Convertible bonds_3

Post on: 18 Сентябрь, 2015 No Comment

H ave you ever had a cake and eaten it? Thought not. If youve been luckier than me, you may wish to investigate convertible bonds.

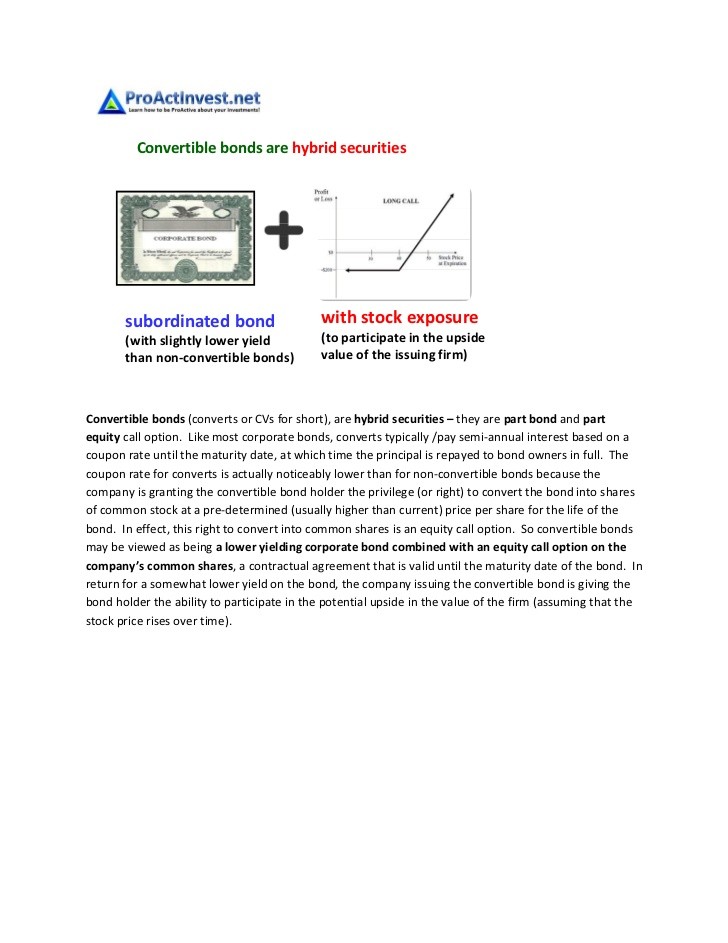

A convertible bond is just as its name suggests one that can be converted into a chunk of the companys equity at certain times during its life, usually at the discretion of you as the bond owner.

Being able to convert debt into equity at a favorable time is clearly a right worth having. For this reason, convertible bonds pay a lower interest rate than normal corporate bonds issued by the same company.

A convertible bond can be thought of as a two-part investment: The fixed interest element of the corporate bond component, and an option represented by the convertible component.

Convertible bonds move in mysterious ways

Ill argue later in this corporate bond series (leaning heavily on David Swensons excellent Unconventional Success ) that corporate bonds are actually much harder to value than they seem. Thats extra true of convertible bonds, because of the built-in option.

The price of a convertible bond will often track the companys share price, for instance, due to the option to convert into those shares.

But when the option to convert is very uneconomic, it is pretty worthless. The convertible bond price will then tend to move with standard fixed interest bonds, most obviously influenced by interest rates.

In contrast when it becomes economic to convert, convertibles will closely track the shares. The yield could become almost irrelevant in such circumstances, or it could be a key factor as investors compare the coupon on the bonds to the share dividend and time their conversion for when the implied price of converting is the same as the share price AND the shares pay a greater income than the convertible bond.

Simple, eh?

If all this isnt confusing enough, convertibles are invariably structured to give you the right to convert a certain amount of corporate bond at par value into a certain number of shares. For example, they may give you the right to convert £100 of the face value of your debt into 30 shares. In other words, theres some (trivial but tedious) maths involved.

Trigger happy private investors love convertibles due to the potential for capital gain, but whether you, I, or they can consistently generate better profits for the risk they are taking by holding and trading convertibles is another matter.

I personally think convertibles are best thought of not as corporate bonds, and instead put into a box marked speculative investments. Convertibles are not an essential asset class for private investors .

The next part in this series will look at a few other kinds of bonds you may encounter, including some that arent bonds at all. Pop your email in the box below or subscribe via RSS to make sure you see it.

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.