Credit Risk Adjusted MLP ETN Yields Are Not As Attractive As MLP Funds

Post on: 6 Май, 2015 No Comment

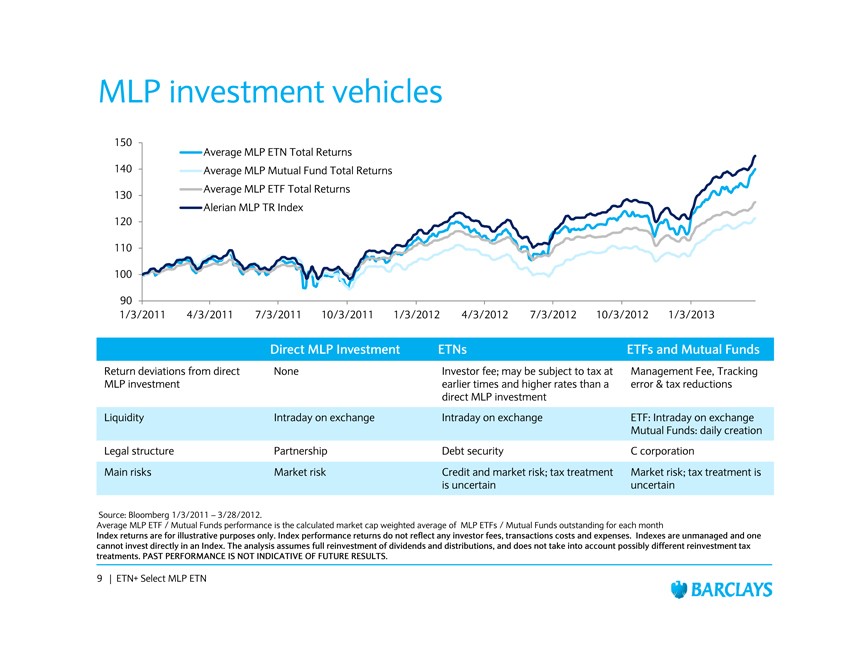

MLP ETNs are unsecured bonds issued by banks. They carry all of the credit risk of the bank, as well as the investment risks of the MLP index they track. MLP ETFs, CEFs and mutual funds carry the investment risks of the active or passive MLP portfolio, but do not carry the bank credit risk attached to ETNs.

Virtually by definition, MLP ETNs pay a lower MLP business risk yield than an MLP fund, because there is an issuer credit risk involved that must be taken away.

This argument applies equally to ETNs representing any other asset category, but we focus on MLP ETNs in this article.

Here is the information you need to do a back of the envelope check to see what the MLP yield component of the total yield actually is for your MLP ETN:

- ETN yield

- credit rating for the issuing bank

- remaining years to maturity for the ETN

- prevailing yield on corporate bonds of that maturity for that credit rating

- yield on Treasury bonds of that number of years to maturity

- yield on Treasury bonds for the number of years you expect to hold the ETN

You may need to do some interpolation, but that is better than doing nothing.

Core Idea:

One way to look at yields on bonds is to think of it as consisting of a credit risk free rate (Treasury rate for remaining years in ETN) and a credit risk rate (bond yield less the risk free rate). Note that credit risk free does not mean interest rate risk free or inflation rate risk free [we won’t be debating the default risk of US Treasuries in this article].

Comparable corporate bond yield less comparable Treasury yield equals the credit risk yield.

Similarly, you could decompose MLP yields in that way, as consisting of a risk free Treasury rate for the number of years you expect to hold the ETN plus an MLP specific risk rate.

MLP portfolio yield less expense ratio less Treasury yield for expected holding period equals MLP business risk yield.

The credit risk adjusted MLP business risk yield equals the MLP business risk yield less the credit risk yield.

AMJ Example

Collecting Facts and Making Some Estimates:

AMJ is issued by JP Morgan (NYSE:JPM ) and matures in 2024 (about 12 years in the future). JPM has an A negative corporate credit rating from S&P.

Schwab lists Corporate A rated bonds with 10 years to go at 3.67% and those with 20 years to go at 4.91%. Let’s make a simple linear interpolation and guess that a 12-year corporate bond with an A rating would have a around a 3.9% yield.

The Alerian MLP index yield is 5.87%. The ETN fee is 0.85%, making the current run rate ETN yield 5.02%.

The 10-year Treasury rate is 1.54%, and the 20-year rate is 2.24%. A linear interpolation would be about 1.7% to simulate a 12 year Treasury.

Let’s assume a 5 year expected holding time for AMJ, and therefore look for the 5-year Treasury rate to gauge the credit risk free rate for comparison to the straight MLP yield to determine the MLP business risk yield. That yield is abut 0.6%

Doing The Math As Narrative:

The straight MLP product has a business risk yield of about 4.4% above the credit risk fee 5-year Treasury rate. We got that by subtracting the 5-year Treasury rate of 0.6% from the MLP index yield of about 5.0%

The ETN has a credit risk yield of 2.2% above the credit risk free 12-year Treasury rate of 1.7%. We got that by subtracting the 1.7% 12-year Treasury rate from the 3.9% general corporate bond rate for an A rated company.

Take the 2.2% credit risk yield from the MLP business risk yield of 4.4%, and you see yourself getting paid only 2.2% for the business risk you are taking, if you first account for the full credit risk you are taking with the ETN bond structure.

Making It A Formula:

MLP Business risk yield =

MLP nominal yield — holding period Treasury yield =