Currencies And Currency Pairs Learning Center

Post on: 11 Август, 2015 No Comment

Topics covered in this chapter:

- Main characteristics of major currencies and their economies.

- Definitions of currency pairs and how synthetic pairs are made.

- The pip value is a variable. how it can be calculated and why its value matters.

- The spread and how to overcome the break even point in a trade.

- The rollover. calculate it and integrate it as an edge to your trading.

- How to distinguish the maximum margin requirement from the effective leverage. Understand leverage once and for all.

- Types or orders available in most Forex trading platforms.

In this chapter the student will learn what can be traded in spot Forex and how it is done. We will start by defining the currency pairs and the mechanics of trading: more complicated concepts like margin and leverage will be covered in details as well as calculations of pip values, spreads and rollovers.

What do I need to learn to become a trader? You dont need a superior intelligence to succeed at trading. A formal education, such as mathematics or economy is not a disadvantage, but its not a guarantee of success either. We will teach you here what you need to know: the foundations to stand on and build your experience upon. Once understood the basics, traders learn through study, trial and error, testing and analysis. It is very important though, to hold realistic expectations from the very beginning.

1. Currencies and Currency Pairs

The Exchange Rate

The concept of buying and selling capital can be initially confusing because youre not buying any asset in exchange for money, like you do in the stock market, for example. Instead you are simultaneously buying one currency and selling another, that is, doing an exchange.

In the stock market, traders buy and sell shares; in the futures market, traders buy and sell contracts; in the Forex market, traders buy and sell lots . When you buy a currency lot, you are speculating on the value of one currency compared to another, that is, on the exchange rate itself.

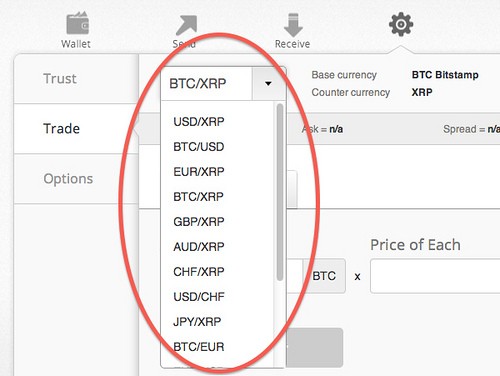

Currencies are traded in pairs. The pair is written in a particular format, best demonstrated by way of two examples. The Euro and the US Dollar:

EUR/USD

or the British Pound and the Japanese Yen:

GBP/JPY

Every purchase of one currency implies a reciprocal sale of the other currency, and vice versa. This means that buying equals selling — curious isnt it? But the fact is that you are buying and selling the exchange rate. not a single currency.

Imagine if currencies would be traded single and you would want to buy 100 US Dollars. Do you think it would be easy to find someone offering more than 100 Dollars for the same amount? Probably not. The value of a currency does not change in itself, what changes is its value in relation to other currencies. This is a characteristic of a free floating exchange rate system, as you learned in the previous chapter.

If you hear another trader saying Im buying the Euro, he/she is expecting that the value of the Euro will rise against the US Dollar and speculates by buying the EUR/USD exchange rate. The traders ability to anticipate how the exchange rate will move will determine if the trade will represent a win or a loss.

The first member of every pair is known as the base currency, and the second member is called the quote or counter currency. The International Organization for Standardization (ISO) decides which currency is the base and which one is the quote within each pair.

The exchange rate shows how much the base currency is worth as measured against the counter currency. For example, if the USD/CHF rate equals 1.1440, then one US Dollar is worth 1.1440 Swiss francs. Remember, the value of the base currency is always quoted in the counter currency member within the pair (hence the name quote currency). A simple rule to understand the exchange rates would be to think of the base currency as one unit of that currency being worth the value of the exchange rate expressed in the quote currency.

Go to the world Foreign Exchange Rates table and select the currencies of your choice to get a picture how each of the major currencies behaves in relation to all the others.

Following the previous example, one US Dollar is worth 1.1440 Swiss Francs.

Therefore, any unrealized profit or loss is always expressed in the quote currency. For example, when selling 1 US Dollar, we are simultaneously buying 1.1440 Swiss francs. Likewise, when buying 1 US Dollar, we are simultaneously selling 1.1440 Swiss francs.

