Credit Derivatives

Post on: 31 Март, 2015 No Comment

Credit Derivatives Move Beyond Plain Vanilla

by Sunil K. Aggrawal

Sunil K. Aggrawal received his MBA with an emphasis in Finance from the Leonard N. Stern School of Business in May of 1999.

Over the years, Wall Street’s financial wizards have continually responded to the markets� demand for more efficient financing tools that allow corporations to either lower their cost of funds, take advantage of special tax situations or access a new lending base. In the early 1980s the interest rate market began a new wave of financial innovation with the development of the swap market, which provided reduced credit margins for borrowers in different markets while allowing derivative houses to gain profits through their role as intermediaries. At each phase of the swap market’s development, new interest rate derivatives to were added to product menus. For example, vanilla interest rate swaps paved the way for cross currency swaps bringing the foreign exchange markets into the field and flat-forward foreign exchange contracts contributed to the emergence of the energy swaps market. In each of these cases, the market was bundling, unbundling, repackaging and transferring risk between counterparties.

One of the latest crazes to hit the market has been the introduction of credit derivatives, mechanisms that allow institutions to unbundle the credit risk portion of traditional debt instruments from market risk in an effort to improve pricing efficiency. Sections 1 and 2 will provide descriptions of the credit derivatives market and the basic instruments that are trading today. Section 3 offers a more detailed description of two applications of these derivatives that will fuel much of the growth in trading volume over the next few years, loan portfolio management and merger and acquisition deals. These cases begin with a description of the situation facing the counterparties involved and then demonstrate how a customized credit derivative can be applied. The last two sections provide insight into the more pragmatic side of the business where dealers work around pricing, hedging, documentation and regulatory obstacles to put deals together.

While this paper attempts to provide a comprehensive commentary on the state of the credit derivatives market today, the research is by no means exhaustive and access to information on the latest cutting edge trade in these markets can be difficult to obtain. As with a personal computer purchased two months ago, once one understands everything it can do, the PC is probably obsolete. In the derivatives markets, once a list of all the trades in the market has been compiled, its participants have come up with five or ten new ones.

1. Credit Derivatives

1.1 What are Credit Derivatives?

Credit derivatives are privately negotiated bilateral contracts that allow users to manage their exposure to credit risk. For example, a bank concerned that one of its customers may not be able to repay a loan can protect itself against loss by transferring the credit risk to another party while keeping the loan on its books. This mechanism can be used for any debt instrument or a basket of instruments for which an objective default price can be determined. In this process, buyers and sellers of the credit risk can achieve various objectives, including reduction of risk concentrations in their portfolios, and access to a portfolio without actually making the loans. Credit derivatives offer a flexible way of managing credit risk and provide opportunities to enhance yields by purchasing credit synthetically. Credit derivatives cannot eliminate all credit risk because inherent in the transfer of a loan exposure to Company A, is the introduction of a new exposure to Company B because of the use of a derivative with Company B. Generally, AAA-rated Special Purpose Corporations or Vehicles (SPCs or SPVs) are created to enter into such transactions to reduce the new exposure. Examples of credit derivatives include Credit Linked Notes (CLNs), Total Return Swaps (TRSs), Credit Default Puts, Credit Spread Options and others which will be discussed in Section 2.

1.2 What is Credit Risk?

Credit risk is the possibility that a borrower will fail to service or repay a debt on time. The degree of risk is reflected in the borrower’s credit rating, which defines the premium over the riskless borrowing rate it pays for funds and ultimately the market price of its debt. Credit risk has two variables: market risk and firm-specific risk. Credit derivatives allow users to isolate, price and trade firm-specific credit risk by unbundling a debt instrument or a basket of instruments into its component parts and transferring each risk to those best suited or most interested in managing it. There are various traditional mechanisms to reduce credit risk including refusal to make a loan, insurance products, guarantees and letters of credit, but these mechanisms are less effective during periods of economic downturn when risks that normally offset each other simultaneously default and financial institutions suffer substantial loan losses.

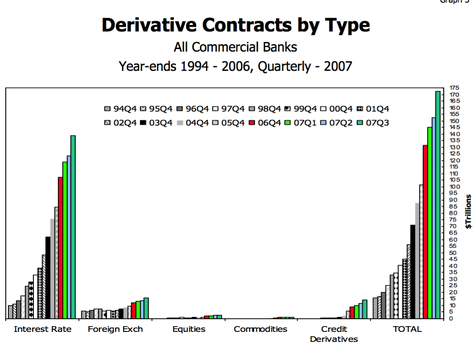

1.3 Estimated Market and Active Players

Credit derivatives have emerged as a major risk management tool in recent years. The total volume outstanding of credit derivatives is estimated to exceed $75 billion. Once largely confined to banks, the market participants have expanded to include insurance companies, hedge funds, mutual funds, pension funds, corporate treasuries and other investors looking for yield enhancement or credit risk transference. The market has evolved from the financial institutions’ needs to manage their illiquid credit concentrations and their use of default puts to hedge their credit exposure. Existing derivative techniques have been used for emerging market debt and have further been applied to corporate bonds and syndicated bank loans. Total Return Swaps, for example, were developed to sell customized exposures to investors looking for a pick-up in yields on their portfolios. These structures enable investors to obtain exposure to portfolios which were not available to them previously and provides them with new diversification opportunities.

Several factors have contributed to the development of the credit derivative market. Investors have shown interest in these products for yield enhancement given the increasingly narrow credit margins on conventional corporate and emerging market sovereign issues. As investors have come to understand these products more fully, trading volumes have increased. Now dealers are more frequently warehousing trades in the same way they warehouse and manage interest rate risk. Over-the-counter brokers have entered the market and the International Swaps and Derivatives Association (ISDA) is responding to the call for standardized documentation.

Comments from most market participants indicate a consensus expectation of continued growth and increased liquidity in the future. Credit derivatives will make credit risk pricing more efficient, much as Collateralized Mortgage Obligations (CMOs) did for mortgage pricing, and help segregate credit risk from market risk in bond and loan pricing. Institutions best suited to handle the credit risk component of these debt instruments will be able to buy only that portion of the risk and warehouse it.

2. Types of Credit Derivatives

The product menu in the credit derivatives market is changing every day, but there are four major instruments that make up the bulk of the trading volume today: Total Return Swaps, Credit Default Swaps, Credit Spread Options and Credit Linked Notes. Terminology varies among market participants, sometimes based on geography. For example, Credit Default Swaps are sometimes called Credit Swaps so it is difficult to maintain a consistent lexicon when discussing this developing market. Traders and marketing staff are careful to provide detailed descriptions of a transaction-specific payoff profile so it is of more value to understand under what circumstances one will receive a payment, or be required to make one, than it is to know a list of product names.

Table 1, from the British Bankers’ Association, provides estimates of how credit derivative trading volume breaks down by product type. Of most interest in this chart is their view of the likely trend in the market which favors the development of products which allow end users to manage their borrowing spread over the risk-free rate. With a broad menu of products for corporate treasurers to manage their absolute exposure to the level of interest rates (swaps, caps, collars), they will next look for ways to stabilize their company’s borrowing spreads.

Table 1

Credit Derivatives� Share of the Market