CONVERTIBLE DEBT EXAMPLE

Post on: 25 Апрель, 2015 No Comment

CONVERTIBLE DEBT EXAMPLE

Example Suppose that TSJ Sports issues $10 million in three-year convertible bonds with a 5% yield and a 25% premium. This means that TSJ will have to pay $500,000 in .

Convertible Bond Bond that can be exchanged for a common stock of the same company according to the terms specified when the bond was issued

This is a convertible note term sheet template developed by an open source. financial covenants such as required debt service ratios are usually not appropriate .

This article briefly outlines the characteristics of convertible bonds, their advantages, and some of the factors that influence their value. What are Convertible Bonds?

Follow-up. please on the cap: Assume $4.5m cap on the 500k convertible debt note. Assume your example & assumptions (e.g. debt does not come out of pre-money .

MCI Convertible Bond Pricing Example Venkat Subramaniam, Lecture Notes Pricing Convertible Bonds An In-Class Example In March 1983, Mr. Wayne English, the …

Convertible Bond Bond that can be exchanged for a common stock of the same company according to the terms specified when the bond was issued

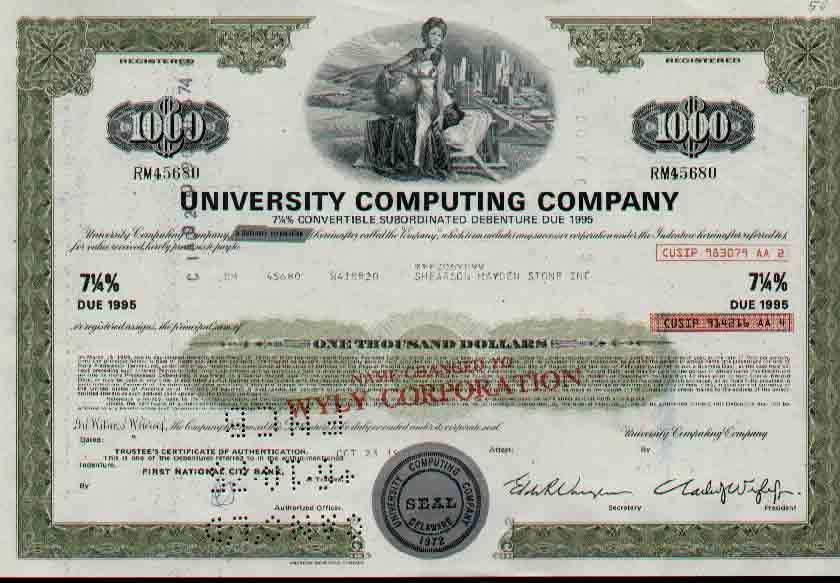

Convertible Debt EXAMPLE: On January 1, 2004, the Lopez Co. issued at face value of $5,000,000 of 8-year, 10% convertible debentures, due January 1, 2012.

How to use convertible in a sentence. Example sentences with the word convertible. convertible example sentences.

Convertible debt provides risk protection for investors and allows for participation in appreciation as the value of stock increases.

Convertible bonds are hybrid securities that have both debt and equity features. Like a normal straight bond, the buyer receives coupon payments at the interest rate .

This article briefly outlines the characteristics of convertible bonds, their advantages, and some of the factors that influence their value. What are Convertible Bonds?

How to use convertible in a sentence. Example sentences with the word convertible. convertible example sentences.

Convertible Bond Example • At node G. the bondholder optimally choose to convert since what is obtained under conversion ($1. at nodes I and J. that is $1.00 .

Earlier in the convertible debt series we talked about the “discounted price to the next round” approach to providing a discount on convertible debt.

Heads Up Audit and Enterprise Risk Services. Top Down on Convertibles? FASB Tightens Convertible Debt Accounting for Issuers. by Adrian Mills and Magnus Orrell .

An Example Convertible Debt Deal. $2 million in the form of a two-year fixed price Convertible Secured Note, which is convertible into common .

In finance, a convertible bond or convertible note (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can .

Chapter 8.5 — Conversion of Bond Debt using Book Value & Market Value Methods & Examples to Illustrate — Repayment of Bonds & Credit to .

In this section, we take a specific example of a convertible bond with reasonable complexity, and discuss the pricing and hedging of this bond. 4.1 Bond Specification

Convertible debt with no cap is stupid for investors. (To take one example, I would argue that submitting startups to a full ratchet on the downside.

A convertible debenture can often be called for redemption by the company prior to maturity. The point of the redemption option is that management can .

Convertible debt provides risk protection for investors and allows for participation in appreciation as the value of stock increases.

The convertible bond in this example was a discount bond and the speaker discusses how to account for the value of the discount relative to the actual bonds .

Convertible Bonds — An Introduction. By Beat Thoma, Fisch Asset Management. Convertible bonds are a combination of equities and bonds and possess various …

It provides examples. Worksheet 14 Contingently Convertible Debt With a Market Price Trigger That Requires Settlement of the Principal Amount of the Debt .

Convertible debt is a type of security frequently issued by startups when raising seed capital. With convertible debt, the startup issues the seed investor a .

Convertible Bonds — An Introduction. By Beat Thoma, Fisch Asset Management. Convertible bonds are a combination of equities and bonds and possess various …

Feb 25, 2014 · Convertible debt is a financing term that is used to refer to any type of debt financing where there is the option of converting the outstanding balance .

Quick answer: convertible equity (or a convertible security) is convertible debt without the repayment feature at maturity or interest. Background