We can also express this equivalence by inverting the USD/CHF exchange rate to derive the CHF/USD rate, that is:

CHF/USD = (1/1.1440) = 0.874

This means that the quote of one Swiss franc is 0.874 US Dollars. Note that CHF has now become the base currency and its value is accrued in USD.

In spot Forex, not all pairs have the US Dollar as the base currency. Primary exceptions to this rule are the British Pound, the Euro and the Australian and New Zealand Dollar.

GBP/USD, EUR/USD, AUD/USD, NZD/USD

When looking at a chart you can see if a currency pair, or in other words, the exchange rate between two currencies, is rising or falling.

In the above example the chart illustrates the strength of the base currency, the Euro, relative to the quote currency, the US Dollar. Remember, the quote currency is the one in which the exchange rate is quoted.

The next chart shows the same base currency but this time relative to the Australian Dollar. Both charts comprise the same period and as you can see, the value of the Euro has shown a different behavior towards the USD than towards the AUD.

Our Rates and Charts section is a superb place to familiarize yourself with different chart types and charting packages.

In a free floating system, there are two main factors that can affect exchange rates every day: international trade (import/export of commodities. manufactured goods and services) and capital flows (following certain interest rates. equity performance, government debt instruments like bonds ).

It is by buying and selling a currency, therefore exchanging it with other currencies, that it becomes stronger or weaker, independently from the fact of this transaction being speculative or not.

Basically there are two main methods to estimate where a currency is heading: analizing the economic fundamentals and analyzing the price action through technical analysis.

The first refer to the economic and political factors that influence the value of currencies, such as the release of economical data and news. Currencies reflect the performance and policies of entire economies, sovereign governments and industry. It is the comparison of different currencies and their economies that drives exchange rates up and down.

The second are graphical representations of the exchange rates like you see above. Price charts show supply and demand levels represented through price patterns which can be recognized visually. As a numerical sequence, price series can be also technically analyzed using mathematical formulas, represented by technical indicators .

In Unit C. you will be familiarized with such fundamental and technical analytical resources. They will help you to interpret the market in a meaningful way. But before you start to interpret, there is a lot of information about price action that you can obtain simply through observation. Chapters A03 and A04 will teach you just that.

Trading Forex is in fact like trading entire economies. A huge difference compared to equities — where companies are traded — is that trends in Forex can last very long. Due to the fact that macroeconomic events can continue to influence the market over a time frame of months and years, an economy that is weak tends to stay weak for a long time. A company that is in trouble can be turned around fairly quickly, but not an entire economy.

Many retail traders feel the need to buy and sell bottoms on the charts. hopping for a turn-around, but the fact is that a currency that has been weakening can always go lower in value, and one that has been gaining strength can always go higher too. The lesson here is that if you want to fight trends in the Forex world, be sure to have a sound and tested method able to capitalize on such circumstances.

Observe the market closely. To achieve success in Forex, you must become an astute observer. Download a free charting platform and take notes each day on the patterns and the constants you discover. In the beginning you will see just candles making mountains and valleys on the chart. with no further meaning, but with time and persistence, patterns will start to emerge and you will be able to pick up behavior constants from the charts. Start focusing on one or two pairs only, and dont overflow you with too much information. To trade for a living you wont need to trade with 10 pairs at once. In fact, many professional traders specialize in only one or two currency pairs.

Before proceeding further into the mechanics, lets devote a moment to the currency pairs themselves.

Currency Pairs

The following is a list of the most frequently traded currencies, their trading symbols, their nicknames and major characteristics:

USD (US Dollar)

The US Dollar is by far the most transacted currency in the world. This is due to several factors as you have already learned in the last chapter. First, its the worlds primary reserve currency. which makes this currency highly susceptible to changes in interest rates. Second, the USD is a universal measure to evaluate any other currency as well as many commodities such as oil (hence the term petrodollar) and gold.

Todays other major currencies like the Euro, the British Pound, the Australian Dollar and New Zealand Dollar are moving against the American currency, and so do the Japanese Yen, the Swiss franc and Canadian Dollar.

70% of the U.S economy depends on domestic consumption, making its currency very susceptible to data on employment and consumption. Any contraction in the labor market has a negative effect on this currency.

