough decisions to solve the sovereign debt crisis of confidence and lift European economic performance. A weaker Euro currency value has to be the conclusion as weaker economic figures emerge from northern Europe on top of the southern European basket-cases (now including Spain and Italy). The NZD/USD rate is still expected to follow the EUR/USD rate down over coming months.

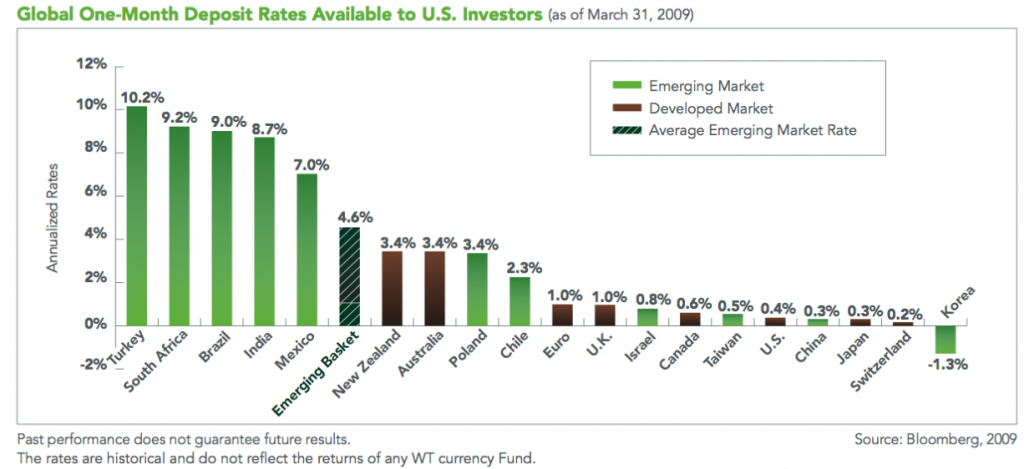

A lower global growth expectation should continue to push commodity prices lower over the rest of 2011. International prices for milkpowder and sheepmeat/beef have continued to fall over recent weeks, further removing one of the previously very positive fundamental underpinnings for the NZ economy and currency. All the one-off variables that forced the NZ dollar higher on its own account in May/June from 0.7800 to the 0.8200 area (earthquake reinsurance inflows, foreign investors buying of NZ Govt bonds, stronger GDP growth and the more upbeat outlook from the RBNZ in June) have now all run their course and do not stand out as likely to repeat. Global investors have abruptly reversed out of the “growth and commodity” risk currencies of the AUD and NZD and given the now much less certain global economic/market environment ahead, they are unlikely to return in a hurry. Some speculate that the currency “carry-trade” may come back in vogue with US interest rates remaining lower for longer and thus push the NZD upwards. However, increased risk aversion by investors should outweigh that normally positive factor for the Kiwi dollar.

If the NZD/USD exchange rate remains above 0.8000 for a prolonged period interest rates will remain low in NZ for longer and the economy will grow at 1.0% to 2.0% in 2012, not 4.00% to 5.00% as per current forecasts. If the NZD/USD rate returns to the mid-0.7000’s, increasing interest rates would then underpin it as the economy will do better in 2012.