Conservative Bond Strategy Returning 12% Annually And 3 5% Maximum Drawdown AdvisorShares

Post on: 28 Март, 2015 No Comment

This article is, in a way, a continuation and enhancement of my article entitled Unique Application of Moving Day Average to High Yield Bond ETFs . In that article I presented a simple tactical strategy of using low duration moving day averages — MDAs — to significantly increase the total return of short duration high yield bonds. I specifically looked at PIMCO BofA ML 0-5 Year High Yield Bond ETF (NYSEARCA:HYS ) and PowerShares S&P-LSTA Senior Loan ETF (NYSEARCA:BKLN ) as potential candidates for this strategy. But after further study, I now think the application of this strategy to AdvisorShares Peritus High Yield Bond ETF (NYSEARCA:HYLD ) will produce superior performance compared to HYS and BKLN.

So in this article I’m going to present the results of low duration MDAs applied to HYLD and show that a Compounded Annual Growth Rate — CAGR — of over 12% is attainable in the future. Plus I will show that this strategy has a remarkably low maximum drawdown of 3.5%. I do not know of many, if any, tactical strategies that can produce double-digit annual growth with such low drawdown risk.

By using a mutual fund proxy for HYLD, I was able to backtest this strategy to 2000 using ETFreplay software. The total timeframe of backtesting is 14 years and encompasses two long-term bull markets and two significant bear markets (2001-2002 and 2008), plus numerous corrections along the way in the bull markets. The success of the strategy over long backtested timeframes gives us more confidence that the strategy will continue working in the future.

If you know anything about HYLD, you know its inception date was relatively recent (December, 2010). So, in order to backtest to 2000, I had to find an adequate mutual fund proxy to represent HYLD. And that proxy turns out to be the Vanguard High Yield Mutual Fund (MUTF:VWEHX ). VWEHX probably mimics HYS better than HYLD, but it is still a good proxy for HYLD. I looked at the correlation factor between VWEHX and HYLD between 2011 and 2013, and it was about 0.3 on average, while the correlation factor of VWEHX with HYS was closer to 0.5. I plotted total return of HYLD, HYS and VWEHX from 2012 to 2014, and the chart is presented below. It can be seen that the overall trends of all three assets are comparable over this short timeframe. It is obvious that the overall performance (total return) of HYLD is better than HYS or VWEHX. The important thing to note is the overall volatility of the different assets. All of the assets have very low volatility; HYLD has a volatility of 4.3%, HYS has a volatility of 3.2%, and VWEHX has a volatility of 3.1%. In order for this MDA strategy to work, we must have low volatility or else there will be excessive MDA crossings and too many trades. Based on these comparisons, I felt VWEHX would be a good proxy for HYLD and HYS, and if anything, HYLD would have higher overall performance (total return) than VWEHX or HYS.

I proceeded to run a moving day average strategy on VWEHX back to the start of 2000. Rather than just running a straight moving day average, I decided to use the moving day average ratio capability in ETFreplay. This strategy applies the crossover of two MDAs to determine whether the portfolio is in VWEHX (risk-on) or another asset (risk-off). I selected the Vanguard Short-Duration Treasury Mutual Fund (MUTF:VFISX ) as my risk-off asset. After many calculations, I selected MDAs of 25 days and 3 days as the best MDAs for this strategy. Please note the strategy is applied to the ratio of VWEHX and VFISX, not to VWEHX directly.

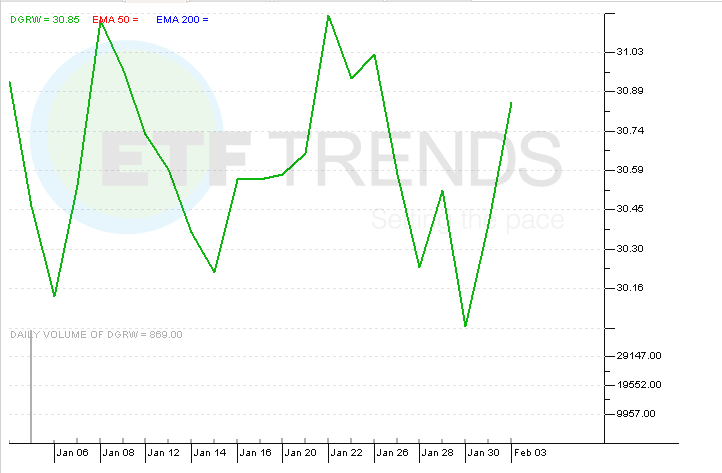

A chart of the ETFreplay calculations is shown below. In addition, the annual total return (dividends included) are shown in a table, along with the maximum drawdown in each year and the number of trade days. On each trade day, one asset is sold and the other asset is bought. It can be seen that the average number of trade days per year was about eight. This is the one negative about this strategy: the investor (or money manager) has to keep a daily track on the strategy. Trades have to be made when the two MDAs cross (beginning of next business day). Perhaps I can set up an email alert to interested parties if there is enough interest. I am using this strategy as one of my own tactical real money strategies, so I have to keep track of the crossover days for myself anyway.