All US Dollar denominated bank deposits held at foreign banks or foreign branches of American banks are known as Eurodollars . Some economists maintain that the overseas demand for Dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate and the flow of trade to readjust. Other economists believe that at some stage in the future these pressures will precipitate a run against the US Dollar with serious global financial consequences.

Nickname: Buck or Greenback

EUR (Euro)

The European Monetary Union is the worlds second largest economical power. The Euro is the currency shared by all the constituting countries which also share a single monetary policy dictated by the European Central Bank (ECB ).

This currency is both a trade driven and a capital flow driven economy. Before the establishment of the Euro, central banks didnt accumulate large amounts of every single European national currency, but with the introduction of the Euro it is now reasonable to diversify the foreign reserves with the single currency. This increasing acceptance as a reserve currency makes the Euro also very susceptible to changes in interest rates .

The effect of the Euro competing with the Dollar for the role of reserve currency is misleading. It gives observers the impression that a rise in the value of the Euro versus the US Dollar is the effect of increased global strength of the Euro, while it may be the effect of an intrinsic weakening of the Dollar itself.

Nickname: Fiber or Single Currency

JPY (Japanese Yen)

The Japanese Yen, despite belonging to the third most important single economy, has a much smaller international presence than the Dollar or the Euro. The Yen is characterized by being a relatively liquid currency 24 hours.

Since much of the Eastern economy moves according to Japan, the Yen is quite sensitive to factors related to Asian stock exchanges. Because of the interest rate differential between this currency and other major currencies that preponderated for several years, it is also sensitive to any change affecting the so-called Carry Trade . Investors were then shifting capital away from Japan in order to earn higher yields. However, in times of financial crisis when risk tolerance increases, the Yen is not used to fund carry trades and is punished accordingly. When volatility surges to dangerous levels, investors try to mitigate risk and are expected to park their money in the least risky capital markets. That means those in the US and Japan.

The concept of carry trade will be disclosed later in this chapter, but a short definition would be: a strategy which involves buying or lending a currency with a high interest rate and selling or borrowing a currency with a low interest rate .

Japan is one of the worlds largest exporters, which has resulted in a consistent trade surplus. A surplus occurs when a countrys exports exceed its imports, therefore an inherent demand for Japanese Yen derives from that surplus situation. Japan is also a large importer and consumer of raw materials such as oil. Despite the Bank of Japan avoided raising interest rates to prevent capital flows from increasing for a prolonged period. the Yen had a tendency to appreciate. This happened because of trade flows. Remember, a positive balance of trade indicates that capital is entering the economy at a more rapid rate than it is leaving, hence the value of the nations currency should rise.

These are the milestones in the Yens 137-year history, from 1871 until the December, 12 2008 when the Yen hit a 13-year high versus the US Dollar.

In some countries the fiscal year and calendar year are not identical. In Japan the start of a new fiscal year is April 1st. Japanese companies usually dress up their balance sheets ahead of the fiscal year-end, by liquidating foreign holdings and bringing home the profits from overseas subsidiaries, in order to raise their bottom lines. This capital flows prior to the start of the new fiscal year, and the fact that banking trading desks lower their transaction volumes, condition the exchange rates and price action in all pairs containing the Yen.

GBP (Pound Sterling)

This was the reference currency until the beginning of World War II, as most transactions took place in London. This is still the largest and most developed financial market in the world and as a result banking and finance have become strong contributors to the national economical growth. The United Kingdom is known to have one of the most effective central banks in the world, the Bank of England (BOE ).

The Sterling is one of the four most liquid currencies in the Forex arena and one of the reasons is the mentioned highly developed capital market.

While 60% of the volume of foreign exchange are made via London, the Sterling is not the most traded currency. But the good reputation of the monetary policy of Great Britain and a high interest rate for a long time contributed to the popularity of this currency in the financial world.

Nickname: Cable or simply Sterling

Even though the economic unit using the Pound Sterling is technically the United Kingdom rather than Great Britain, the ISO currency code is GBP and not UKP as sometimes abbreviated. The full official name of the currency Pound Sterling, is used mainly in formal contexts and also when it is necessary to distinguish the United Kingdom currency from other currencies with the same name such as the Guernsey Pound, Jersey Pound or Isle of Man Pound.

The currency name is sometimes abbreviated to just Sterling, particularly in the wholesale financial markets, while the term British Pound is commonly used in less formal contexts, although it is not an official name for the currency.