Control Portfolio Risk with Managed Futures ETFs

Post on: 22 Июнь, 2015 No Comment

Asset Class ETFs News:

Investors are beginning to understand the risks in the markets. Consequently, more are considering alternative investment strategies, like managed futures exchange traded funds, to help diminish risk exposure and enhance risk-adjusted returns.

Managed futures cover a range of strategies that utilize both long and short positions in futures contracts across various asset classes in an attempt to capture positive returns, regardless of how the underlying market is acting, writes Ryan Issakainen, Senior V.P. at First Trust Advisors on Wealth Management .

Potential investors should be aware that the underlying futures contracts can be volatile, and derivative instruments can be less liquid than other types of investments.

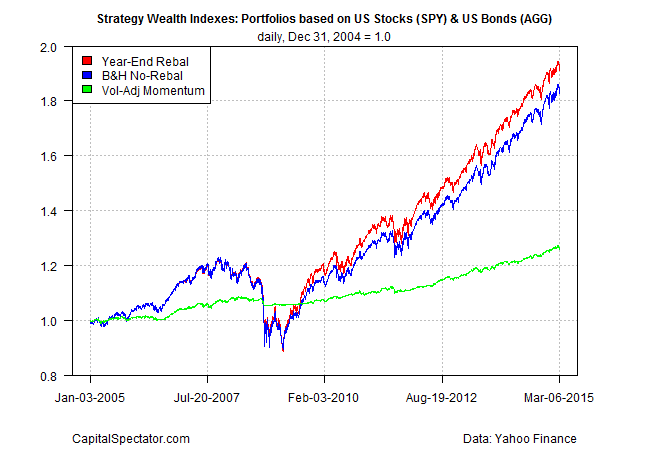

Nevertheless, managed futures strategies help smooth out returns over a longer period through investments with low correlations to traditional portfolio holdings, like stocks and bonds.

Even more important than the stand-alone risk of managed futures, in our opinion, has been the potential of these strategies to reduce risk within a diversified investment portfolio, Issakainen said. This is primarily due to the low, and often negative, correlations between the returns of managed futures and other traditional asset classes, such as stocks and bonds.

Managed futures have held up during periods when stocks were negative. Investors, though, should not confuse managed futures as a direct hedge for stocks.

The investment strategy helps generate better risk-adjusted returns. For example, in a hypothetical blend of the S&P 500, Barclays Capital U.S. Aggregate Bond Index and Barclays US Managed Futures BTOP50 Index, Issakainen found that the 45% stocks/40% bonds/15% managed futures portfolio produced a similar return to the 60% stocks/40% bonds portfolio over the last 25 years, except the 45/40/15 portfolio was 22% less risky than than the 60/40 portfolio.

Investors interested in a managed futures ETF can take a look at the First Trust Morningstar Managed Futures Strategy Fund (NYSEArca: FMF ). which launched in August. The underlying index includes 34 futures positions consisting of 19 commodities, 9 equities and 6 currencies. FMF is up 2.3% over the past three months.

Additionally, the WisdomTree Managed Futures Strategy Fund (NYSEArca: WDTI ) utilizes a combination of U.S. Treasury, currency, and commodity futures. WDTI is up 2.3% year-to-date. [Manage Risk and Diversify with Alternative ETFs ]

For more information on ETFs, visit our ETF 101 category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.