Convertible bond The value of asymmetry and convexity

Post on: 25 Апрель, 2015 No Comment

Date Published: 31 Dec 2013

ACM Executive Summary

Due to its combination of equity and bond characteristics, convertible bonds fund can be a valuable addition to a mixed portfolio of traditional assets.

Convertible offers unlimited upside potential due to the convergence of equity and convertible in rising markets. Conversely, its bond floor will provide downside limitation in the absence of an increase in credit or default risk.

However, there is a case for active management in convertible as the level of convexity is not constant but dependent on the delta. which require adjustments as the profile of the index shifts. Convertibles offer a great source of diversification for bond investors who consider equities to be outside their risk tolerance. or institutional investors who are unable to achieve their desired equity exposure. Moreover, convertible bonds can lower the duration risk of a portfolio, providing protection from potential interest rate hikes.

Bottom-line: The convexity that convertible bonds provide. through their combination of equity and bond characteristics. make them a worthy choice for those seeking enhanced risk-adjusted returns. Read on to find out the features that make convertible bonds more sensitive to an upward move in the underlying share price than it is to a fall of the same magnitude.

Read on to find out the features that make convertible bonds more sensitive to an upward move in the underlying share price than it is to a fall of the same magnitude.

Asymmetric return

- An attractive asymmetric return profile is an expression use to describe an investment with the potential to deliver more upside than downside Although equity markets typically rise over the long term, the timing of entry and exit can be pivotal in determining the upside/downside equation, as many investors have found to their cost.

Asymmetry and convexity

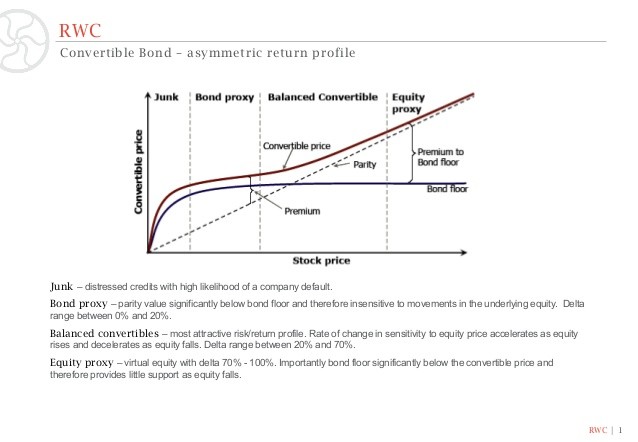

- Convertible bonds offer a potential solution because they provide both equity and bond characteristics. The diagonal line (parity) expresses the intrinsic value of the convertible bond. That is to say, it is the amount that the investor would receive upon exercising the conversion option. As such, it constitutes a lower boundary for the price of the convertible, while the blue line outlines its fair value. A convertible bond is most likely to exhibit its attractive composite characteristics in the central zone of the diagram on the right, when it is a balanced instrument (or at the money). This means that the underlying share price is sufficiently high for the embedded option to potentially gain significantly in value, but not so inflated that the convertible trades as a pure equity proxy and thus loses its bondlike attributes. Fund managers seek to harness the non-linear relationship (or convexity) between the price of the convertible and the underlying stock. This characteristic stems from the concept that convertibles effectively provide increasing exposure to equities in rising markets and progressively reduced exposure in bear markets. Convexity therefore provides investors with extra utility because it means that the convertible is more sensitive to an upward move in the underlying share price than it is to a fall of the same magnitude. As can be seen from the diagram above, at a certain point the parity and convertible price lines converge, implying a 100% correlation between the convertible and the underlying equity (as discussed earlier, the upside potential of equities is theoretically unlimited). Conversely, the bond floor will provide downside limitation in the absence of an increase in credit or default risk. As such, not only is the potential return profile asymmetric but, as long as the bond floor holds, investors will receive some compensation through coupon income for holding until the market turns, should equities enter a bear phase of the cycle.

The case for active management

- Investing in convertible bonds is far from straightforward because the level of convexity is not constant but dependent on the delta the level of sensitivity of convertible bonds to movements in the underlying equities. The sweet spot for convertible bonds is where the delta indicates a suitable mix of bond and equity characteristics (i.e. close to a delta of 0.5, with a broader range of 0.3 — 0.6 typically regarded as being favourable). Active management can help to ensure that a funds delta remains favourable as the profile of the index shifts. A potential example of this is also illustrated in the chart on the right. Given that equity markets have risen strongly of late, a rational approach to active management could potentially involve taking profits on deep in-the-money securities with high deltas and reinvesting the proceeds in more balanced convertibles which offer better downside insulation.