Commodity Swaps Help for Hedging with Swap Contracts

Post on: 20 Май, 2015 No Comment

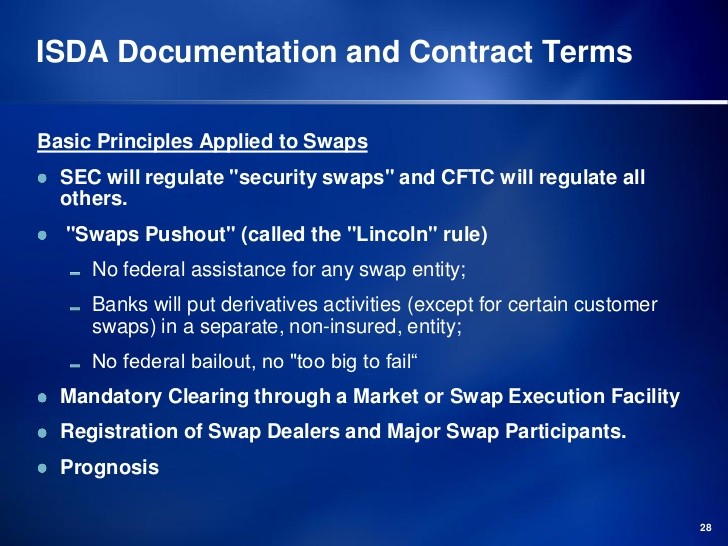

A swap is an agreement whereby two parties (called counterparties) agree to exchange periodic payments. The dollar amount of the payments exchanged is based on some predetermined dollar principal, which is called the notional principal amount or simply notional amount. The dollar amount each counterparty pays to the other is the agreed‐upon periodic rate times the notional amount. The only dollars that are exchanged between the parties are the agreed‐upon payments, not the notional amount.A swap is an over‐the‐counter contract. Hence, the counterparties to a swap are exposed to counterparty risk.

Types of Swaps

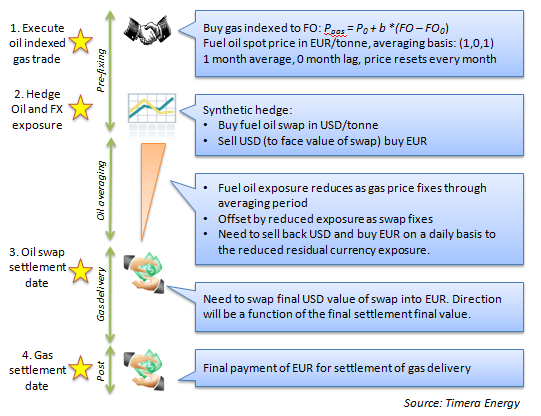

The three types of swaps typically used by non finance corporations are interest rate swaps, currency swaps, commodity swaps, and credit default swaps. In a commodity swap, the exchange of payments by the counterparties is based on the value of a particular physical commodity. Physical commodities include precious metals, base metals, energy stores (such as natural gas or crude oil), and food (including pork bellies, wheat, and cattle). Most commodity swaps involve oil.

For example, suppose that the two counterparties to this swap agreement are Comfort Airlines Company, a commercial airline, and Prebon Energy (an energy broker). The notional amount of the contract is 1 million barrels of crude oil each year and the contract is for three years. The swap price is $19 per barrel. Each year for the next three years, Comfort Airlines Company agrees to buy 1 million barrels of crude oil for $19 per barrel. So, each year Comfort Airlines Company pays $19 million to Prebon Energy ($19 per barrel times 1 million barrels) and receives 1 million barrels of crude oil.The motivation for Comfort Airlines of using the commodity swap is that it allows the company to lock‐in a price for 1 million barrels of crude oil at $19 per barrel regardless of how high crude oil’s price increases over the next three years.

Consider an illustrative swap.

Every year for the next five years Farm Equip Corporation agrees to pay PNC Bank 9%, PNC Bank agrees to pay Farm Equip Corporation the reference rate, one‐year LIBOR. Since the notional amount is $100 million, Farm Equip Corporation Manufacturing agrees to pay $9 million. Alternatively, we can rephrase this agreement as follows: Every year for the next five years, PNC Bank agrees to deliver something (one‐year LIBOR) and to accept payment of $9 million. Looked at in this way, the counterparties are entering into multiple forward contracts: One party is agreeing to deliver something at some time in the future, and the other party is agreeing to accept delivery. The reason we say that there are multiple forward contracts is that the agreement calls for making the exchange each year for the next five years.

While a swap may be nothing more than a package of forward contracts, it is not a redundant contract for several reasons. First, in many markets where there are forward and futures contracts, the longest maturity does not extend out as far as that of a typical swap. Second, a swap is a more transactionally efficient instrument. By this we mean that in one transaction an entity can effectively establish a payoff equivalent to a package of forward contracts. The forward contracts would each have to be negotiated separately. Third, the liquidity of certain types of swaps has grown since the inception of swaps in 1981; some swaps now are more liquid than many forward contracts, particularly long‐dated (i.e. long‐term) forward contracts.

Transtutors.com is an effort on the part of expert tutors to give you maximum support by way of pooling their subject knowledge exclusively for your understanding and knowledge enhancement. It is a highly accessible source of gaining understanding in subject of Management and getting effective homework help and assignment support in topics like Commodity Swaps.

Related Questions

Helen Bowers, owner of Helen’s Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2009 and 2010:

Tags : Finance, Corporate Finance, Working Capital Management, University ask similar question

Glentech Manufacturing is considering the purchase of an automated parts handler for the assembly and test area of its Phoenix, Arizona, plant. The handler will cost $250,000 to purchase plus $10,000 for installation and.

Tags : Finance, Others, Business Valuation and Analysis, University ask similar question

Students are organizing a Battle of the Bands contest. They know that at least 100 people will attend. The rental fee for the hall is $200 and the winning band will receive $500. In order to guarantee that they.

Tags : Finance, Corporate Finance, Stock Valuation, University ask similar question

Hi I need help with this homework from questions 11 to 16. Please with formulas not financial calculator.

Tags : Finance, Risk Management, Others, University ask similar question

App Store Co. issued 14-year bonds one year ago at a coupon rate of 6.9 percent. The bonds make semiannual payments.Required:If the YTM on these bonds is 5.5 percent, what is the current bond price?

Tags : Finance, Others, Entrepreneurial Finance, University ask similar question

Harvard Concord Case Study

Tags : Finance, Corporate Finance, Leasing, University ask similar question

Risk Management Part 1 •Explain the various definitions of disability that are found in disability-income insurance. •Explain the following disability insurance income provisions. Residual disability ?Benefit period.

Tags : Finance, Risk Management, Risk Management Techniques, College ask similar question

I am submitting 2 questions number 1 and 3 in the attach file, Inwhich I indicated the possible solutions for. I need explanation for support calculations in detail for my possible solutions. Please put support calculations.

Tags : Finance, Others, Behavioral Finance, Graduation ask similar question

Tags : Finance, Corporate Finance, Leasing, University ask similar question

Tags : Finance, Corporate Finance, Time Value of Money, University ask similar question