Credit Default Swaps A Reuters introduction

Post on: 26 Апрель, 2015 No Comment

For more information on how the Reuters Professional products related to Credit Default Swaps can serve you Find out about how Reuters can help you

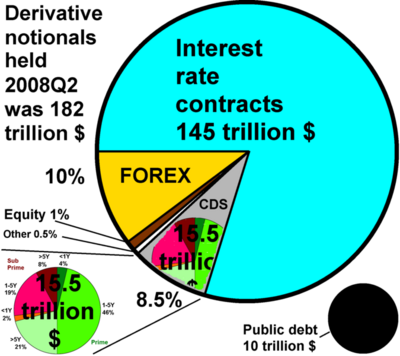

The credit default swaps market is growing at a rapid pace. Credit default swaps are derivative instruments based on underlying fixed income securities such as corporate and government bonds. Swaps are privately negotiated contracts traded on over-the-counter markets.

The buyer of a credit default swap pays a premium to the seller to assume the risk of the issuer of the underlying security defaulting on the coupon or interest payment. Credit default swaps are used for hedging as they enable investors to insure their bond holdings against the risk of default. They are also traded for investment purposes.

Credit default swaps traders look for sophisticated information and analysis tools to help them perform effectively. They need fast and reliable credit default swap pricing data and easy-to-use search functionality. They also require tools that enable them to perform a variety of analyses from calculating swap values to comparing swap prices and spreads against those of other instruments.

Credit default swap traders have to monitor the fixed income markets and the factors that could cause debt issuers to default because credit default swap prices are linked to those of their underlying instruments and are affected by the market’s view of default probability. And if traders are dealing in default swaps based on corporate bonds, they need to track the equity markets as well. So they need access to a wide range of information, in addition to derivatives data, to analyse credit. This range of information includes bond pricing; bond terms and conditions; information on issuers with details of their credit ratings, capital structure and issued debt; stock performance; company fundamental data; and brokers’ estimates. Comprehensive news coverage of the markets and the events that drive them is also essential.

Reuters premium cross-asset information products include a credit default swaps service tailored to meet the needs of financial professionals trading in the fast-growing credit derivatives market. Reuters offers integrated access to news, market data, analysis and instant messaging tools. Reuters provides extensive credit default swap pricing data, information on more than 1.9 million debt instruments, and coverage of more than 12,000 companies. Reuters global network of journalists includes 500 specialists who report on the issues affecting the credit derivatives, fixed income and equity markets.

For more information on how the Reuters Professional products related to Credit Default Swaps can serve you Find out about how Reuters can help you