Consumer spending

Post on: 16 Март, 2015 No Comment

Introduction

Consumption is spending by households on goods & services

In 2011 total UK consumer spending was 851 billion out of a total GDP level of 1437 billion

Consumption is far and away the biggest single component of aggregate demand, in 2011 it was 60% of GDP

Many factors affect the ability and willingness of people to spend and this has a large effect on the economic cycle

What are the main factors affecting consumer spending?

- Disposable income and spending the propensity to spend

John Maynard Keynes one of the major figures in the history of economics (pictured on the right) developed a theory of consumption that depended mainly on disposable income. Disposable income is income after direct taxes and welfare benefits have been taken into account.

What matters more is the rate at which consumers increase demand as income rises. This is called the marginal propensity to consume. Say that someone receives extra pay of 2000 and they spend 1500, thus the marginal propensity to consume is 1500 / 2000 = 0.75. The remainder is saved so the marginal propensity to save is 0.25.

A simple rule to remember is that the marginal propensity to consumer added to the marginal propensity to save must always equal 1.

The marginal propensity to consume and to save differs from person to person. Generally, people on lower incomes tend to have a higher propensity to spend. This matters when the government announces changes in taxation and the level of welfare benefits.

- Interest Rates lower interest rates cuts the cost of paying the debt on a mortgage and thereby increases the effective disposable income of homeowners. One of the features of the recent recession has been the sharp reduction in official policy interest rates by central banks. This is designed to boost consumer spending and avoid a slump. The Bank of England has kept interest rates at 0.5% from February 2009 through to August 2012 (the time of writing).

- Household Wealth for example a sustained fall in house prices might cause a decline in personal wealth and spending as homeowners have less housing equity available to borrow. This is sometimes referred to as the negative wealth effect. Housing equity is the difference between the market value of your property and how much still has to be paid on a housing loan (a mortgage).

- Consumer Confidence for example, fears of rising unemployment and expectations of higher taxes will hit consumer sentiment and spending. If you dont have enough confidence, you are unlikely to go ahead with major purchases such as a new car.

- The supply of credit: One of the features of the credit crunch has been a slump in the flow of credit available for many households and businesses banks have become less willing to lend and if they do, the rate of interest on the loan has increased. The supply of mortgage finance has dried up and would-be homebuyers now need to find a bigger deposit before getting a home loan. The loan to valuation ratios have fallen that has affected peoples ability to borrow to fund property purchases.

- The distribution of income. Lower income families tend to have a higher propensity to consume than better-off households (who tend to have a higher savings ratio). Thus a redistribution of income towards poorer families may have the effect of boosting total consumer demand.

Consumer Confidence

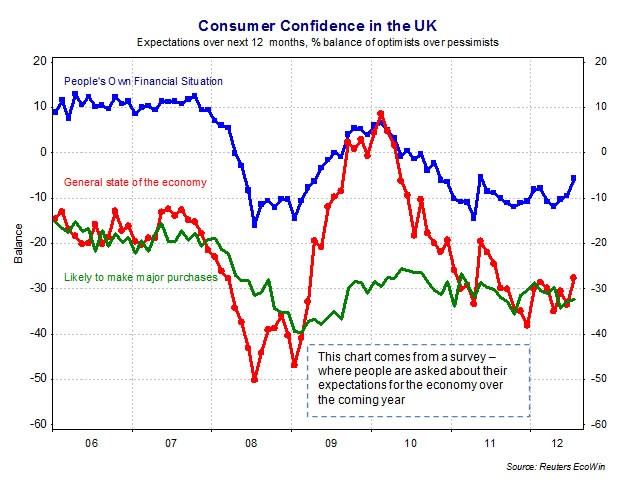

- Consumer confidence is often measured using surveys and our chart below tracks what has happened to confidence in the UK over recent years

- The credit crunch happened in 2008 and the recession took hold in 2009 confidence dropped sharply

- There was a rebound in confidence during late 2009 but this has tailed away in 2010 and 2011 raising fears of a double-dip recession. Confidence has remained low during 2012 and this is an important factor holding back the level of consumer spending.

The Wealth Effect

- Wealth represents the value of a stock of assets. For most people the majority of their wealth is held in the form of property. shares in quoted companies on the stock market, savings in banks, building societies and money accumulating in occupational pension schemes

- Many economists think that there is a positive relationship between wealth and spending although the size of the effect is open to question.

- House prices soared during the first seven years of this decade but then started a steep fall before leveling off in 2009 and falling again (at a gentle pace) in 2010-12

- There was also a sharp decline in the value of the FTSE-100 share index in 2008-09 before a strong recovery in the second half of 2010

- Allied to high levels of consumer debt (e.g. in mortgages and credit cards) there was a fall in the net wealth of the UK household sector

- The size of the wealth effect remains open to question

- Wealth is not simply a matter of property and shares. For millions of people, assets in the form of savings and occupational pension schemes are important. So the real value of their savings and the income that flows from deposit accounts from interest payments will have a direct effect on their spending power.

- In the last three years the average rate of interest on savings deposits have been exceptionally low (less than 1%) and less than the rate of inflation the result has been a cut in the real purchasing power of people who depend on their savings to fund their spending.

Too much borrowing?

UK households took on a rising level of mortgage debt to buy increasingly expensive housing. It has been estimated that the

UK became the most indebted country in the world

UK Budget Statement 2011

Consumer borrowing

Most of us at some time in our lives need to borrow money to finance spending.

The credit market for individuals is complex. Broadly speaking we can distinguish between:

Unsecured borrowing that is a loan or an overdraft which is not tied to the value of another asset

. Examples of this are student overdrafts, bank loans and money borrowed on store and credit cards

Secured borrowing is lending where the borrower must use another asset as collateral for the loan.

The best example of this is a mortgage with a bank or building society. Home buyers are at risk if they fail to keep up with monthly mortgage repayments and ultimately, the lender may foreclose and seek repossession of the property.

One of the most important features of the British economy in recent years has been the high levels of borrowing. To use a technical term, what we have seen is a leveraging up of the consumer sector people seem to have been happy to increase the ratio of their debt to income with the result that the UK still has one of the highest debt-to-income ratios of any of the leading economies.

The cost of borrowing money interest rates on loans

It is worth noting how much more expensive is an unsecured loan compared to the official policy interest rate set by the Bank of England. In the summer of 2012, the average interest rate charged on a bank overdraft or on credit cards was higher than 16% — more than thirty times the official monetary policy interest rate! And over four times the cost of a typical mortgage.

Why are interest rates so much higher? Partly it is because the risk of a borrower defaulting on their loan is greater for credit card borrowing. Risk-averse banks and credit card companies will charge a premium rate on these loans to cover these risks. One effect of high levels of borrowing has been a steep rise in the number of personal bankruptcies in the British economy and the high level of unpaid debt is continuing to limit the scale and speed of a recovery in consumer spending after the 2009 recession.