Compare Savings Rates with US Savings Bonds

Post on: 2 Октябрь, 2015 No Comment

Published on Thu Feb 10, 2011

By Jennifer Rose Hale

You may come to expect a few standard gifts for the big moments in your life: a pen or watch when you graduate, a toaster when you get married or a silver rattle when a baby is born. Another standard gift you may see during these life milestones? A U.S. savings bond.

Many of us receive these bonds, understand they’re different from a check and tuck them into a filing cabinet, fireproof safe or safe deposit box.

But what exactly is a savings bond?

A loan to the government, a payoff for you

A U.S. savings bond is a type of investment, a security which is issued and backed by the U.S. government.

When your aunt buys you a U.S. savings bond for a wedding gift, she’s loaning money on your behalf to the U.S. government for a set period of time in exchange for a guaranteed interest rate. The bond is the government’s promise to pay back the money with interest at the maturity date. In this way, a savings bond is similar to a certificate of deposit .

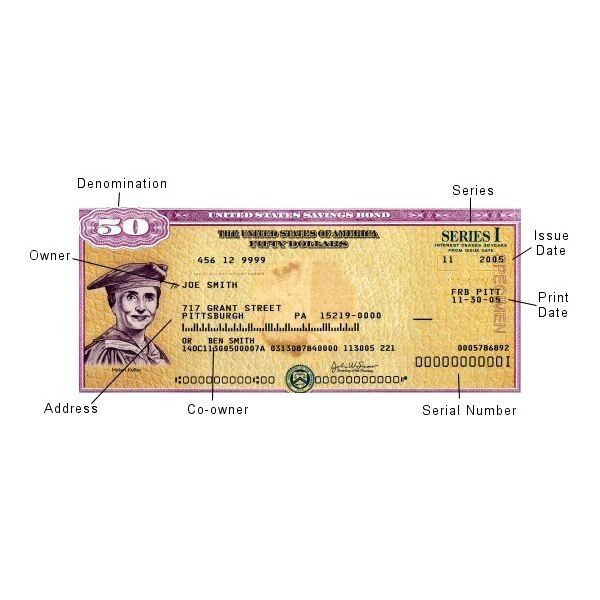

The government borrows the money for operating expenses and to pay off existing debt. When the bond matures, the government pays back the loan, plus interest, to the bond’s owner. Savings bonds are issued in an individual’s name and require a Social Security number.

You also can think of savings bonds as paper in the safe deposit box, but today’s bonds are issued electronically as well. Savings bonds are sold by the U.S. Department of the Treasury and are available online.

What types of savings bonds are there?

As of late 2010, the Treasury Department sells two types of bonds: I and EE. The Treasury website provides a detailed comparison of the two, but the main difference is in the earnings:

- EE bonds earn a fixed rate of return.

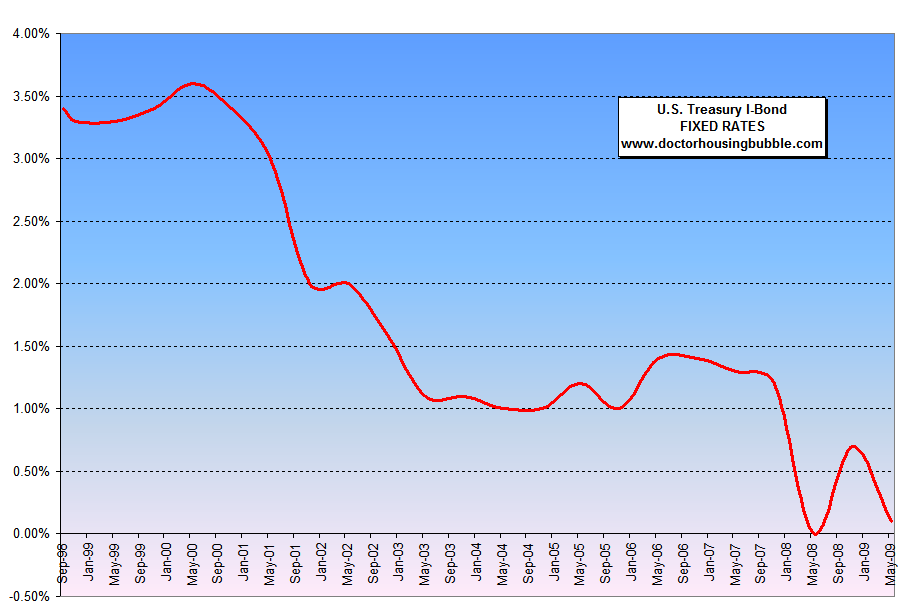

- I bonds earn a return that’s a combination of a fixed rate and the inflation rate.

Depending on what type you buy, the terms are different:

- Paper EE bonds are still sold at half the face value (you pay $25 for a $50 bond), and, upon maturity at 20 years, are guaranteed to be worth the face value of the bond.

- Electronically issued EE bonds and all I bonds are bought at face value ($50 for a $50 bond).

The Treasury Department maintains a press release with current savings bond earnings .

This article describes the U.S. savings bonds available as of late 2010. If you have bonds that are more than a few years old, the Treasury Department has information on those earnings as well.

Savings bonds: pros and cons

As investments, savings bonds have a few positives:

- They have the security of U.S. government backing. The federal government guarantees the value of the bond and rate of return.

- Interest accrued is tax exempt until the bond is redeemed. After you redeem the bond, you will receive a form from the IRS showing accrued interest for tax purposes.

- They’re (mostly) liquid. Savings bonds can be sold before their maturity date, as early as one year after purchase. Redeeming them within five years of purchase costs a three-month interest penalty.

However, savings bonds have drawbacks as well:

- Their interest rate is uncompetitive. You probably will find better rates in a high-yield saving account .

- They can be lost or forgotten. NPR reported one happy story about a recycling-plant worker who found $22,000 in old savings bonds and tracked down the rightful owner; other stories haven’t ended as well. In other words, it may be worth checking through those attic boxes before leaving them out on the curb.

- They can’t be transferred to someone else. Unlike other types of U.S.-backed securities, such as Treasury bills, savings bonds remain the property of the person named on the bond. A bond can be inherited, but not sold or gifted by a living owner.

Savings bonds are one of the safest investments around, but are not a replacement for a fully funded emergency fund or a more liquid CD or money market account. If you receive a savings bond from Aunt Eleanor, stash it in a safe place, register it with the Treasury Department and look forward to the maturity date.