Convertible Preferred Stock Definition Example

Post on: 1 Июль, 2015 No Comment

What it is:

Convertible preferred stock is preferred stock that holders can exchange for common stock at a set price after a certain date.

How it works/Example:

Let’s assume you purchase 100 shares of XYZ Company convertible preferred stock on June 1, 2006. According to the registration statement, each share of preferred stock is convertible after January 1, 2007, (the conversion date) to three shares of XYZ Company common stock. (The number of common shares given for each preferred share is called the conversion ratio. In this example, the ratio is 3.0.)

If after the conversion date arrives XYZ Company preferred shares are trading at $50 per share, and the common shares are trading at $10 per share, then converting the shares would effectively turn $50 worth of stock into only $30 worth (the investor has the choice between holding one share valued at $50 or holding three shares valued at $10 each). The difference between the two amounts, $20, is called the conversion premium (although it is typically expressed as a percentage of the preferred share price; in this case it would be $20/$50, or 40%).

By dividing the price of the preferred shares ($50) by the conversion ratio (3), we can determine what the common stock must trade at for you to break even on the conversion. In this case, XYZ Company common must be trading at a minimum of $16.67 per share for you to seriously consider converting.

Convertible preferred shares trade like other stocks. but the conversion premium influences their trading prices. The lower the conversion premium, (that is, the closer the preferred shares are to being in the money ,) the more the price of the preferred shares will follow the price movements of the common stock. The higher the conversion premium, the less the convertible preferred shares follow the common stock.

Usually, holders of convertible preferred can convert at any time after the conversion date, but sometimes the issuer can force conversion. Either way, converting preferred stock into common stock dilutes the common shareholders, which is why companies sometimes offer to buy back converted shares.

Also, as with traditional preferred, holders of convertible preferred stock generally do not have the voting privileges enjoyed by holders of common stock.

Why it Matters:

Like common stock. preferred shares represent an ownership stake in a company; in other words, a claim on its assets and earnings .

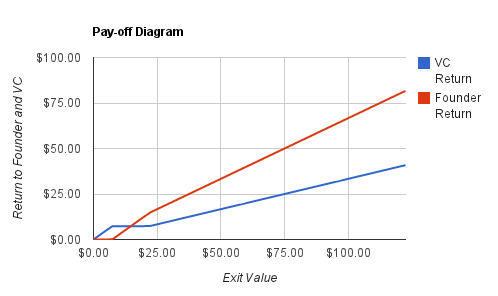

Return

The primary difference between preferred stock and common stock relates to the order in which shareholders are paid in the event of bankruptcy or other corporate restructuring. If the issuing company seeks bankruptcy protection, then the owners of preferred shares take priority over common shareholders when it comes time to pay dividends and liquidate the company’s assets.

Further, although dividends paid on common stock are not guaranteed and can fluctuate from quarter to quarter, preferred shareholders are usually guaranteed a fixed dividend paid on a regular basis. This means that interest rates affect the pricing of preferred stock. High rates could make a preferred dividend seem unattractive and low rates could make it seem attractive.

Issuing convertible preferred is a way for companies to raise capital on better terms than they could with traditional equity financing. especially if they have low stock prices already (new equity would dilute shareholders considerably) or if they have poor credit and cannot borrow at reasonable rates. With convertible preferred, a company can secure a lower interest rate than with pure debt financing and use the promise of a dividend to sell shares at a higher price. However, since companies with poor credit sometimes use preferred shares to gain revenue. the risk of default may be slightly higher.

Like corporate bonds. most convertible preferred stocks are rated by one of the major ratings agencies, the largest and most widely known being Standard & Poor’s and Moody’s. If the stock is rated only by one of the smaller rating agencies, such as Duff & Phelps or Fitch, then investors should be aware that the organization may not have been able to obtain a positive rating from either S&P or Moody’s.

Regulators generally classify convertible preferred as equity rather than debt. This classification is helpful to issuers because the interest payments come with tax breaks and the securities don’t increase issuers debt-to-equity ratios. However, analysts sometimes consider preferred and convertible preferred as debt when performing ratio analyses .

Convertible preferred stock is just one of many types of hybrid issues on the market these days, and in general, the securities are a way to increase yields and lower risk. Ultimately, investors must consider whether the higher yield of convertible preferred compensates them for the higher risk of an equity security.