Convertible Bonds An Issuer s Guide (Asia Edition)

Post on: 18 Май, 2015 No Comment

Keywords: convertible bonds, conversion price, fixed rate bond

INTRODUCTION

WHAT ARE CONVERTIBLE BONDS?

Convertible bonds are, customarily, fixed rate bonds issued by a company, the terms of which allow the holders of the bonds to convert them into ordinary shares of the company at a prescribed conversion price during a prescribed new conversion period.

Convertible bonds can be seen as a combination of two separate financial instruments namely:

- a fixed rate bond; and

- an embedded equity call option.

This combination of features provides investors in convertible bonds with certain distinct advantages over a similar investment in plain vanilla bonds or the ordinary shares of the company. In very general terms, convertible bonds are capable of offering investors equity upside potential in the ordinary shares of the relevant company as a result of the equity call option and, at the same time, capped downside risk as a result of the fixed rate bonds coupon and ultimate return of principal on the final maturity date. This equity upside potential and capped downside risk is often termed Optionality by convertible bond practitioners. Exchangeable bonds are exchangeable into already issued ordinary shares of a company (other than the issuer of the exchangeable bond) at a prescribed exchange price during a prescribed exchange period.

HOW ARE CONVERTIBLE BONDS PRICED AND HOW AND WHEN DO THEY CONVERT INTO ORDINARY SHARES?

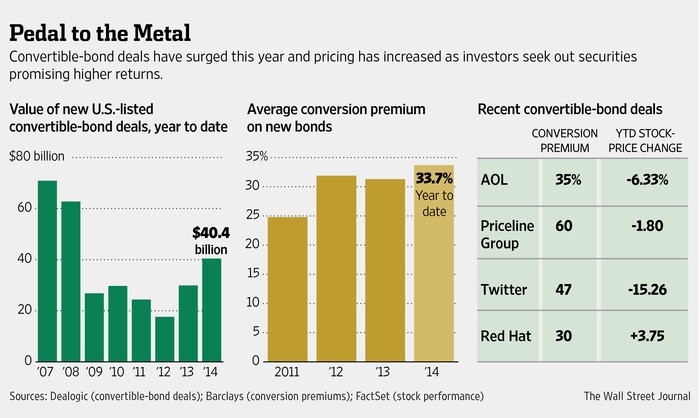

There are many technical methods of valuing convertible bonds (and, in particular, of pricing the embedded equity call option) and it is beyond the scope of this Guide to explore pricing methodologies in detail. Pricing consists of two elements, the initial conversion price and the coupon. The initial conversion price of a convertible bond is, customarily, based on the sum of (i) the volume weighted average price of the ordinary shares of the company (VWAP) between announcement of the offering (Launch) and the pricing of the convertible bonds (Pricing) and (ii) a conversion premium thereto (the Conversion Premium).

The correlation between the coupon payable on a convertible bond and the Conversion Premium is important. In summary, investors will expect to receive a correspondingly higher coupon on a convertible bond if the Conversion Premium is set at the higher end of its pricing range. Investors will, in these circumstances, expect to have to wait a longer period before the market price of the ordinary shares of the company exceeds the conversion price of their bonds, at which point it becomes economically viable for the bondholders to convert. Investors will, accordingly, treat convertible bonds with a high Conversion Premium as more debt like and require, as a result, a coupon more in line with that payable on a plain vanilla bond of a similar credit. Alternatively, if the Conversion Premium is set at the lower end of its pricing range, it is likely that investors may accept a correspondingly lower coupon.

Remember that the Conversion Premium reflects the value of the embedded equity call option in the convertible bond. The value of the convertible bonds is also comprised, however, of (i) the value of the bonds themselves (represented by the discounted value of the coupons and their redemption price and known as the Bond Floor) and (ii) the value of the ordinary shares of the company underlying the convertible bonds from time to time (and known as Parity). These features will be discussed in more detail later on in this guide.

WHAT ARE THE BENEFITS AND DISADVANTAGES OF CONVERTIBLE BONDS TO AN ISSUER AND AN INVESTOR ALIKE?

There are a number of benefits for issuers and investors in convertible bonds. There are, of course, downsides for both parties to consider: