Corporate Bonds Analysis Valuation and Portfolio Management Corporate Bond Portfolios Credit

Post on: 25 Апрель, 2015 No Comment

Location:

Prague, NH Hotel Prague

- Recent Trends in Corporate Bond Markets

- The US and European Corporate Bond Markets

- Pricing and Valuation of Corporate Bonds

- Credit Risk Analysis of Corporate Bonds

- Constructing Optimal Corporate Bond Portfolios

- Managing Interest Rate in Corporate Bond Portfolios

- Managing Credit Risk in Corporate Bond Portfolios

- Managing Market Liquidity Risk

Corporate bonds have attracted wide interest in recent years. To investors, corporate bonds offer an attractive alternative to low-yielding government bonds and risky equities. Issuers see the corporate bond market as an alternative to bank financing, which has become difficult and/or expensive to obtain post-crisis.

The purpose of this course is to give you a good understanding of corporate bonds, of their investment and risk characteristics, and of their importance as an asset class.

We start with introduction to corporate bonds and corporate bond markets. We discuss recent developments and trends in these markets and we give an overview of the different types and legal forms of bonds. We also explain how and where bonds are issued and how they are traded.

Further, we explain how corporate bonds are priced, traded and valued in the primary and secondary markets. We explain factors that affect the liquidity and pricing of corporate bonds, and we give examples of how bonds are priced on the basis of swap-curves and various benchmarks.

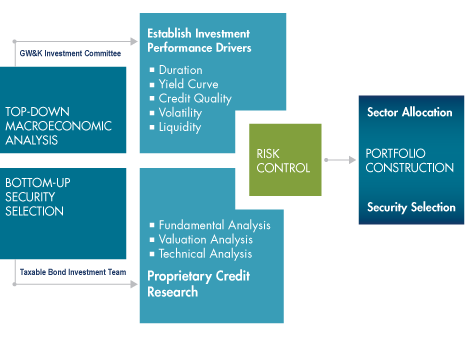

We then turn to credit analysis of bonds. We give you a thorough review of fundamental and quantitative methods for assessing the quality and credit risk of “investment grade” as well as “high yield” corporate bonds. We illustrate with practical, real-life examples. We also explain the rating agencies approaches to assessing the credit quality of corporate bond issues.

On day two, we focus on portfolio management. We explain and demonstrate how optimal portfolios can be constructed using traditional mean-variance techniques as well as more sophisticated methods, including a “rating transition” framework. Further, we explain how to manage interest and FX risks in corporate bond portfolios, with particular emphasis on the importance of managing the portfolio’s duration in a low-yield environment. We also explain and demonstrate how credit risk and credit spread risk can be hedged using single-name and, basket and index credit default swaps. Finally, we discuss how to measure and manage the market liquidity risk of a corporate bond portfolio. We study the exposure of corporate bond returns to liquidity shocks and explain the different effects that such shocks have on investment grade speculate grade bonds. We also explain the existence of time-varying liquidity risk of corporate bond returns and discuss experiences from recent episodes of flight to liquidity.