Corporate Bonds What You Need to Know Before Investing

Post on: 15 Июнь, 2015 No Comment

Bonds issued by a corporation with a maturity of greater than one year are called corporate bonds. Below is a video summary on what you need to know before investing in corporate bonds. You can find the longer text version below the video.

You’re in the Right Place!

Intro to Corporate Bonds

There are thousands of corporations that issue bonds and the credit quality of corporate bonds varies much more widely than that of treasury bonds or municipal bonds. While a default by the US Government has never happened, and municipal defaults are few and far between, corporations (none of which have the ability to tax in order to pay off their debt) default on their bonds on a fairly regular basis.

Before investing in a corporate bond you’ll want to make sure you know its credit rating and understand how the bond is structured. Is the bond secured by a specific asset or an unsecured bond where the investors are out of luck in the case of a default? What place in line do investors hold if the corporation defaults on its bonds? Is it senior debt which is paid first, or subordinated debt that is paid only if there is anything left after senior debt holders are paid?

Lastly, you want to understand if the bond has any embedded options like a call option, which usually benefits the corporation, or a convertibility option, which can benefit the investor. For more on this read our articles on convertible bonds and callable bonds .

Corporate Bond Prices

All brokers must report their corporate and agency bond trades to FINRA within 15 minutes of the trade or fact potential regulatory action. TRACE (Trade Reporting and Compliance Engine ) is their system for collecting and distributing market data. In addition, they have tables which show the number of bonds rising and declining in value at the end of the day.

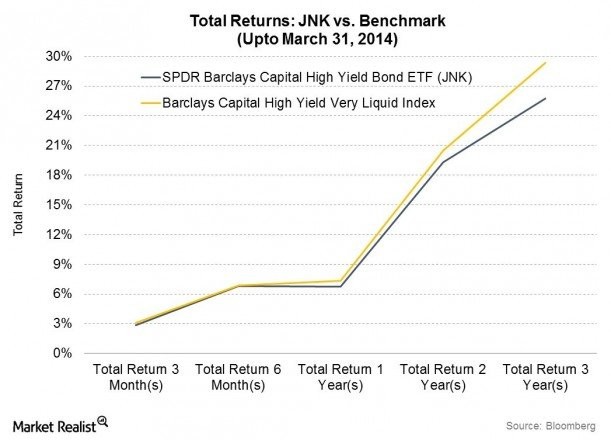

Junk Bonds

Junk bonds are corporate bonds whose rating is lower than Baa3 for Moody’s or BBB- for Standard & Poor’s and Fitch, the three major credit rating agencies. They are also referred to as “high yield bonds” because of the higher interest rate investors require to compensate for the increased risk involved with junk bonds. In any given year as many as 15% of all junk bonds issued default .

Believe or not, the debt of most corporations is considered junk. According to Glen Yago at the Milken Institute, “The debt of 95 percent of U.S. companies with revenues over $35 million (and of 100 percent of companies with revenues less than that) is rated non-investment grade, or junk.” For investors who are willing to take on the risk, there are plenty of options for investing in junk bonds.

If you’re interested we have a great series on how to buy junk bonds here. which is written by LearnBonds contributor The Masked Investor.